Insiders who purchased Omni Bridgeway Limited (ASX:OBL) shares in the past 12 months are unlikely to be deeply impacted by the stock's 14% decline over the past week. After taking the recent loss into consideration, the AU$4.67m worth of stock they bought is now worth AU$6.67m, indicating that their investment yielded a positive return.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

Check out our latest analysis for Omni Bridgeway

Omni Bridgeway Insider Transactions Over The Last Year

The insider Vadim Rubinchik made the biggest insider purchase in the last 12 months. That single transaction was for AU$4.6m worth of shares at a price of AU$0.93 each. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of AU$1.34. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

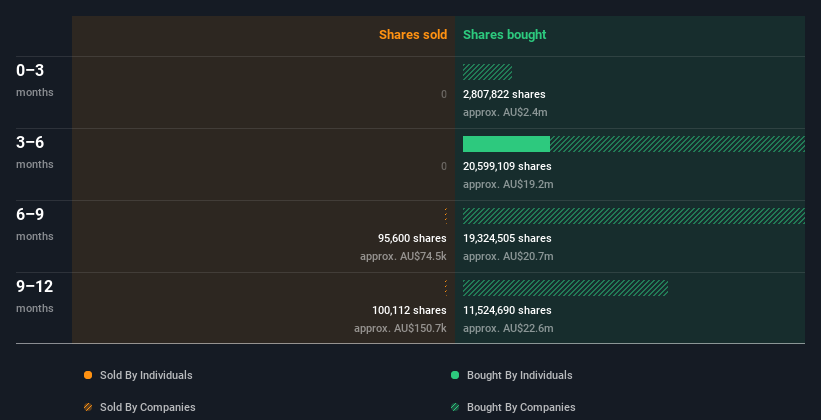

While Omni Bridgeway insiders bought shares during the last year, they didn't sell. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

Omni Bridgeway is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insider Ownership Of Omni Bridgeway

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Omni Bridgeway insiders own about AU$24m worth of shares. That equates to 6.4% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At Omni Bridgeway Tell Us?

There haven't been any insider transactions in the last three months -- that doesn't mean much. But insiders have shown more of an appetite for the stock, over the last year. Insiders do have a stake in Omni Bridgeway and their transactions don't cause us concern. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Every company has risks, and we've spotted 1 warning sign for Omni Bridgeway you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:OBL

Omni Bridgeway

Provides dispute and litigation finance services in Australia, the United States, Canada, Latin America, Asia, New Zealand, Europe, the Middle East, and Africa.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion