- Australia

- /

- Metals and Mining

- /

- ASX:MAH

Emerald Resources And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

The Australian market has climbed 2.2% in the last 7 days and is up 11% over the past 12 months, with earnings forecast to grow by 13% annually. In this favorable environment, identifying promising stocks like Emerald Resources and two other undiscovered gems can enhance your portfolio by leveraging current market momentum and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Lycopodium | NA | 15.62% | 29.55% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| Plato Income Maximiser | NA | 11.43% | 14.26% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| SKS Technologies Group | NA | 31.29% | 43.27% | ★★★★★★ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Paragon Care | 340.88% | 28.05% | 68.37% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.62 billion.

Operations: Emerald Resources NL generates revenue primarily from its mine operations, totaling A$339.32 million.

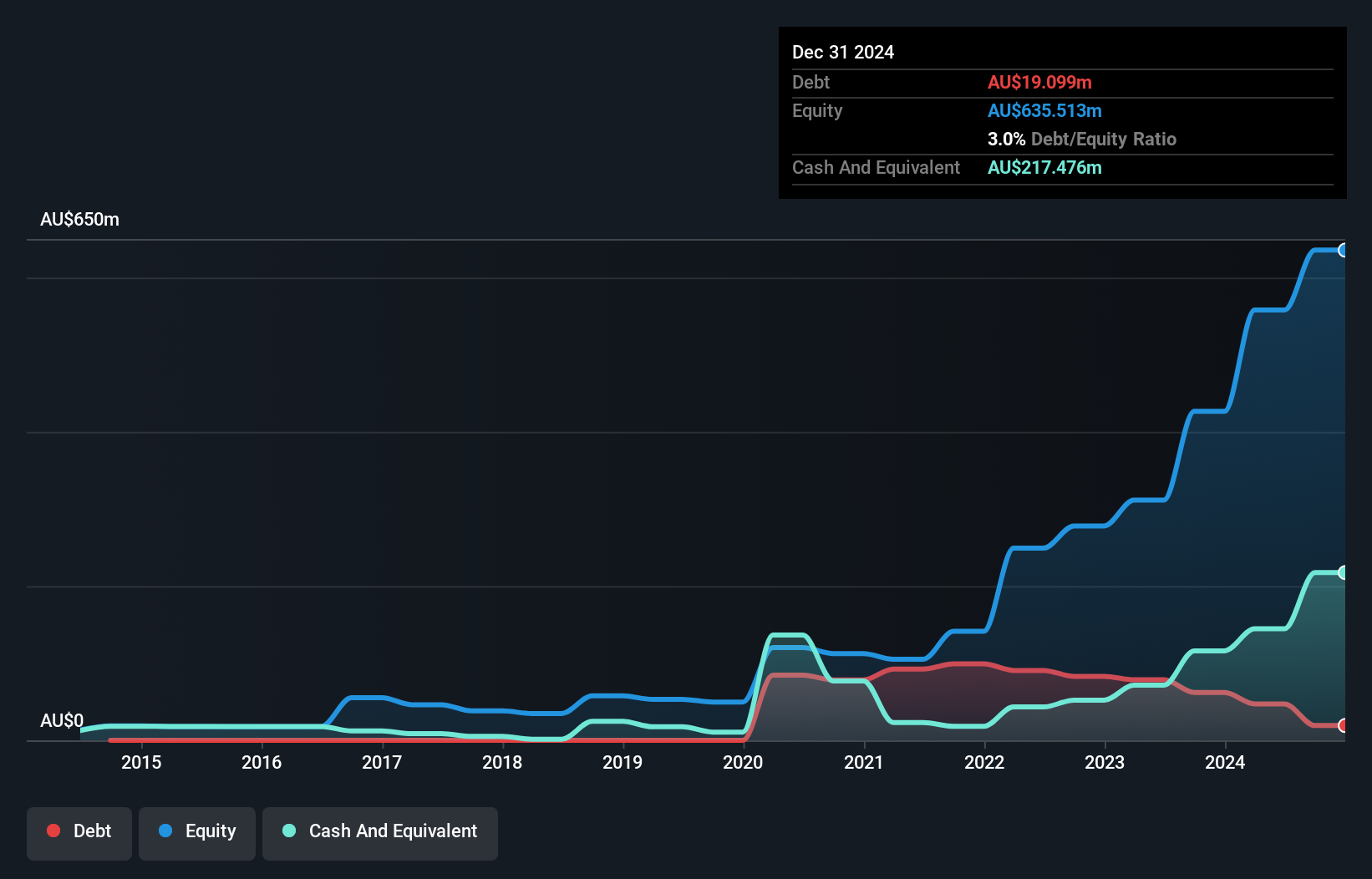

Emerald Resources, a small cap in the mining sector, is trading at 56.9% below its estimated fair value. Over the past year, earnings grew by 53.4%, outpacing the industry’s -19%. The company’s debt to equity ratio has increased from 0% to 14.5% over five years, yet it holds more cash than total debt and covers interest payments with EBIT at 14x coverage. Future earnings are forecasted to grow by 20.14% annually.

- Unlock comprehensive insights into our analysis of Emerald Resources stock in this health report.

Gain insights into Emerald Resources' past trends and performance with our Past report.

Macmahon Holdings (ASX:MAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining, mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia, with a market cap of A$609.50 million.

Operations: Macmahon Holdings generates revenue primarily from its mining (including civil) segment, amounting to A$1.89 billion. The company's financial performance includes a notable gross profit margin of 10.50%.

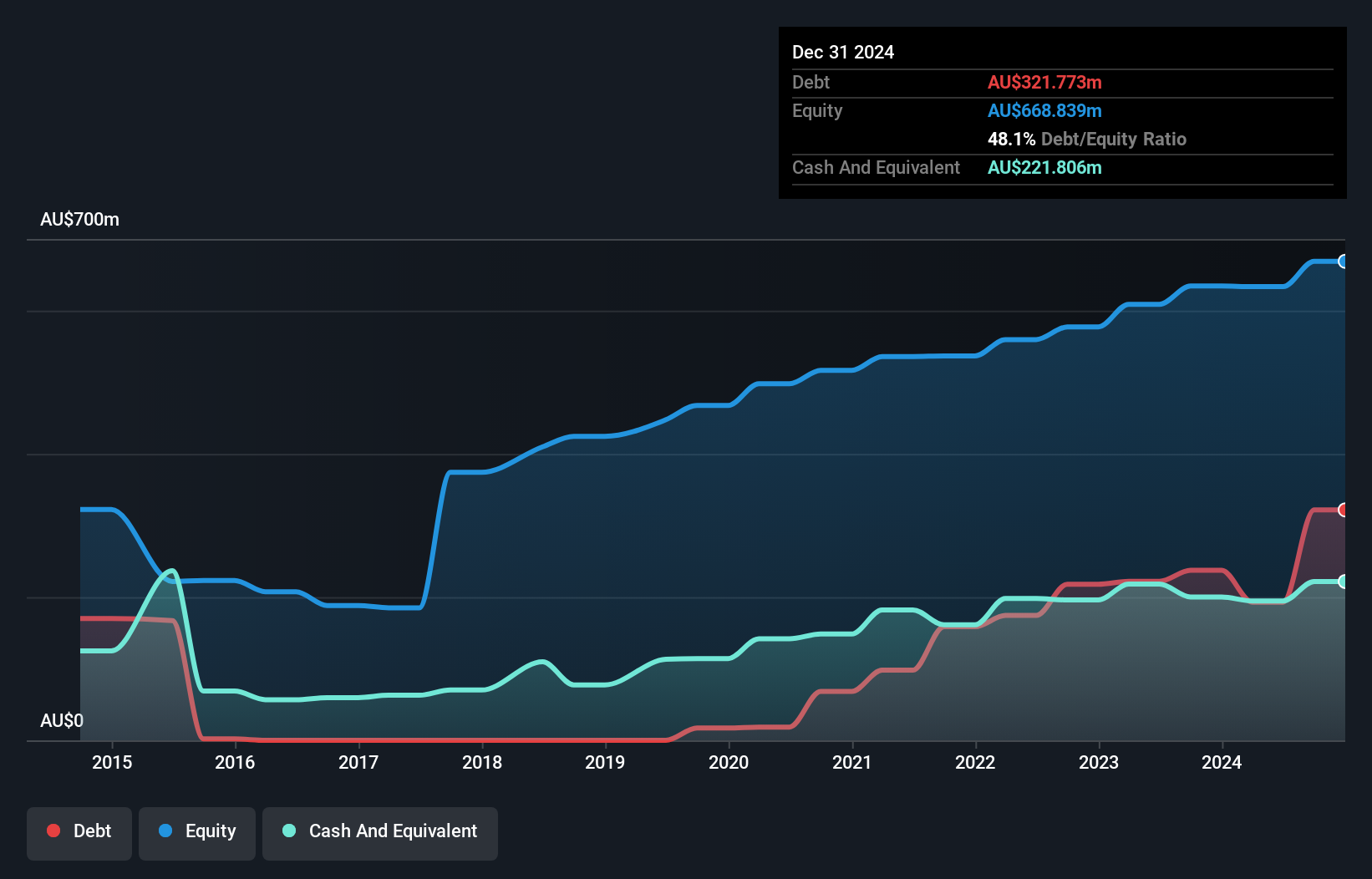

Macmahon Holdings, a small player in the mining services sector, has shown impressive growth with earnings up 49.7% over the past year. Trading at 35.6% below its estimated fair value, it offers good relative value compared to peers. The net debt to equity ratio stands at a satisfactory 5.9%, and interest payments are well covered by EBIT at 5.4x coverage. With profitability ensuring no cash runway concerns, Macmahon appears poised for steady future performance with forecasted earnings growth of 5.77% annually.

- Get an in-depth perspective on Macmahon Holdings' performance by reading our health report here.

Assess Macmahon Holdings' past performance with our detailed historical performance reports.

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Westgold Resources Limited engages in the exploration, operation, development, mining, and treatment of gold assets primarily in Western Australia with a market cap of A$2.83 billion.

Operations: Westgold Resources generates revenue primarily from its Bryah and Murchison segments, contributing A$153.05 million and A$537.63 million, respectively.

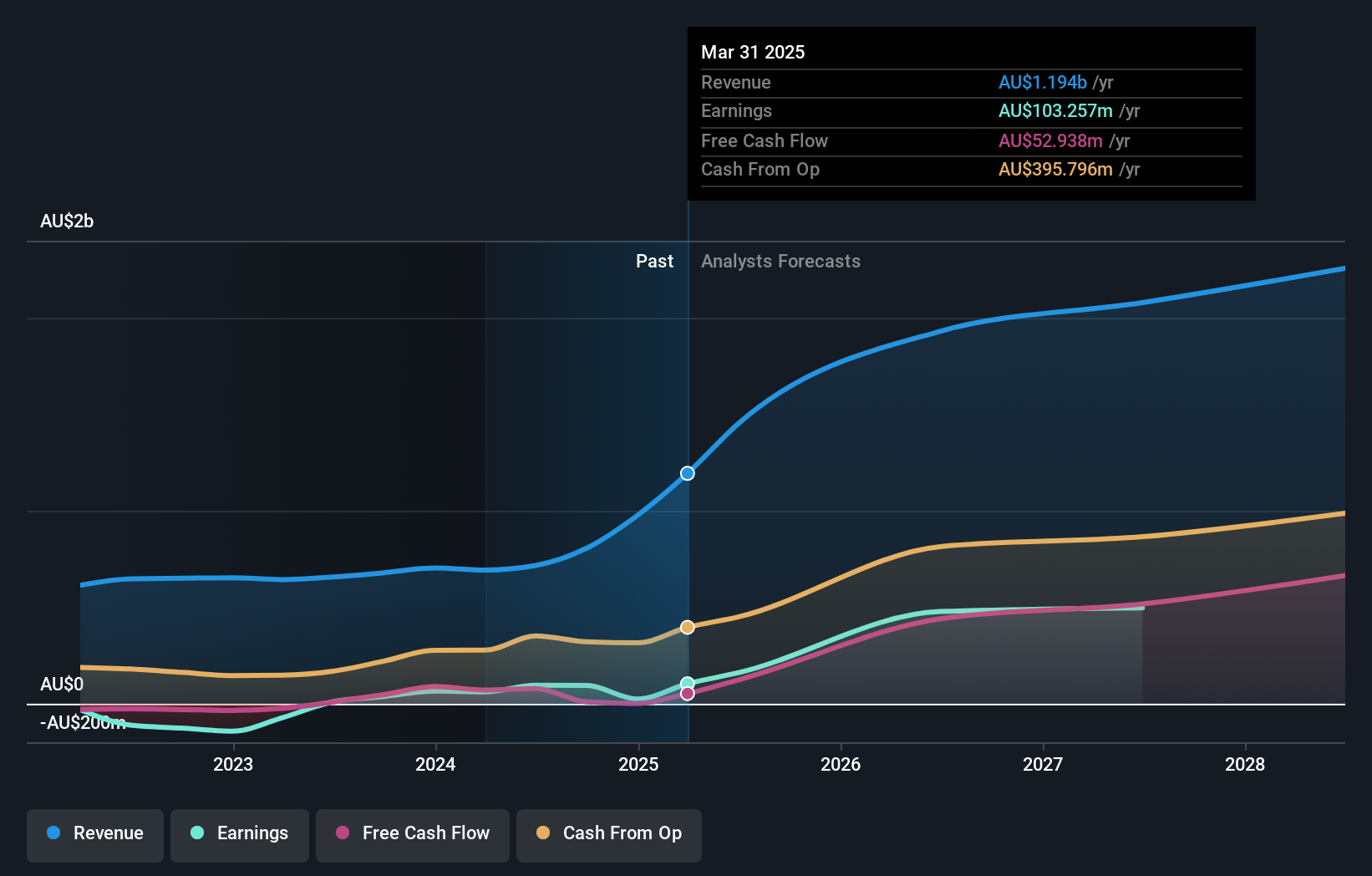

Westgold Resources, a burgeoning player in Australia's mining sector, has recently turned profitable and is forecasted to grow earnings by 75% annually. The company reported net income of A$44.07 million for nine months ending March 2024, compared to a net loss of A$7.05 million the previous year. Westgold's South Junction mine added an impressive 225koz to their Ore Reserve, boosting total reserves by 233%. Notably debt-free and with high-quality earnings, Westgold continues to expand its operations strategically.

- Take a closer look at Westgold Resources' potential here in our health report.

Evaluate Westgold Resources' historical performance by accessing our past performance report.

Make It Happen

- Unlock more gems! Our ASX Undiscovered Gems With Strong Fundamentals screener has unearthed 50 more companies for you to explore.Click here to unveil our expertly curated list of 53 ASX Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAH

Macmahon Holdings

Provides surface mining, underground mining and mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives