- Australia

- /

- Oil and Gas

- /

- ASX:AXP

AXP Energy And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market has recently experienced a downturn, with the ASX200 dipping below the 8,300-point level amid mixed sector performances. Despite this volatility, there are still opportunities for investors willing to explore less traditional avenues like penny stocks. Although the term may seem outdated, these smaller or newer companies can provide significant potential when backed by strong financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.505 | A$313.17M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.80 | A$232.15M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.935 | A$315.05M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.60 | A$784.13M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$215.17M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.84 | A$103.2M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.86 | A$479.51M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AXP Energy (ASX:AXP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AXP Energy Limited is an oil and gas production and development company operating in the United States with a market capitalization of A$11.65 million.

Operations: The company's revenue is primarily derived from its operations in the Denver-Julesburg Basin, generating $0.64 million.

Market Cap: A$11.65M

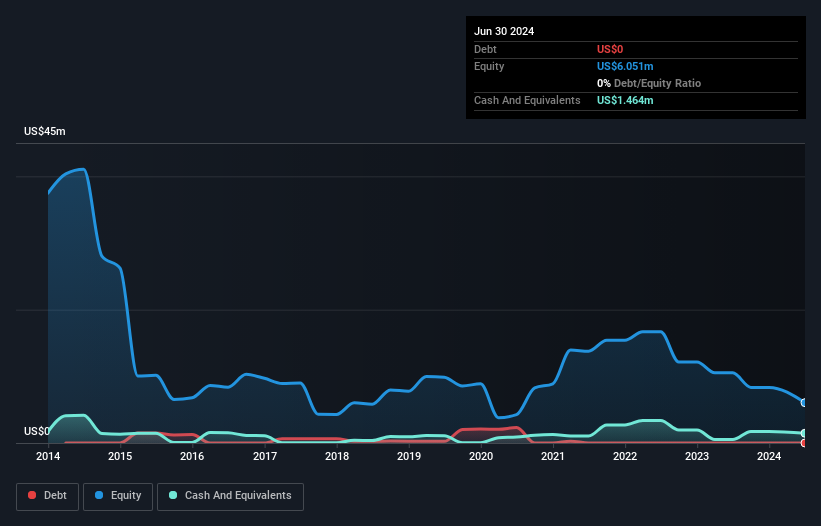

AXP Energy, with a market cap of A$11.65 million, operates in the oil and gas sector but remains pre-revenue with US$0.64 million in earnings from its Denver-Julesburg Basin operations. The company is debt-free and has seen reduced volatility over the past year, though it still experiences high share price fluctuations. Recent strategic moves include a Joint Development Agreement with Blackhart Technologies to utilize stranded natural gas for power generation at its Pathfinder Field in Colorado, potentially unlocking significant value. However, concerns remain about its financial stability as highlighted by an auditor's going concern doubts.

- Jump into the full analysis health report here for a deeper understanding of AXP Energy.

- Understand AXP Energy's track record by examining our performance history report.

Boss Energy (ASX:BOE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boss Energy Limited explores for and produces uranium deposits in Australia and the United States, with a market cap of A$1.07 billion.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: A$1.07B

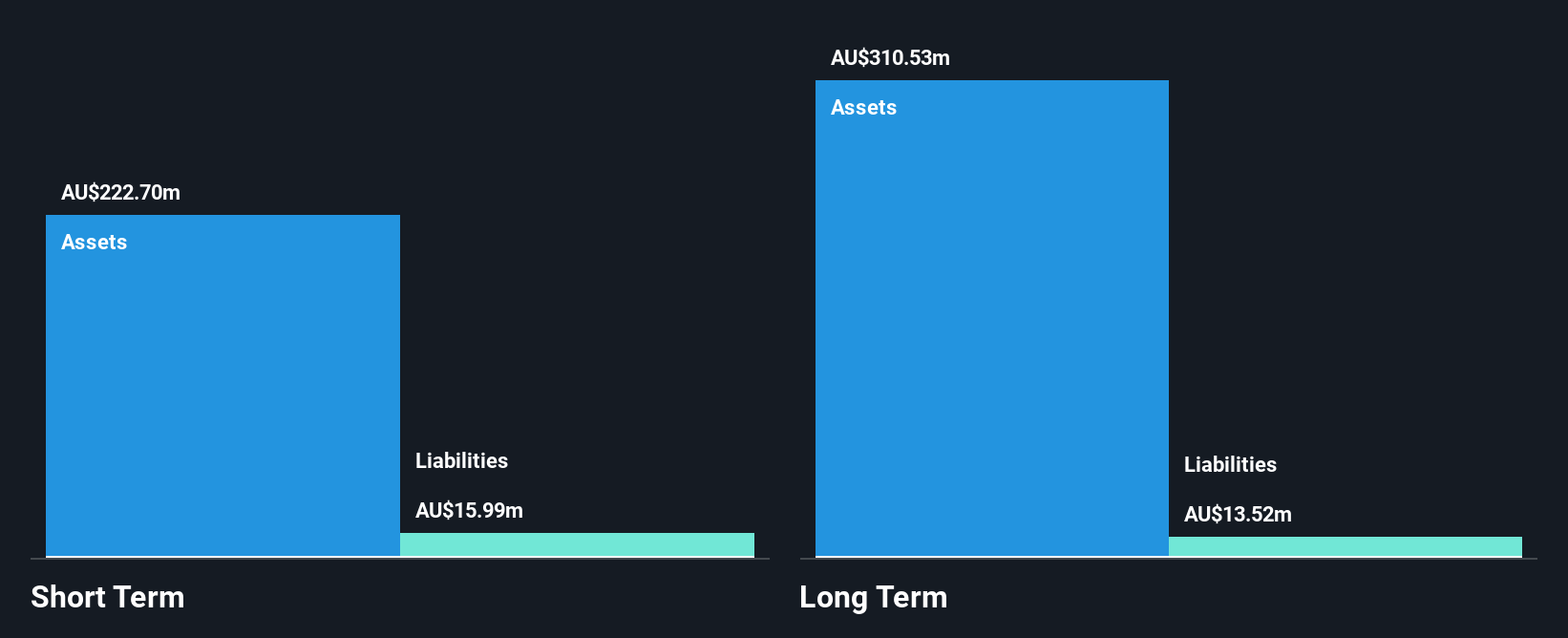

Boss Energy, with a market cap of A$1.07 billion, remains pre-revenue and debt-free, benefiting from strong short-term asset coverage over liabilities. The company has seen substantial earnings growth of 255.4% in the past year, significantly outpacing industry averages and showing accelerated profit growth compared to its five-year average. Despite its low return on equity at 8.7%, Boss Energy's financial health is bolstered by no debt concerns and stable weekly volatility at 7%. Recent leadership changes include appointing Matt Dusci as COO, bringing extensive mining industry experience that may influence strategic development positively.

- Click here and access our complete financial health analysis report to understand the dynamics of Boss Energy.

- Explore Boss Energy's analyst forecasts in our growth report.

Pengana Capital Group (ASX:PCG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pengana Capital Group (ASX:PCG) is a publicly owned investment manager with a market capitalization of A$75.12 million.

Operations: The company generates revenue of A$40.48 million from the development, offering, and management of investment funds.

