- Australia

- /

- Capital Markets

- /

- ASX:NGI

Unveiling Undiscovered Gems in Australia August 2025

Reviewed by Simply Wall St

As the Australian market continues to reach new heights, with the ASX200 hitting an all-time intra-day high of 9,054 points, investors are closely watching sector performances where Materials lead the charge while Financials lag behind. In this dynamic environment, identifying undiscovered gems involves seeking companies that demonstrate resilience and growth potential amid shifting economic tides and sector-specific trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Lycopodium | 0.97% | 16.20% | 28.63% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments, operating as HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$1.15 billion.

Operations: HFA Holdings Limited generates revenue primarily from its Lighthouse segment, contributing $137.95 million. The company's market capitalization is A$1.15 billion.

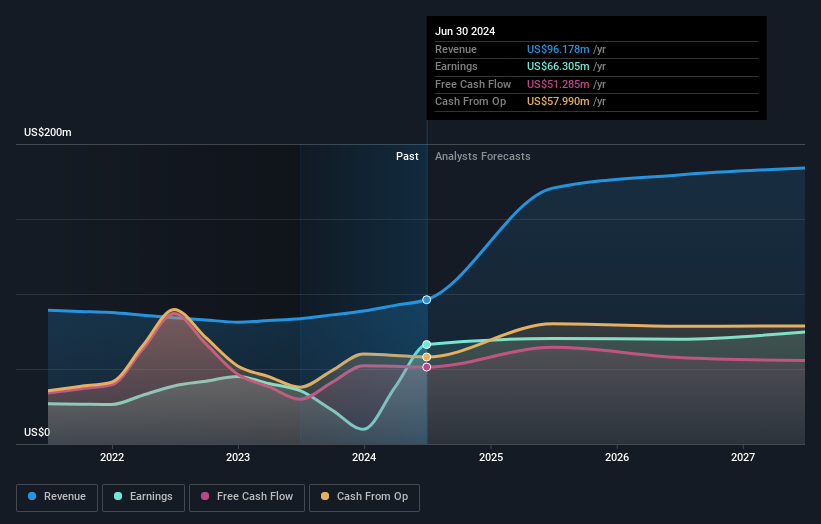

Navigator Global Investments, an intriguing player in the Australian market, has demonstrated significant growth with a 306.8% increase in earnings over the past year, surpassing industry norms. The company is trading at 33.5% below estimated fair value and maintains a debt-to-equity ratio of 2.4%, reflecting prudent financial management. Despite these strengths, future earnings are forecasted to decline by an average of 10.4% annually over the next three years due to reliance on performance fees and economic fluctuations impacting revenue stability. Recent leadership changes include Roger Davis assuming Chairmanship post-Michael Shepherd's retirement, potentially influencing strategic direction positively with his extensive experience in financial services and governance.

Smart Parking (ASX:SPZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Smart Parking Limited is a company that specializes in designing, developing, and managing parking management solutions across New Zealand, Australia, Germany, and the United Kingdom with a market capitalization of A$405.09 million.

Operations: Smart Parking Limited generates revenue primarily from its Parking Management segment in the United Kingdom, contributing A$52.52 million, and from its Technology Division at A$5.27 million. The company's net profit margin is a key indicator of financial performance, reflecting the efficiency of its operations across various regions.

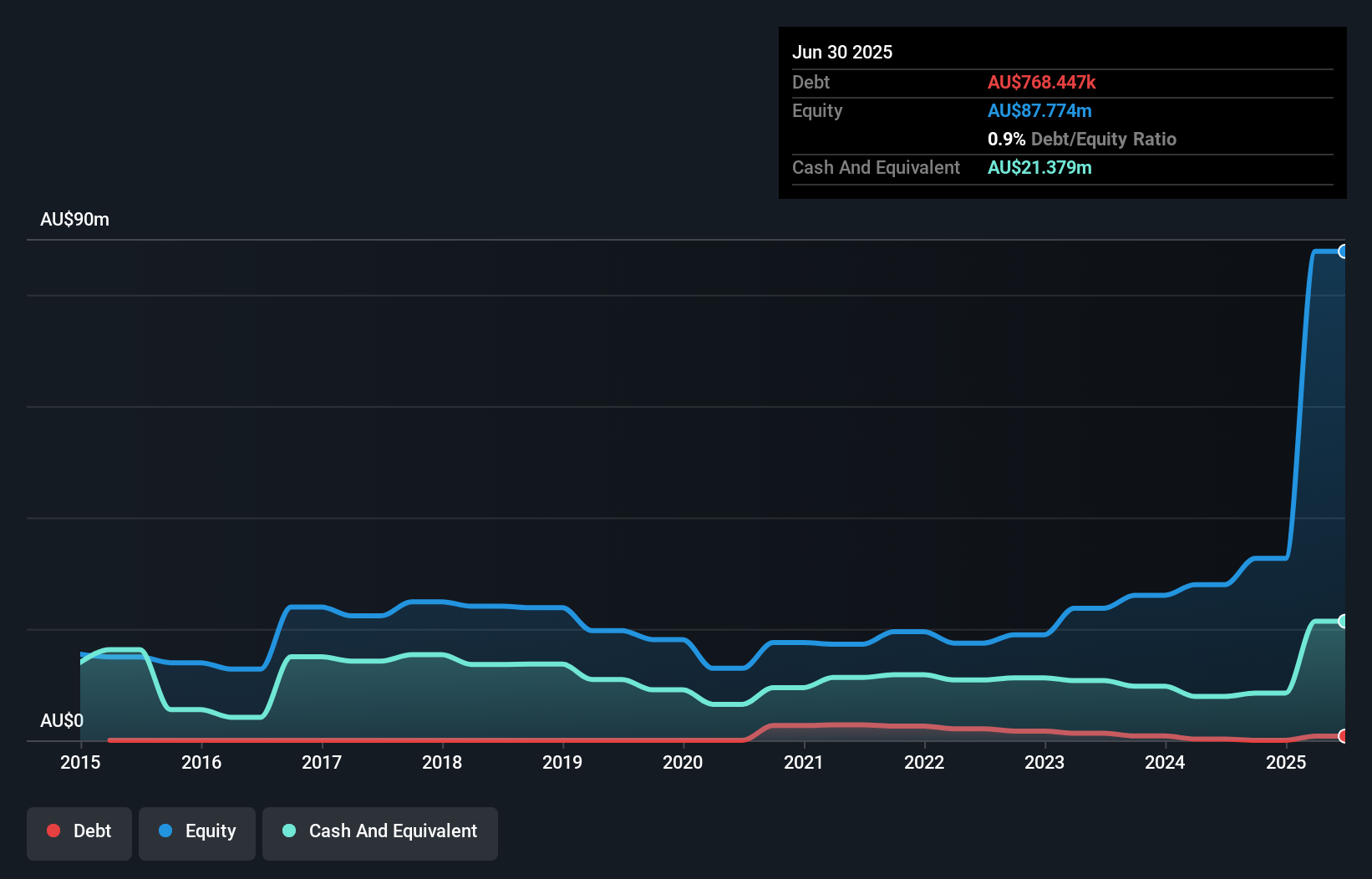

Smart Parking is making waves with its robust earnings growth of 46.8% over the past year, outpacing the industry average of 11.6%. The company reported A$77.33 million in sales for the year ending June 2025, up from A$54.7 million previously, with net income rising to A$5.42 million from A$3.69 million a year ago. Despite a slight increase in debt-to-equity ratio to 0.9% over five years, Smart Parking remains cash flow positive and covers interest payments well at a 9x EBIT coverage rate. Looking ahead, they are eyeing U.S expansion through strategic acquisitions like Peak Parking to bolster revenue streams and enhance profitability further by integrating advanced technologies into their operations while navigating potential regulatory challenges in key markets such as the UK.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia with a market cap of A$1.06 billion.

Operations: Tasmea generates revenue through its services in shutdowns, maintenance, emergency breakdowns, and capital upgrades. The company has a market capitalization of A$1.06 billion.

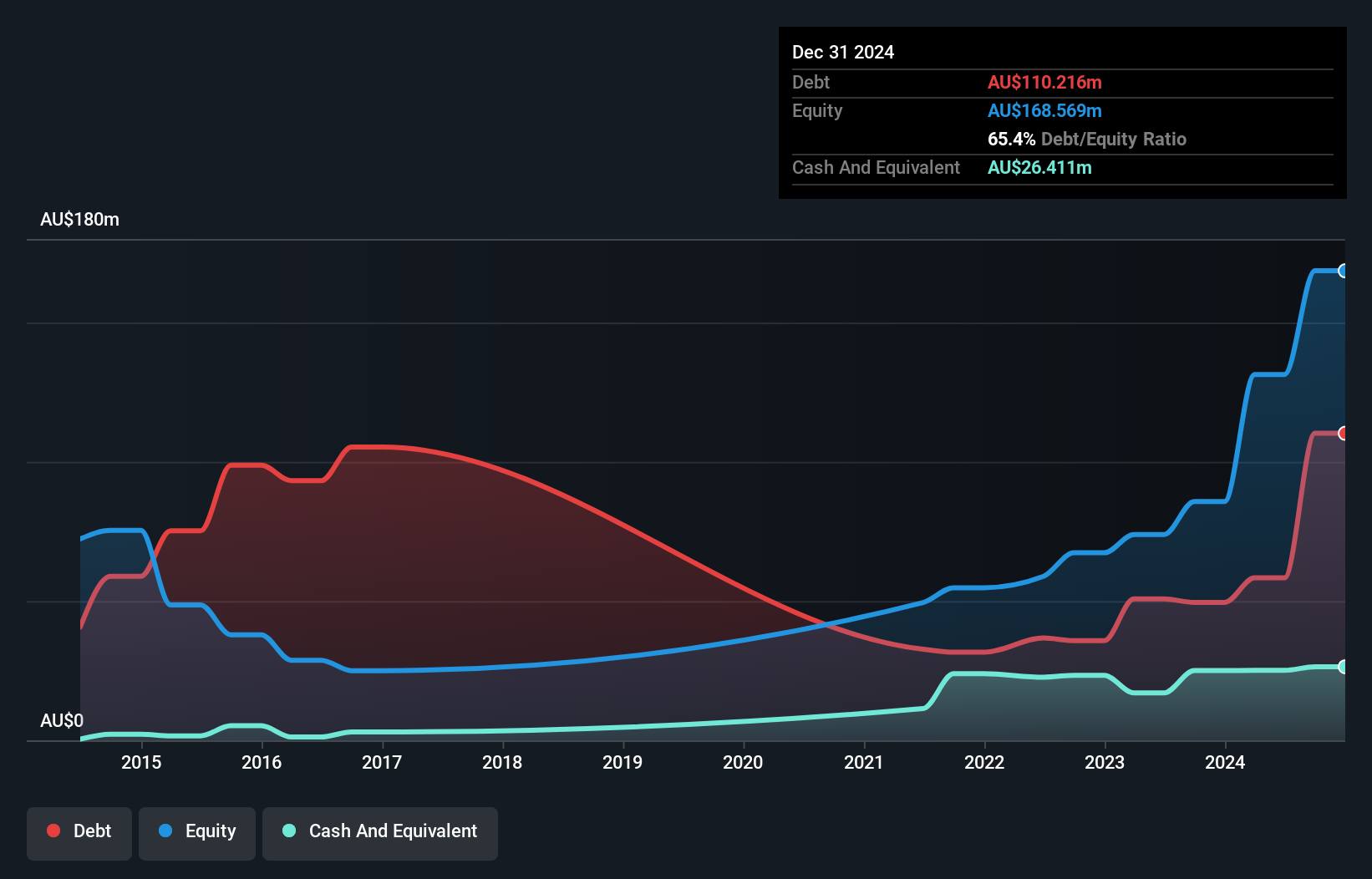

Tasmea, a dynamic player in Australia, has shown impressive growth with a net income jump from A$30.35 million to A$53.07 million over the past year, alongside sales climbing to A$547.91 million from A$400.01 million. The company's earnings per share also increased to A$0.2322 from A$0.1516, reflecting robust financial health and strategic execution. Tasmea's debt-to-equity ratio improved significantly over five years, dropping from 137% to 65%, highlighting prudent financial management despite its high net debt to equity ratio of 49%. Looking ahead, Tasmea targets an EBIT of A$110 million for fiscal year 2026 and plans dividends between 30%-50% of NPAT while supporting organic expansion and acquisitions.

- Take a closer look at Tasmea's potential here in our health report.

Explore historical data to track Tasmea's performance over time in our Past section.

Turning Ideas Into Actions

- Delve into our full catalog of 51 ASX Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Very undervalued with proven track record.

Market Insights

Community Narratives