- Australia

- /

- Capital Markets

- /

- ASX:RPL

ASX Stocks Like Aussie Broadband That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

The Australian market has been experiencing cautious sentiment, with ASX futures dipping slightly overnight as traders weigh the implications of recent economic data and global financial trends. In such an environment, identifying undervalued stocks can offer potential opportunities for investors looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Symal Group (ASX:SYL) | A$2.77 | A$4.68 | 40.8% |

| Superloop (ASX:SLC) | A$2.81 | A$5.36 | 47.5% |

| SenSen Networks (ASX:SNS) | A$0.098 | A$0.19 | 48% |

| Ramelius Resources (ASX:RMS) | A$3.66 | A$7.27 | 49.7% |

| LGI (ASX:LGI) | A$4.36 | A$7.71 | 43.4% |

| Kogan.com (ASX:KGN) | A$3.41 | A$6.82 | 50% |

| Genesis Minerals (ASX:GMD) | A$6.66 | A$13.03 | 48.9% |

| Cromwell Property Group (ASX:CMW) | A$0.455 | A$0.85 | 46.4% |

| Aussie Broadband (ASX:ABB) | A$5.32 | A$10.58 | 49.7% |

| Airtasker (ASX:ART) | A$0.34 | A$0.67 | 49.6% |

Let's explore several standout options from the results in the screener.

Aussie Broadband (ASX:ABB)

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.56 billion.

Operations: The company's revenue is derived from several segments, including Business (A$108.07 million), Wholesale (A$89.99 million), Residential (A$676.81 million), Symbio Group (A$214.48 million), and Enterprise and Government (A$97.79 million).

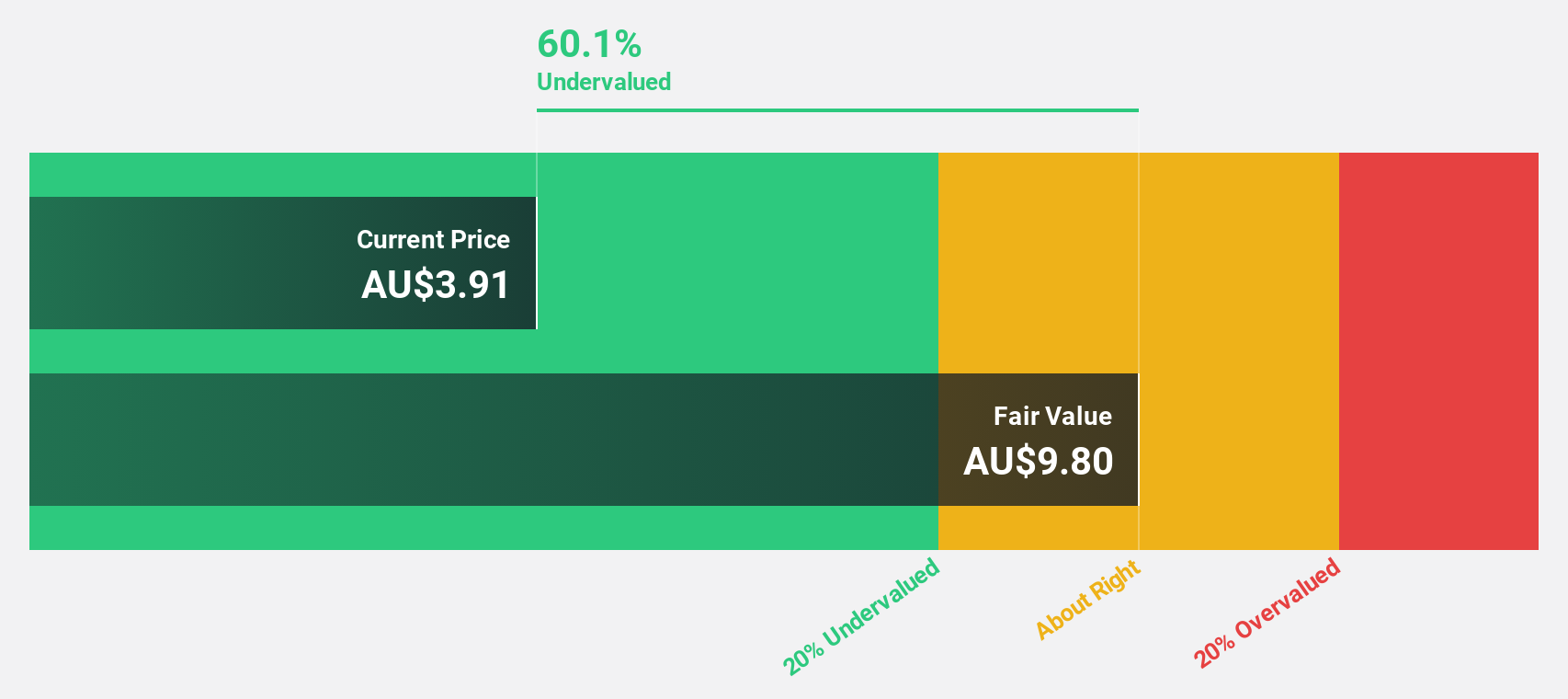

Estimated Discount To Fair Value: 49.7%

Aussie Broadband is trading at A$5.32, significantly below its estimated fair value of A$10.58, indicating it is undervalued by over 20%. While revenue growth is forecasted at 8.4% per year, slower than the ideal rate, earnings are expected to grow significantly at 21.7% annually, outpacing the Australian market's growth rate of 12.2%. However, its Return on Equity remains modestly forecasted at 13.8% in three years.

