- Australia

- /

- Consumer Finance

- /

- ASX:PLT

Plenti Group (ASX:PLT investor one-year losses grow to 57% as the stock sheds AU$12m this past week

Plenti Group Limited (ASX:PLT) shareholders will doubtless be very grateful to see the share price up 38% in the last quarter. But that's small comfort given the dismal price performance over the last year. Specifically, the stock price slipped by 57% in that time. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Plenti Group

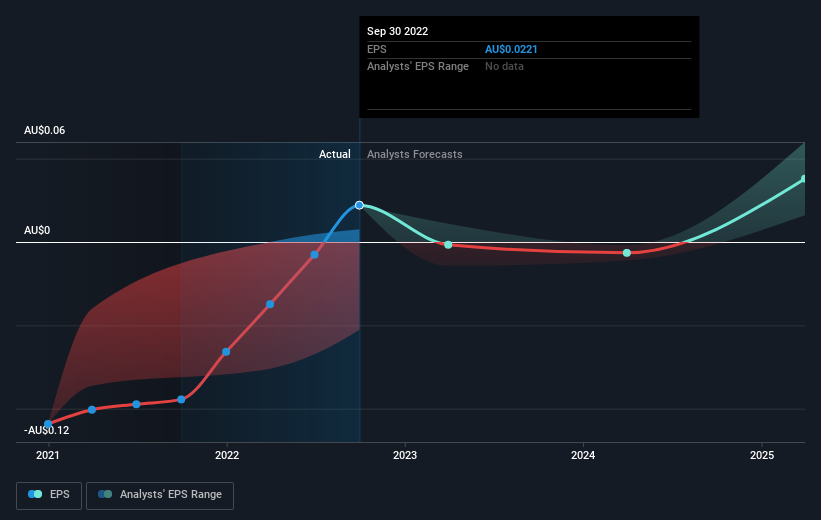

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Plenti Group managed to increase earnings per share from a loss to a profit, over the last 12 months.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While Plenti Group shareholders are down 57% for the year, the market itself is up 6.7%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 38%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Plenti Group has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Plenti Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PLT

Plenti Group

Engages in the fintech lending and investment business in Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives