- Australia

- /

- Diversified Financial

- /

- ASX:OBL

Omni Bridgeway (ASX:OBL) pulls back 11% this week, but still delivers shareholders favorable 7.4% CAGR over 5 years

Omni Bridgeway Limited (ASX:OBL) shareholders have seen the share price descend 13% over the month. On the bright side the share price is up over the last half decade. In that time, it is up 38%, which isn't bad, but is below the market return of 48%.

Since the long term performance has been good but there's been a recent pullback of 11%, let's check if the fundamentals match the share price.

See our latest analysis for Omni Bridgeway

Omni Bridgeway isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last half decade Omni Bridgeway's revenue has actually been trending down at about 7.9% per year. Despite the lack of revenue growth, the stock has returned a respectable 7%, compound, over that time. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

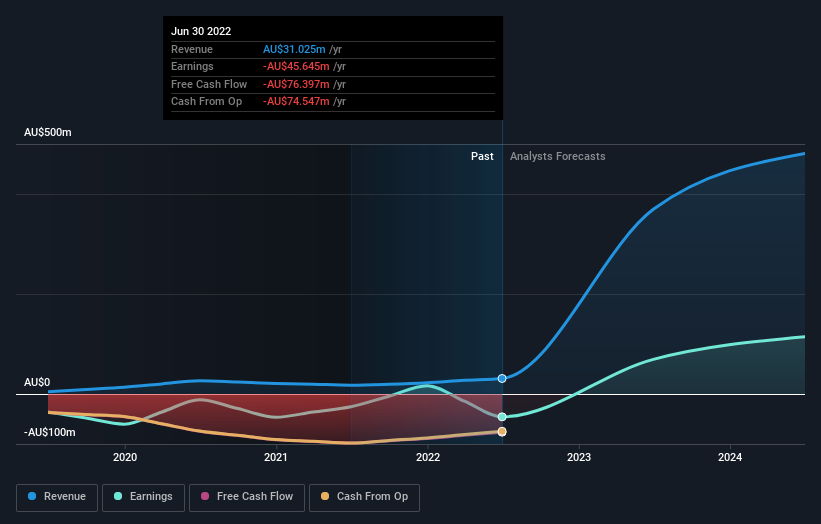

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Omni Bridgeway's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Omni Bridgeway's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Omni Bridgeway's TSR of 43% over the last 5 years is better than the share price return.

A Different Perspective

We're pleased to report that Omni Bridgeway shareholders have received a total shareholder return of 18% over one year. That gain is better than the annual TSR over five years, which is 7%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Omni Bridgeway better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Omni Bridgeway , and understanding them should be part of your investment process.

But note: Omni Bridgeway may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:OBL

Omni Bridgeway

Offers dispute and litigation finance services in Australia, the United States, Canada, Latin America, Asia, New Zealand, Europe, the Middle East, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives