- Australia

- /

- Capital Markets

- /

- ASX:QAL

Navigator Global Investments And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close slightly down by 0.06% at 8,374 points, with IT and Materials sectors performing well while Real Estate lagged behind. Despite these mixed performances, investors continue to explore opportunities in smaller or newer companies often referred to as penny stocks. Although the term 'penny stock' might seem outdated, these stocks can still offer significant potential when backed by strong financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.94 | A$315.87M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.535 | A$106.04M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$248.73M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.20 | A$340.76M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.825 | A$101.54M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.31 | A$61.65M | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Navigator Global Investments (ASX:NGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Navigator Global Investments, trading as HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$784.13 million.

Operations: The company's revenue primarily comes from its Lighthouse segment, which generated $95.93 million.

Market Cap: A$784.13M

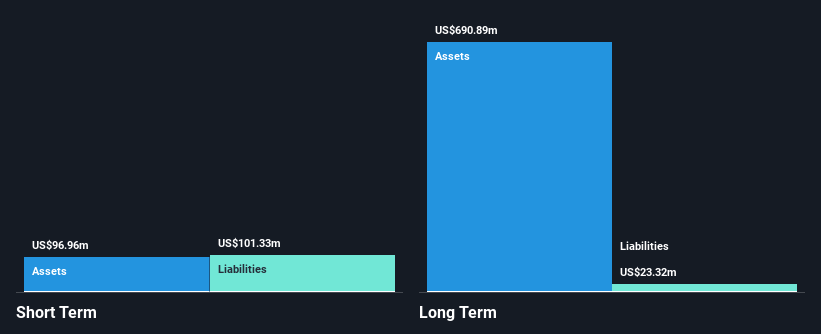

Navigator Global Investments, trading as HFA Holdings Limited, has demonstrated robust earnings growth, with an 86.7% increase over the past year and a consistent 14.6% annual growth over five years. Despite a large one-off gain of A$17.7 million impacting recent results, the company maintains high-quality earnings and is debt-free, eliminating concerns about interest coverage or debt levels. While its short-term assets (A$97 million) slightly fall short of covering short-term liabilities (A$101.3 million), long-term liabilities are well-covered by assets. Trading at good value compared to peers and industry standards enhances its appeal among penny stocks in Australia.

- Click here to discover the nuances of Navigator Global Investments with our detailed analytical financial health report.

- Gain insights into Navigator Global Investments' future direction by reviewing our growth report.

Qualitas (ASX:QAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qualitas is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt acquisitions and restructuring, third-party capital raisings, and consulting services, with a market cap of A$761.63 million.

Operations: The company's revenue is derived from Direct Lending, which contributes A$26.79 million, and Funds Management, accounting for A$13.61 million.

Market Cap: A$761.63M

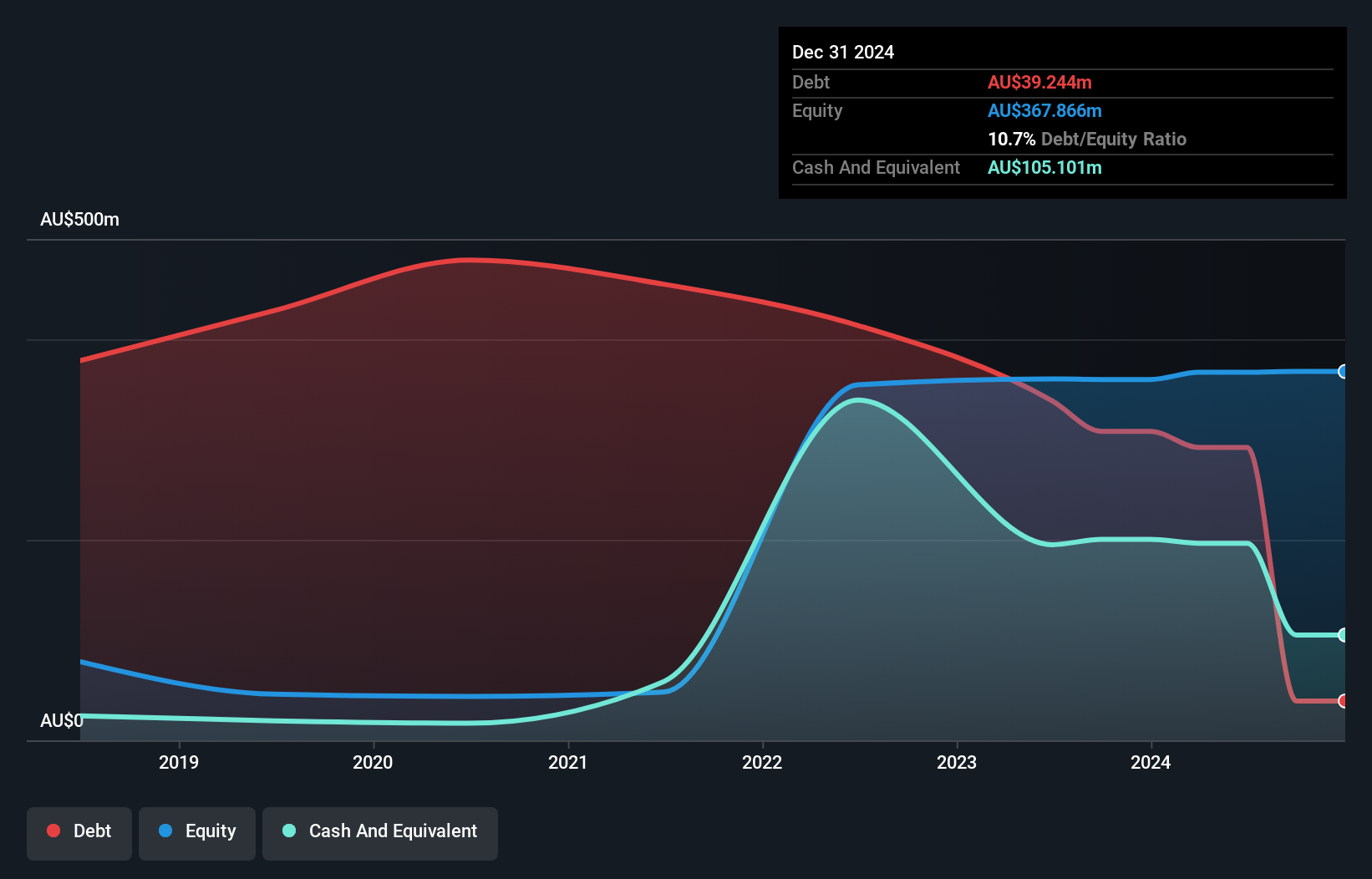

Qualitas, with a market cap of A$761.63 million, shows strong financial health as its short-term assets (A$583.8M) comfortably cover both short-term (A$143.6M) and long-term liabilities (A$197.6M). The company's debt to equity ratio has significantly improved from 931.3% to 79.6% over five years, with operating cash flow covering 24.8% of its debt—a satisfactory figure indicating prudent financial management despite interest coverage being slightly below optimal levels at 2.8x EBIT. Earnings have grown robustly by 25.2% annually over five years but lagged industry growth last year at 17.2%.

- Take a closer look at Qualitas' potential here in our financial health report.

- Learn about Qualitas' future growth trajectory here.

Sheffield Resources (ASX:SFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheffield Resources Limited is involved in the evaluation and development of mineral sands in Australia, with a market cap of A$61.19 million.

Operations: Sheffield Resources does not report any specific revenue segments.

Market Cap: A$61.19M

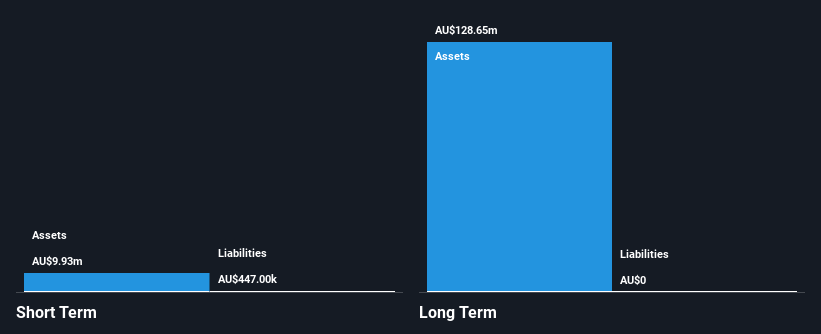

Sheffield Resources Limited, with a market cap of A$61.19 million, is pre-revenue and currently unprofitable. Despite this, the company maintains financial stability with no debt and short-term assets of A$9.9 million exceeding liabilities of A$447,000. The board has an average tenure of 4.7 years, suggesting experienced governance. While earnings are forecast to grow significantly by 67% annually, the company's share price has been highly volatile recently and exhibits higher volatility than most Australian stocks. Sheffield Resources has a sufficient cash runway for over three years if free cash flow continues its historical growth trend.

- Get an in-depth perspective on Sheffield Resources' performance by reading our balance sheet health report here.

- Gain insights into Sheffield Resources' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Navigate through the entire inventory of 1,031 ASX Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qualitas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QAL

Qualitas

Qualitas is a real estate investment firm which focuses on direct investment in all real estate classes and geographies, acquisitions and restructuring of distressed debt, third party capital raisings and consulting services.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives