- Australia

- /

- Capital Markets

- /

- ASX:NGI

3 ASX Stocks Estimated To Be Trading Below Intrinsic Value By At Least 16.8%

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has risen 2.2%, and over the past 12 months, it is up 11%, with earnings expected to grow by 13% per annum over the next few years. In this context of robust market performance, identifying stocks trading below their intrinsic value can offer significant opportunities for investors seeking to capitalize on potential undervaluation.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.73 | A$1.37 | 46.6% |

| Telix Pharmaceuticals (ASX:TLX) | A$19.75 | A$38.96 | 49.3% |

| Ingenia Communities Group (ASX:INA) | A$5.37 | A$10.58 | 49.2% |

| Regal Partners (ASX:RPL) | A$3.45 | A$6.62 | 47.9% |

| Megaport (ASX:MP1) | A$11.22 | A$21.52 | 47.9% |

| Domino's Pizza Enterprises (ASX:DMP) | A$33.41 | A$63.61 | 47.5% |

| Treasury Wine Estates (ASX:TWE) | A$12.11 | A$24.19 | 49.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| hipages Group Holdings (ASX:HPG) | A$1.20 | A$2.31 | 48% |

| Airtasker (ASX:ART) | A$0.265 | A$0.52 | 49.4% |

Let's dive into some prime choices out of the screener.

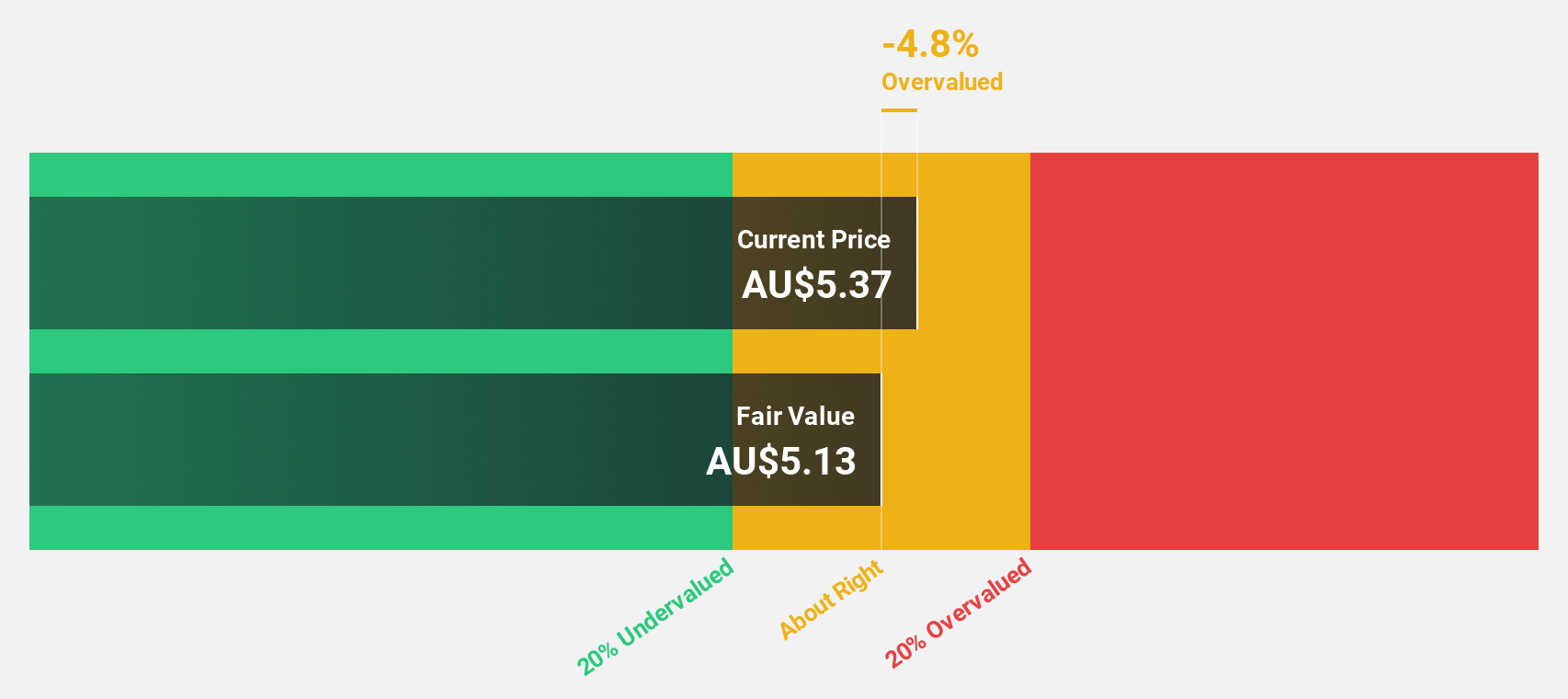

Ingenia Communities Group (ASX:INA)

Overview: Ingenia Communities Group (ASX:INA) is a leading operator, owner, and developer offering quality residential communities and holiday accommodation with a market cap of A$2.19 billion.

Operations: Ingenia Communities Group generates revenue from three main segments: Residential Communities (A$140.70 million), Lifestyle & Holidays (A$78.50 million), and Fuel, Food & Beverage Services (A$15.30 million).

Estimated Discount To Fair Value: 49.2%

Ingenia Communities Group's recent earnings report showed a rise in revenue to A$472.29 million from A$394.47 million, although net income dropped significantly to A$14.02 million from A$64.37 million due to large one-off items impacting results. Trading at around 49% below its estimated fair value of A$10.58, Ingenia appears undervalued based on cash flows despite lower profit margins and debt not well covered by operating cash flow.

- Our expertly prepared growth report on Ingenia Communities Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Ingenia Communities Group's balance sheet health report.

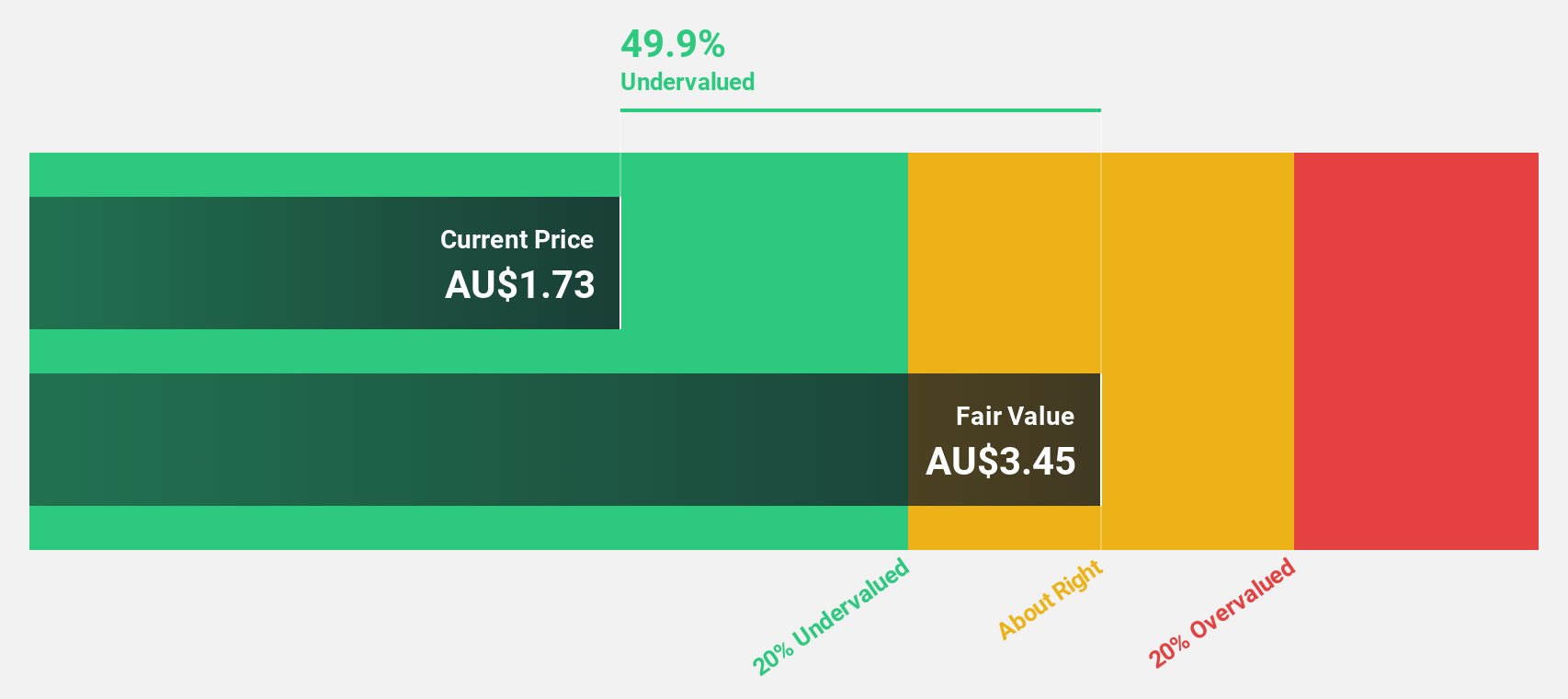

Navigator Global Investments (ASX:NGI)

Overview: Navigator Global Investments (ASX:NGI) is a fund management company operating in Australia with a market cap of A$867.35 million.

Operations: Navigator Global Investments generates its revenue primarily from its Lighthouse segment, which accounted for $120.49 million.

Estimated Discount To Fair Value: 16.8%

Navigator Global Investments (A$1.72) is trading 16.8% below its estimated fair value of A$2.07, suggesting it may be undervalued based on cash flows. Despite a significant drop in profit margins from 55.4% to 11.1%, earnings are forecast to grow at a robust rate of 34.64% per year, outpacing the Australian market's growth rate of 13.1%. However, shareholders experienced substantial dilution over the past year and return on equity is expected to remain low at 10.6%.

- Upon reviewing our latest growth report, Navigator Global Investments' projected financial performance appears quite optimistic.

- Get an in-depth perspective on Navigator Global Investments' balance sheet by reading our health report here.

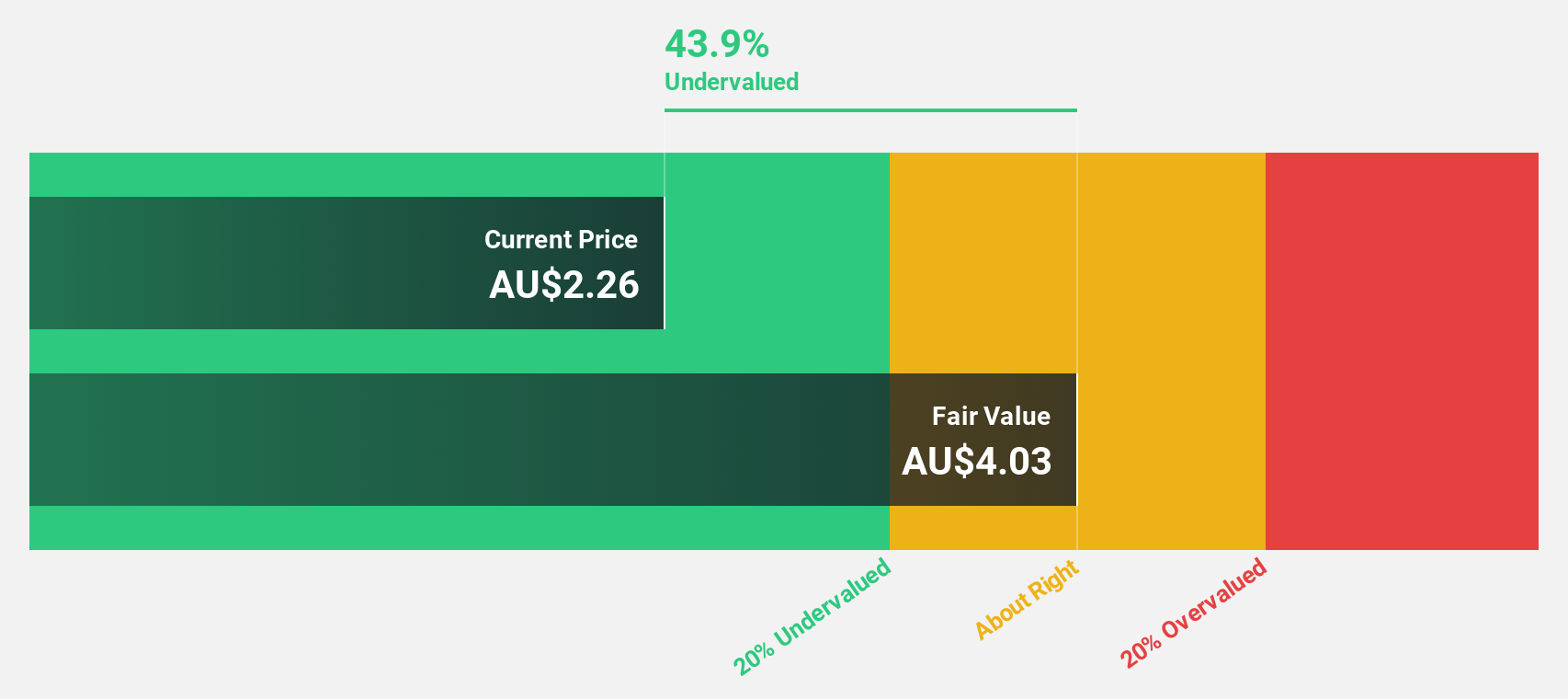

Nuix (ASX:NXL)

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across the Asia Pacific, Americas, Europe, Middle East, and Africa with a market cap of A$1.42 billion.

Operations: Nuix generates revenue through its investigative analytics and intelligence software solutions across various regions, including the Asia Pacific, Americas, Europe, Middle East, and Africa.

Estimated Discount To Fair Value: 17.2%

Nuix Limited (A$4.77) trades below its estimated fair value of A$5.76, indicating potential undervaluation based on cash flows. The company reported a net income of A$5.03 million for the year ending June 30, 2024, reversing a prior net loss. Revenue grew to A$220.62 million from A$182.47 million, and earnings are forecast to grow significantly at 57% per year over the next three years, outpacing the Australian market's growth rate of 13.1%.

- Insights from our recent growth report point to a promising forecast for Nuix's business outlook.

- Unlock comprehensive insights into our analysis of Nuix stock in this financial health report.

Make It Happen

- Navigate through the entire inventory of 38 Undervalued ASX Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Reasonable growth potential with adequate balance sheet.