- Our earnings growth report unveils the potential for significant increases in Aussie Broadband's future results.

- Navigate through the intricacies of Aussie Broadband with our comprehensive financial health report here.

Ramelius Resources (ASX:RMS)

Overview: Ramelius Resources Limited is involved in the exploration, evaluation, mine development and operation, production, and sale of gold with a market cap of A$7.04 billion.

Operations: The company's revenue is derived from its operations at Edna May, contributing A$227.99 million, and Mt Magnet, generating A$975.38 million.

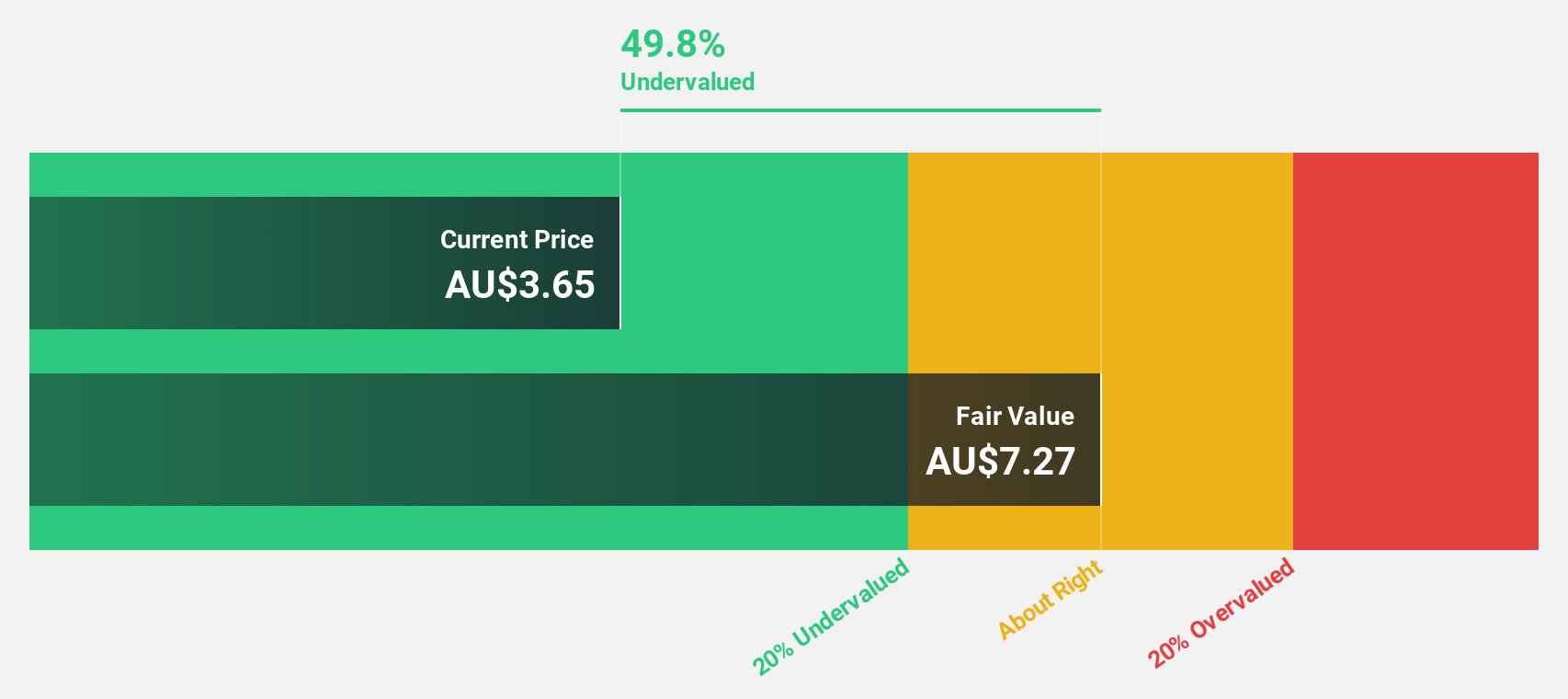

Estimated Discount To Fair Value: 49.7%

Ramelius Resources is trading at A$3.66, well below its estimated fair value of A$7.27, highlighting a substantial undervaluation based on cash flows. Despite past shareholder dilution and an unstable dividend history, the company offers good relative value compared to peers. Its earnings are forecasted to grow at 13.7% annually, surpassing the Australian market's rate of 12.2%. Recent events include discussions on a five-year growth pathway and its addition to the S&P/ASX 100 Index.

- In light of our recent growth report, it seems possible that Ramelius Resources' financial performance will exceed current levels.

- Click here to discover the nuances of Ramelius Resources with our detailed financial health report.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.14 billion.

Operations: The company generates revenue from the provision of investment management services, amounting to A$245.45 million.

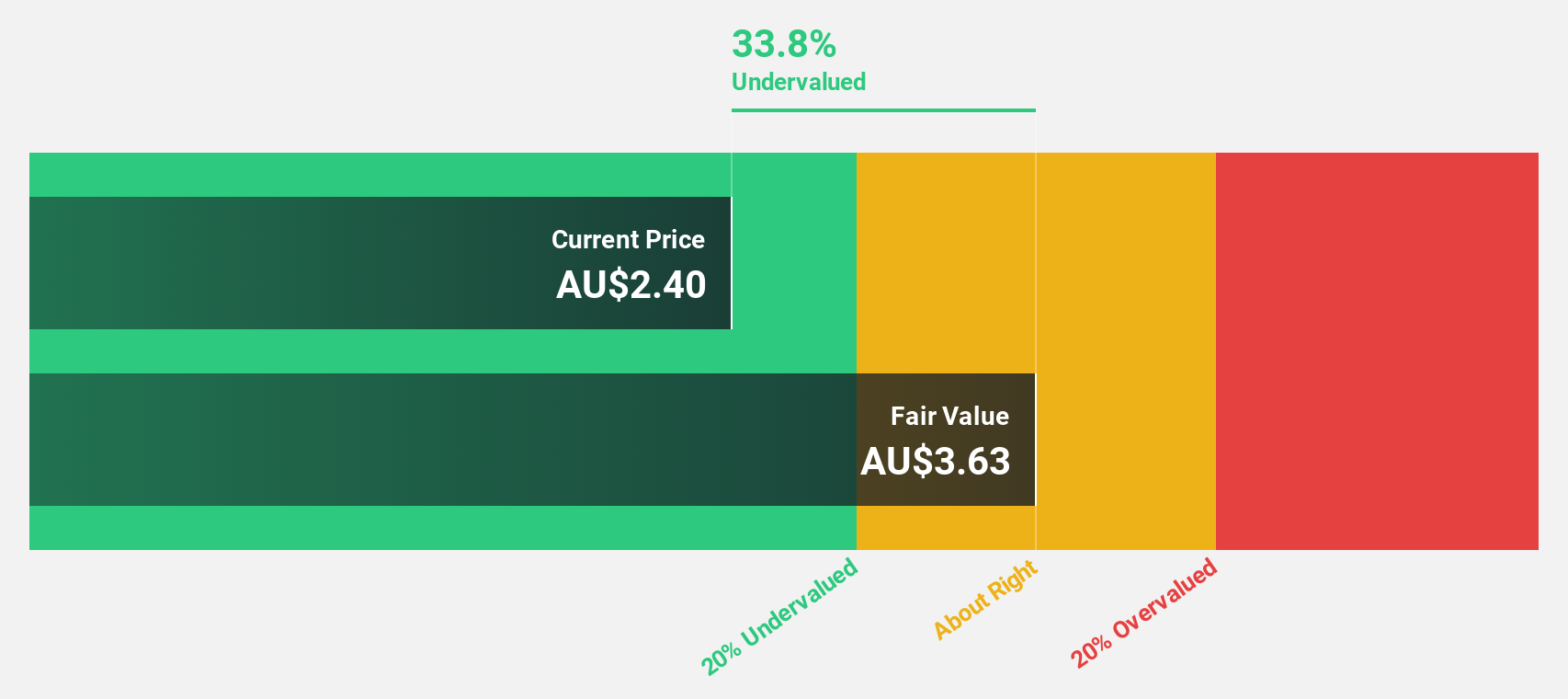

Estimated Discount To Fair Value: 37.1%

Regal Partners is trading at A$3.1, significantly below its fair value estimate of A$4.93, suggesting it is undervalued based on cash flows. Despite a decline in profit margins from 28.1% to 17.2% and recent insider selling, the company's earnings are forecasted to grow substantially at 31.5% annually over the next three years, outpacing market averages. Recent inclusion in the S&P/ASX 300 and Small Ordinaries indices enhances its visibility among investors.

- The analysis detailed in our Regal Partners growth report hints at robust future financial performance.

- Take a closer look at Regal Partners' balance sheet health here in our report.

Next Steps

- Click here to access our complete index of 36 Undervalued ASX Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026