- Australia

- /

- Metals and Mining

- /

- ASX:PRN

3 ASX Penny Stocks With Market Caps Up To A$2B

Reviewed by Simply Wall St

The ASX200 is set to open 0.27% higher on Wednesday, reflecting a positive trend influenced by Wall Street's optimism over potential trade deals and strong corporate earnings, despite mixed economic data. In this context of cautious optimism, investors may find opportunities in penny stocks—smaller or newer companies that offer affordability and potential growth. While the term 'penny stock' might seem outdated, these investments can still provide value when backed by solid financials, as demonstrated by the three examples discussed in this article.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.66 | A$133.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.84 | A$1.04B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.38 | A$65.1M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$119.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.38 | A$160.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.895 | A$637.03M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.725 | A$845.39M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.68 | A$1.23B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.375 | A$44.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 988 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, importation, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, and international markets with a market cap of A$623.23 million.

Operations: The company's revenue primarily comes from its Water Solutions segment, which generated A$417.40 million.

Market Cap: A$623.23M

GWA Group Limited, with a market cap of A$623.23 million, primarily generates revenue from its Water Solutions segment. Despite a stable weekly volatility of 3%, the company faces challenges with negative earnings growth over the past year and declining net profit margins from 11% to 8.9%. GWA's dividend yield of 6.6% is not well covered by earnings, indicating potential sustainability concerns. However, the company's debt levels are satisfactory and well-covered by operating cash flow and EBIT. Recent board changes include Richard Thornton as deputy chair and Brett Draffen leading the People & Culture Committee, reflecting ongoing governance adjustments.

- Click here to discover the nuances of GWA Group with our detailed analytical financial health report.

- Explore GWA Group's analyst forecasts in our growth report.

Omni Bridgeway (ASX:OBL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Omni Bridgeway Limited, with a market cap of A$435.53 million, provides dispute and litigation finance services across various regions including Australia, the United States, Canada, Latin America, Asia, New Zealand, Europe, the Middle East and Africa.

Operations: The company generates revenue of A$132.66 million from funding and providing services related to legal dispute resolution.

Market Cap: A$435.53M

Omni Bridgeway Limited, with a market cap of A$435.53 million, operates in litigation finance and has seen a decrease in net loss from A$47.63 million to A$32.61 million for the half-year ending December 31, 2024. Despite being unprofitable, it maintains a strong financial position with short-term assets of A$915.8M covering both short and long-term liabilities comfortably. The company is not heavily diluted and has an experienced management team led by newly appointed CFO David Breeney. While earnings are forecasted to grow significantly annually, the firm remains challenged by its negative return on equity at present.

- Click to explore a detailed breakdown of our findings in Omni Bridgeway's financial health report.

- Evaluate Omni Bridgeway's prospects by accessing our earnings growth report.

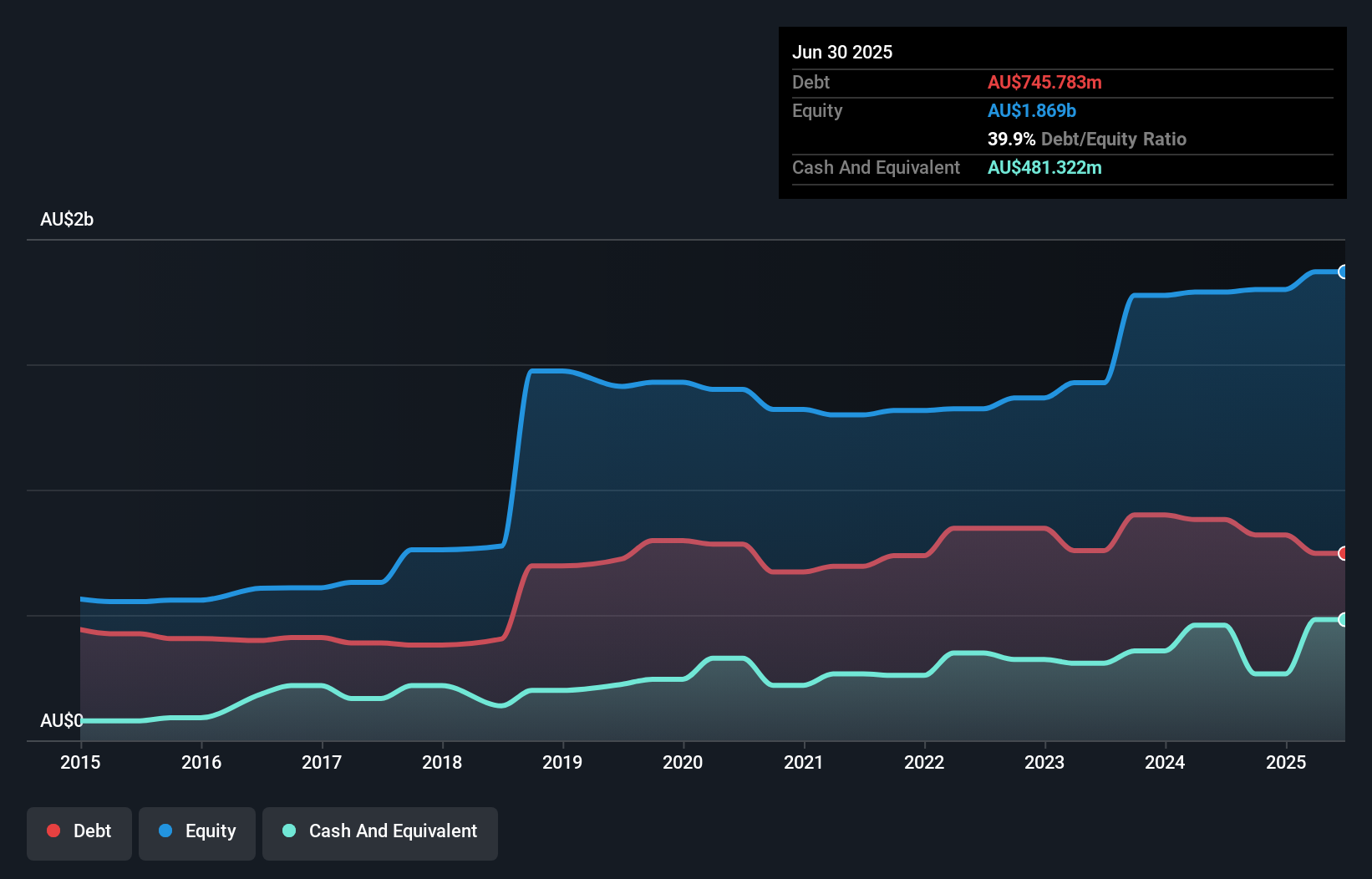

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market cap of A$1.28 billion.

Operations: Perenti's revenue is primarily derived from Contract Mining Services at A$2.50 billion, followed by Drilling Services at A$750.65 million, and Mining Services and Idoba at A$229.77 million.

Market Cap: A$1.28B

Perenti Limited, with a market cap of A$1.28 billion, faces challenges in earnings growth, reporting a decline in net income to A$56.28 million for the half-year ending December 31, 2024. Despite this, the company increased its dividend to 3 cents per share, reflecting confidence in cash generation. Perenti's debt is well-covered by operating cash flow and interest payments are adequately managed by EBIT. The company's short-term assets exceed both short and long-term liabilities, indicating financial stability. However, low return on equity and declining profit margins highlight areas needing improvement amidst stable weekly volatility and satisfactory debt levels.

- Get an in-depth perspective on Perenti's performance by reading our balance sheet health report here.

- Gain insights into Perenti's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Embark on your investment journey to our 988 ASX Penny Stocks selection here.

- Looking For Alternative Opportunities? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRN

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives