- Australia

- /

- Basic Materials

- /

- ASX:JHX

Top 3 ASX Stocks Estimated Below Market Value In July 2024

Reviewed by Simply Wall St

Amidst a generally positive trend in the Australian market, with the ASX200 closing up and most sectors showing gains, investors are keenly observing shifts in various sectors influenced by global economic signals and local corporate developments. In this context, identifying stocks that appear undervalued becomes crucial, as they may offer potential for growth especially when aligned with broader economic movements and sector-specific trends.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MaxiPARTS (ASX:MXI) | A$1.98 | A$3.95 | 49.8% |

| GTN (ASX:GTN) | A$0.435 | A$0.85 | 48.7% |

| Ansell (ASX:ANN) | A$25.96 | A$49.23 | 47.3% |

| hipages Group Holdings (ASX:HPG) | A$1.06 | A$2.06 | 48.5% |

| IPH (ASX:IPH) | A$6.25 | A$11.89 | 47.4% |

| ReadyTech Holdings (ASX:RDY) | A$3.27 | A$6.21 | 47.4% |

| Australian Clinical Labs (ASX:ACL) | A$2.46 | A$4.69 | 47.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| SiteMinder (ASX:SDR) | A$5.03 | A$9.46 | 46.8% |

| MedAdvisor (ASX:MDR) | A$0.55 | A$1.08 | 48.9% |

Here's a peek at a few of the choices from the screener.

James Hardie Industries (ASX:JHX)

Overview: James Hardie Industries plc specializes in producing and selling fiber cement, fiber gypsum, and cement bonded building products for various building construction applications across the United States, Australia, Europe, New Zealand, and the Philippines, with a market capitalization of A$21.15 billion.

Operations: The company's revenue is generated from three primary segments: Europe Building Products at $482.10 million, Asia Pacific Fiber Cement at $562.80 million, and North America Fiber Cement at $2.89 billion.

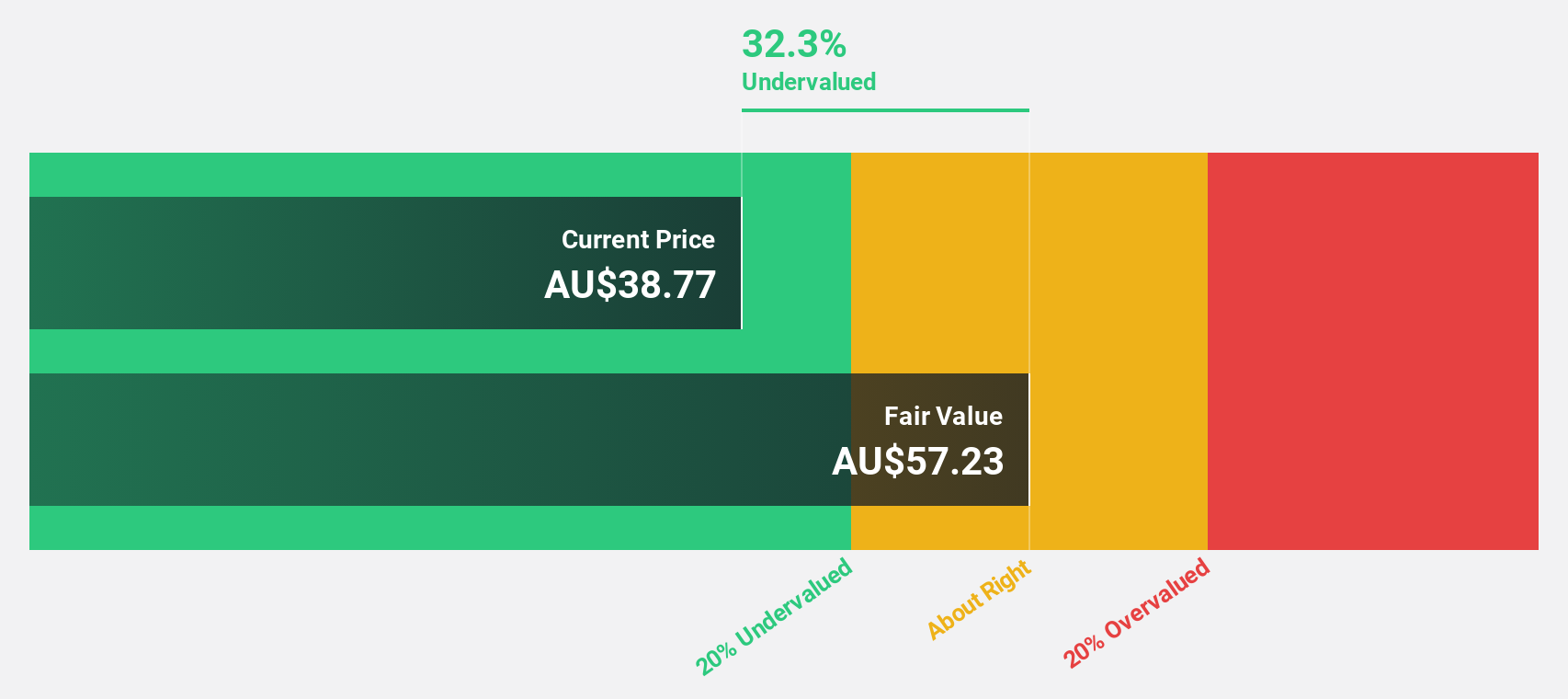

Estimated Discount To Fair Value: 27.5%

James Hardie Industries, trading at A$49.03, appears undervalued based on cash flows with a fair value estimate of A$67.58. Recent financials show stable net income with slight earnings growth expected (13.97% per year), outpacing the Australian market forecast (12.8% per year). Despite high debt levels, the firm is managing an aggressive buyback strategy, increasing its authorization by A$50 million recently and joining the S&P/ASX 20 Index, signaling robust market confidence and operational strength.

- Insights from our recent growth report point to a promising forecast for James Hardie Industries' business outlook.

- Take a closer look at James Hardie Industries' balance sheet health here in our report.

Lotus Resources (ASX:LOT)

Overview: Lotus Resources Limited is a company focused on the exploration, evaluation, and development of uranium properties in Australia and Africa, with a market capitalization of approximately A$668.59 million.

Operations: The firm primarily generates revenue through its uranium exploration and development activities across Australia and Africa.

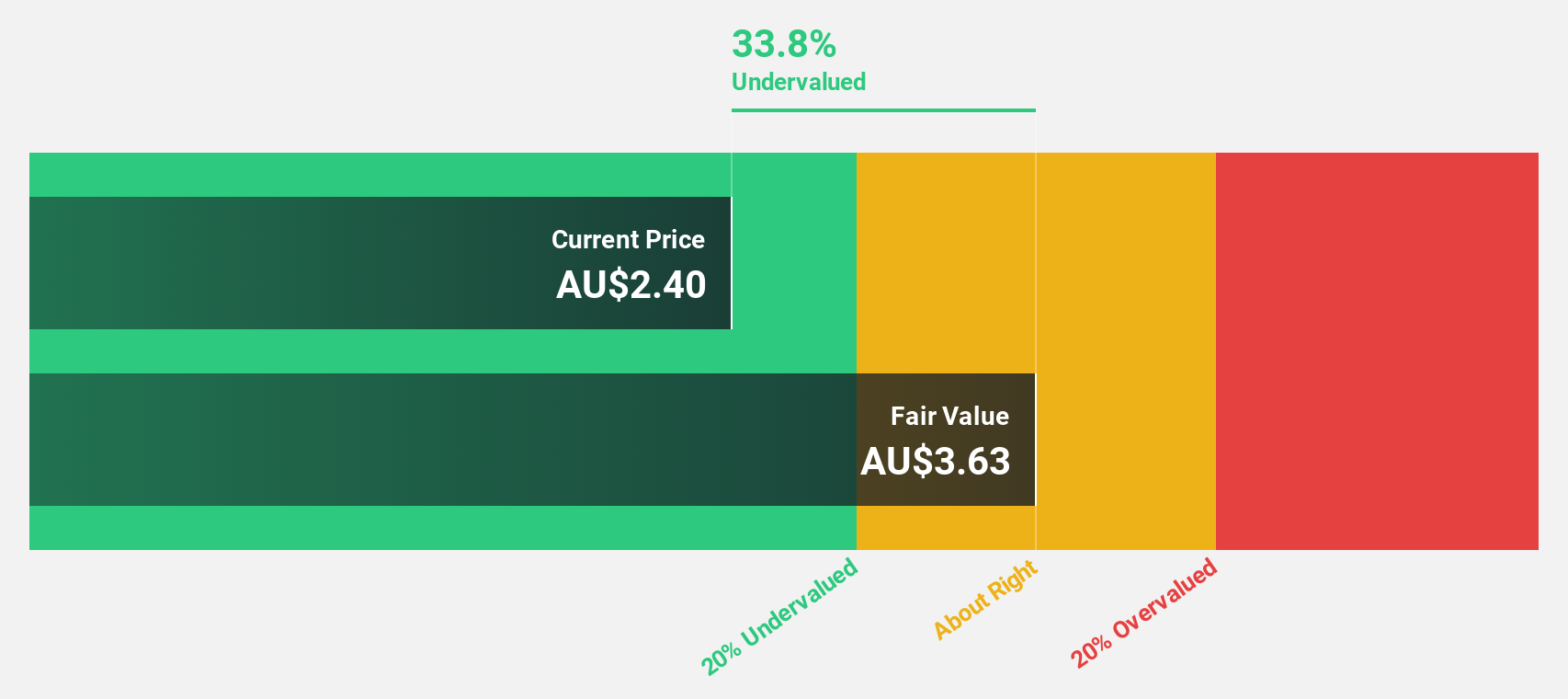

Estimated Discount To Fair Value: 34.5%

Lotus Resources, valued at A$0.37, is perceived as undervalued against a fair value estimate of A$0.56 based on discounted cash flows, reflecting a significant undervaluation. Despite generating less than A$1 million in revenue last year and experiencing shareholder dilution recently, the company is expected to become profitable within three years with an anticipated robust annual earnings growth and an exceptionally high return on equity forecasted at 69.3%. Analyst consensus suggests a potential price increase of 78.9%.

- Our comprehensive growth report raises the possibility that Lotus Resources is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Lotus Resources stock in this financial health report.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited, a privately owned hedge fund sponsor, operates with a market capitalization of approximately A$1.10 billion.

Operations: The company generates revenue primarily through the provision of investment management services, totaling A$105.28 million.

Estimated Discount To Fair Value: 42.3%

Regal Partners, currently priced at A$3.48, appears undervalued compared to its estimated fair value of A$6.03, suggesting a potential opportunity based on discounted cash flow analysis. The company has seen a 19.2% revenue increase over the past year and anticipates continued robust growth with revenue and earnings expected to rise by 21.2% and 32.3% per year respectively, outpacing the Australian market forecasts significantly. However, challenges include lower profit margins compared to last year and significant insider selling recently which could signal caution.

- Upon reviewing our latest growth report, Regal Partners' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Regal Partners.

Next Steps

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 49 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JHX

James Hardie Industries

Engages in the manufacture and sale of fiber cement, fiber gypsum, and cement bonded building products for interior and exterior building construction applications primarily in the United States, Australia, Europe, New Zealand, and the Philippines.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives