The Australian stock exchange is poised for a challenging start this week, with anticipated declines following the introduction of tariffs by the U.S. against Canada, Mexico, and China. Amidst these global pressures and local market fluctuations, investors often seek opportunities in smaller or newer companies that may offer growth potential at a lower entry cost. Penny stocks, despite their somewhat outdated moniker, continue to attract attention for their affordability and potential financial resilience; here we explore three such stocks that stand out for their promising attributes in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.96 | A$245.42M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$106.21M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.23 | A$345.4M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$247.67M | ★★★★★★ |

| Nickel Industries (ASX:NIC) | A$0.765 | A$3.28B | ★★★★★☆ |

Click here to see the full list of 1,029 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

K&S (ASX:KSC)

Simply Wall St Financial Health Rating: ★★★★☆☆

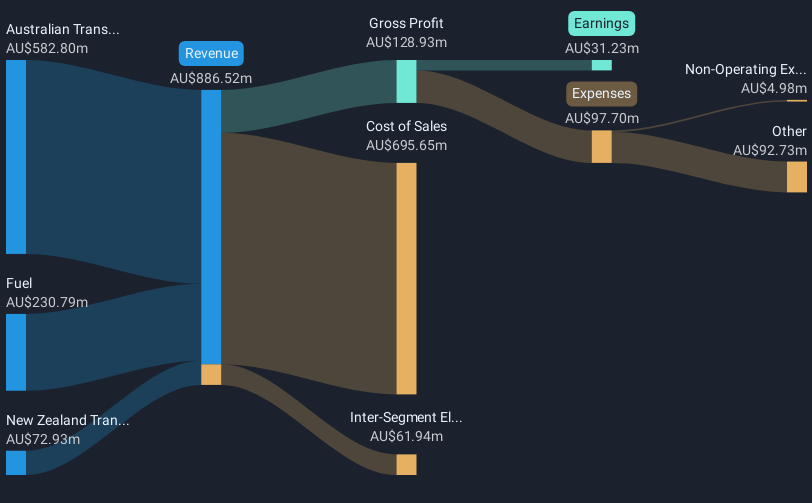

Overview: K&S Corporation Limited operates in the transportation and logistics, warehousing, and fuel distribution sectors across Australia and New Zealand, with a market cap of A$498.13 million.

Operations: The company's revenue is primarily derived from Australian Transport (A$582.80 million), Fuel (A$230.79 million), and New Zealand Transport (A$72.93 million).

Market Cap: A$498.13M

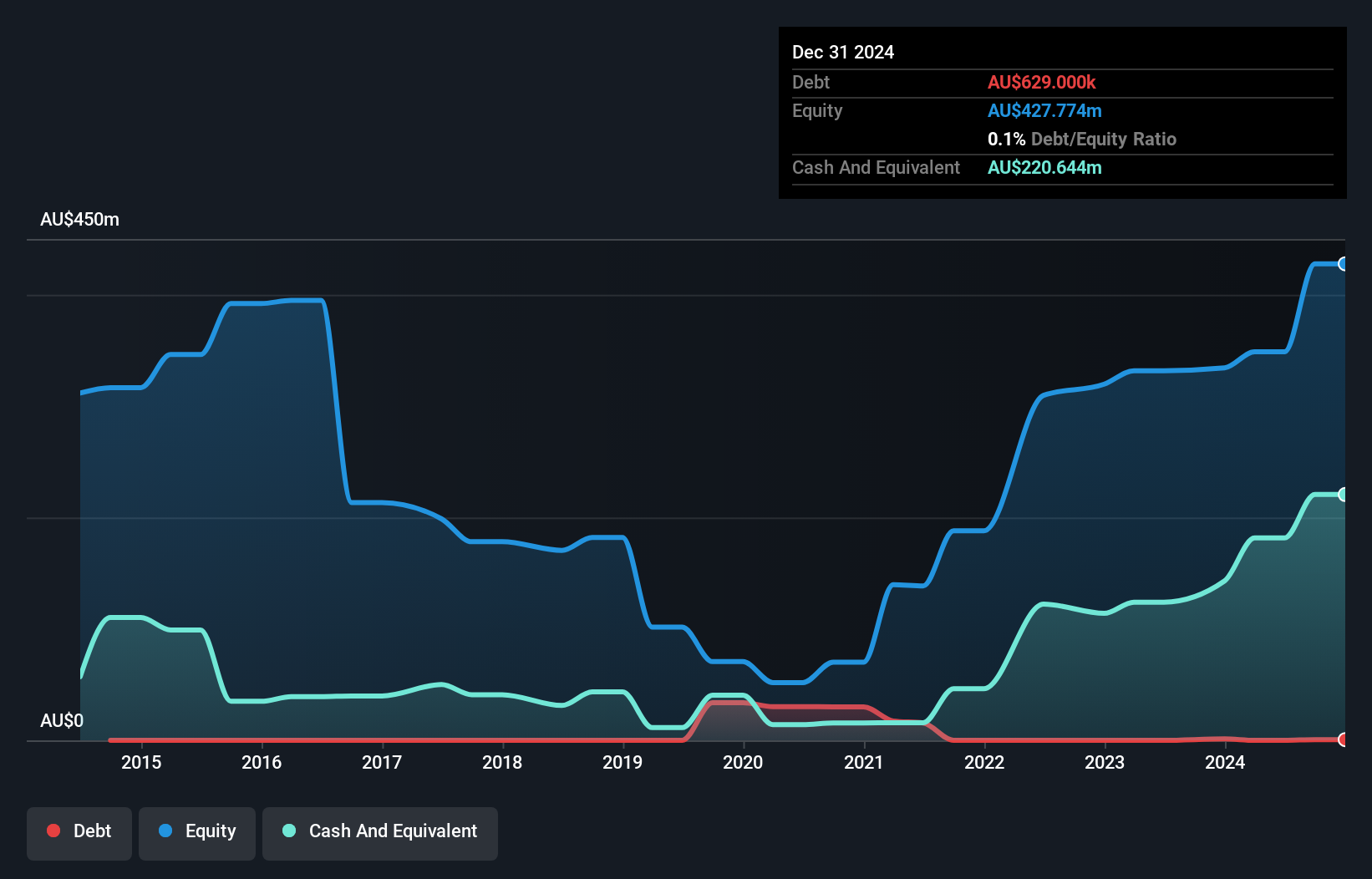

K&S Corporation Limited, with a market cap of A$498.13 million, generates substantial revenue from its Australian and New Zealand transport and fuel operations. The company's net debt to equity ratio is satisfactory at 6.7%, with interest payments well covered by EBIT at 10.2 times coverage, indicating strong financial health in this regard. Although earnings growth slowed to 9.1% last year compared to its five-year average of very large annual growth, profit margins have improved slightly to 3.8%. However, the dividend yield of 4.95% isn't adequately supported by free cash flow, suggesting potential sustainability issues for income-focused investors.

- Click here and access our complete financial health analysis report to understand the dynamics of K&S.

- Examine K&S' past performance report to understand how it has performed in prior years.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metals X Limited is an Australian company focused on the production of tin, with a market capitalization of A$425.47 million.

Operations: The company's revenue is primarily generated from its 50% stake in the Renison Tin Operation, amounting to A$186.22 million.

Market Cap: A$425.47M

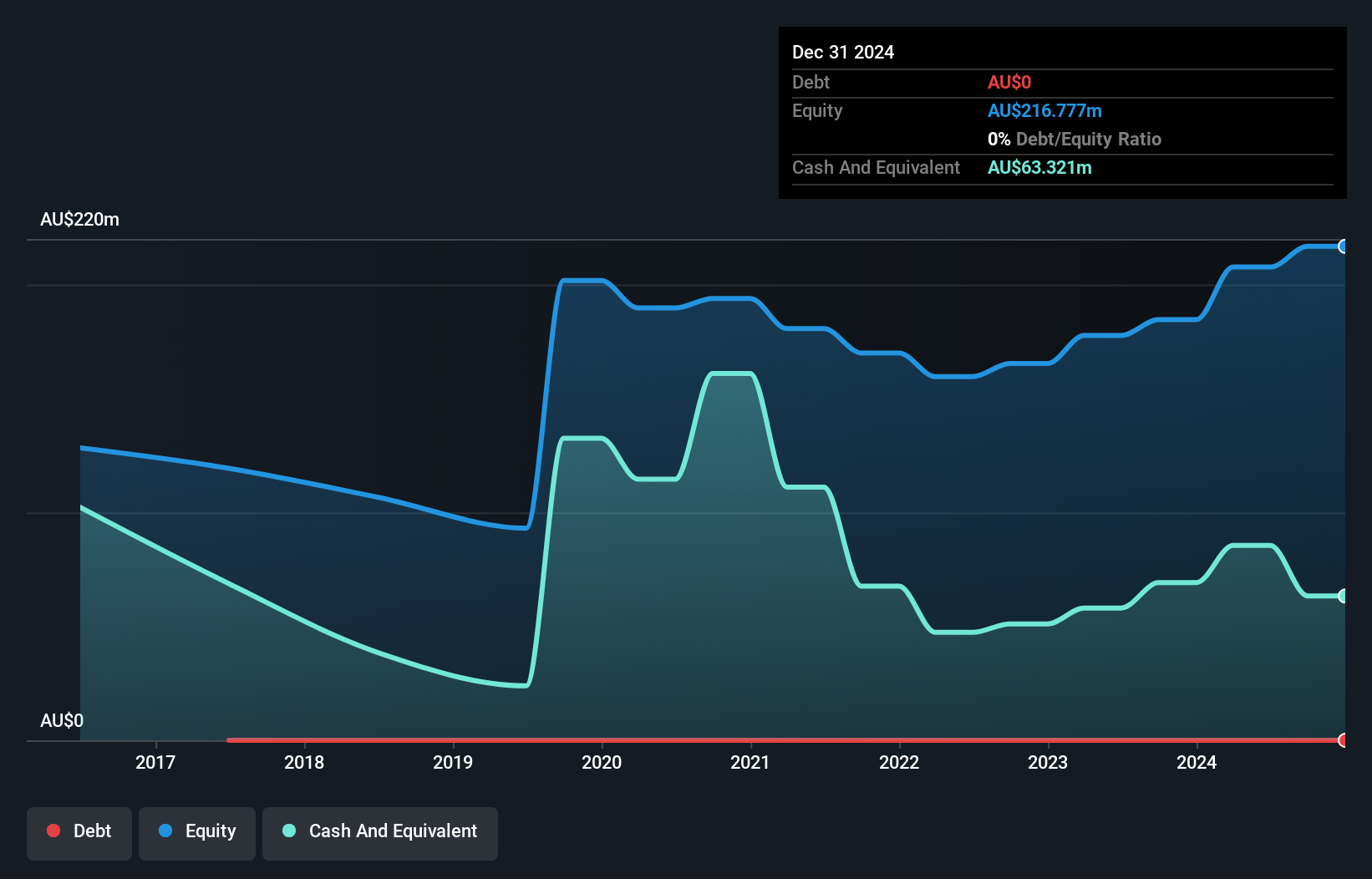

Metals X Limited, with a market cap of A$425.47 million, primarily derives its revenue from a 50% stake in the Renison Tin Operation, generating A$186.22 million. The company has more cash than total debt and short-term assets of A$231.9 million exceed both short and long-term liabilities, indicating solid liquidity management. Despite experiencing a large one-off loss impacting recent financial results and negative earnings growth over the past year, Metals X has achieved profitability over five years with significant annual earnings growth previously recorded at 52.9%. Recent executive changes include Natalie Teo's appointment as company secretary effective November 2024.

- Jump into the full analysis health report here for a deeper understanding of Metals X.

- Assess Metals X's previous results with our detailed historical performance reports.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited provides payment solutions to merchants in Australia and has a market cap of A$435.62 million.

Operations: The company's revenue is primarily generated from its Payments segment, which accounts for A$471.51 million, complemented by Banking revenue of A$14.73 million.

Market Cap: A$435.62M

Tyro Payments, with a market cap of A$435.62 million, has seen its net profit margin improve significantly to 5.2% from last year's 1.4%, reflecting enhanced profitability despite a one-off loss of A$20 million impacting recent results. The company is debt-free, ensuring no interest coverage concerns and strong financial health as short-term assets (A$188.2M) surpass liabilities (A$165.4M). Tyro's earnings growth over the past year was substantial at 327.5%, far exceeding its five-year average of 41.4% per annum and outperforming industry trends, though its Return on Equity remains low at 12.4%.

- Take a closer look at Tyro Payments' potential here in our financial health report.

- Learn about Tyro Payments' future growth trajectory here.

Key Takeaways

- Take a closer look at our ASX Penny Stocks list of 1,029 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K&S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSC

K&S

Engages in the transportation and logistics, warehousing and fuel distribution businesses in Australia and New Zealand.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives