- Australia

- /

- Diversified Financial

- /

- ASX:SZL

Sezzle (ASX:SZL) Price Soars 43% Over Last Quarter

Reviewed by Simply Wall St

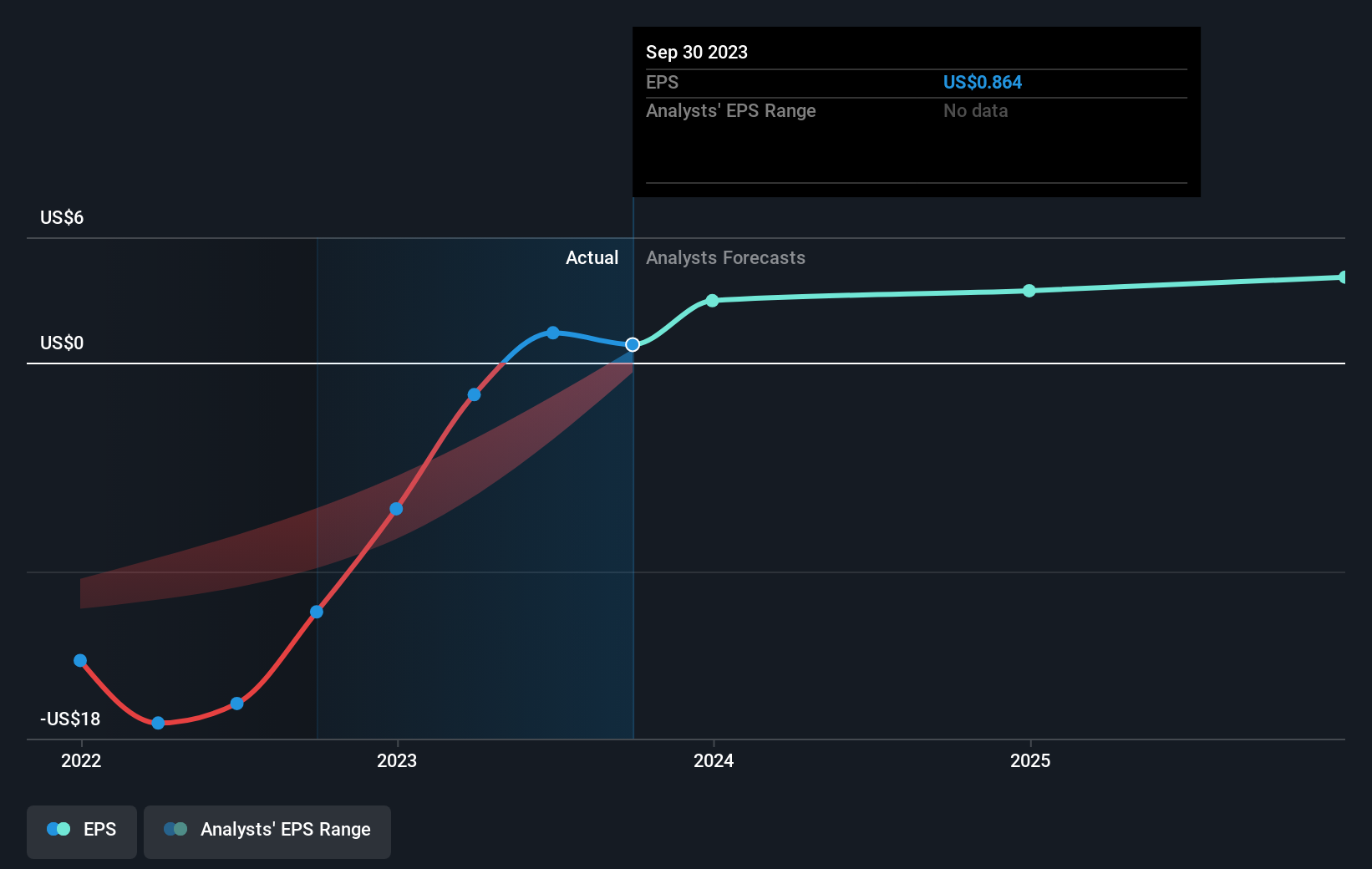

On June 28, 2025, Sezzle (ASX:SZL) was removed from six key indices, potentially impacting its market visibility. Despite this, the company's share price soared 43% over the last quarter. This substantial movement aligns with broader market trends, as the S&P 500 and Nasdaq rose to new highs amid investor optimism in a stable geopolitical and economic climate. Contributing to this surge, Sezzle's robust Q1 2025 earnings and increased revenue forecasts added to positive sentiment, counterbalancing the impact of its index removals. Overall, Sezzle's performance reflects investor confidence buoyed by both company growth and favorable market conditions.

Sezzle has 4 weaknesses (and 3 which make us uncomfortable) we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, Sezzle has provided a total shareholder return of 13.41%. This performance stands out, especially when compared to the Australian Diversified Financial industry, which returned 4.7%, and the broader Australian Market's 9.6% return over the same timeframe. Such outcomes indicate Sezzle's resilience and solid shareholder value creation despite the index removals on June 28, 2025.

The boost in Sezzle's Q1 2025 earnings, marked by substantial growth in sales and net income, may lead to enhanced revenue and earnings forecasts. This shift in financial projections supports the decision to increase earnings guidance for FY 2025, potentially driving investor optimism. However, it's crucial to observe that despite the recent share price surge, the current price remains below the consensus analyst price target of A$29.82, suggesting room for further growth if financial targets are met.

Click to explore a detailed breakdown of our findings in Sezzle's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Medium with questionable track record.

Similar Companies

Market Insights

Community Narratives