Market Cap: A$75.12M

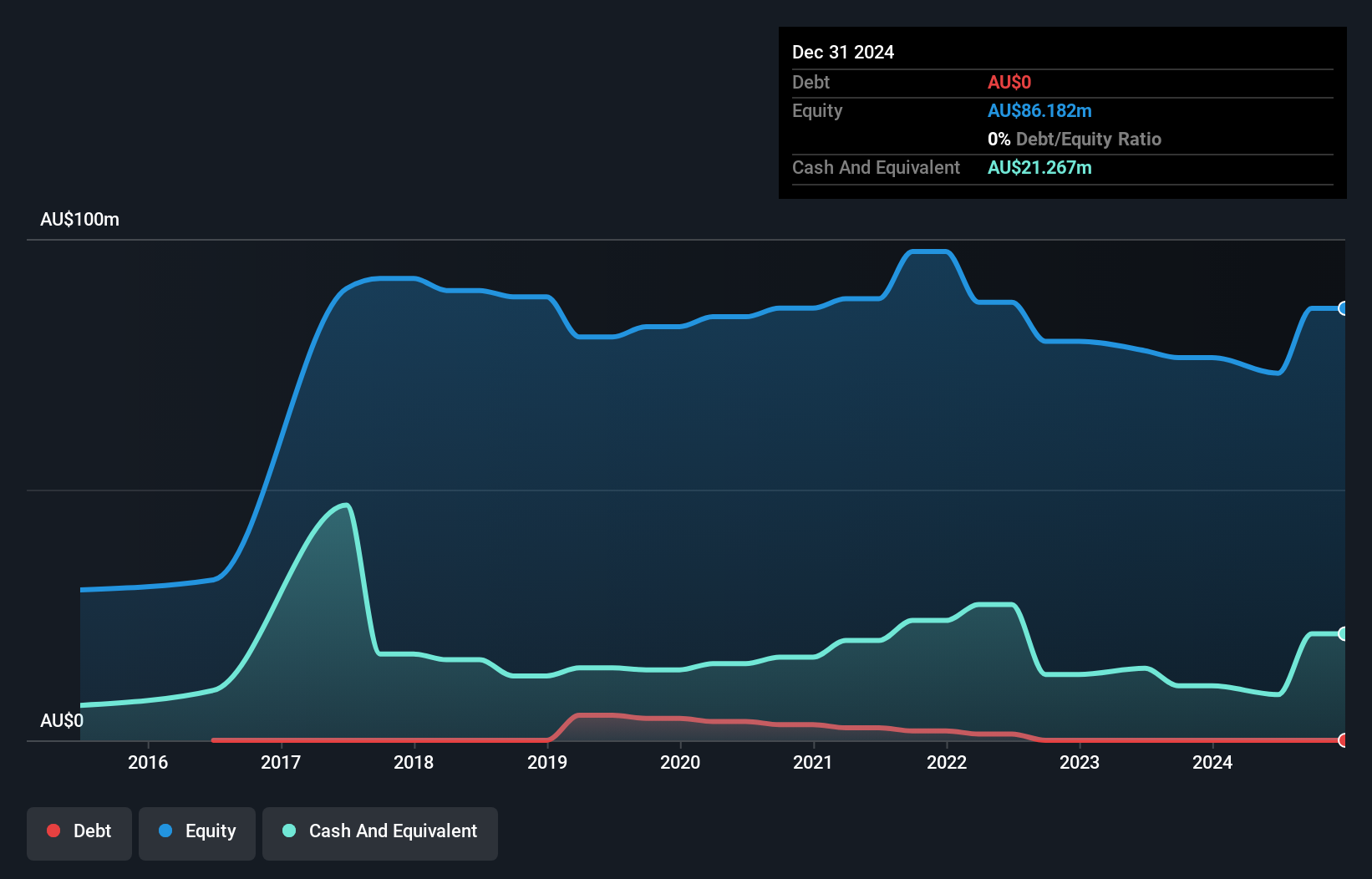

Pengana Capital Group, with a market cap of A$75.12 million, is debt-free and has reduced its losses by 22.9% annually over the past five years despite being unprofitable. The company’s short-term assets of A$18.3 million comfortably cover both short- and long-term liabilities, totaling A$19.6 million combined. Trading at 38.1% below estimated fair value suggests potential undervaluation, although its dividend yield of 3.33% is not well-covered by earnings or cash flows due to profitability issues. Recent strategic discussions and constitutional changes indicate ongoing efforts to enhance operational efficiency amidst stable weekly volatility at 7%.

- Take a closer look at Pengana Capital Group's potential here in our financial health report.

- Review our growth performance report to gain insights into Pengana Capital Group's future.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1,047 ASX Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AXP

AXP Energy

Operates as an oil and gas production and development company in the United States.

Flawless balance sheet low.

Market Insights

Community Narratives