- Australia

- /

- Capital Markets

- /

- ASX:MQG

Top ASX Dividend Stocks For August 2024

Reviewed by Simply Wall St

The Australian market has seen a positive trend, rising 2.2% over the last week and up 11% over the past 12 months, with earnings expected to grow by 13% per annum in the coming years. In this favorable environment, identifying dividend stocks that offer consistent returns becomes crucial for investors looking to capitalize on these growth opportunities.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.63% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.17% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.38% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.37% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 6.99% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.66% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.47% | ★★★★★☆ |

| Bapcor (ASX:BAP) | 4.26% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.65% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.04% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

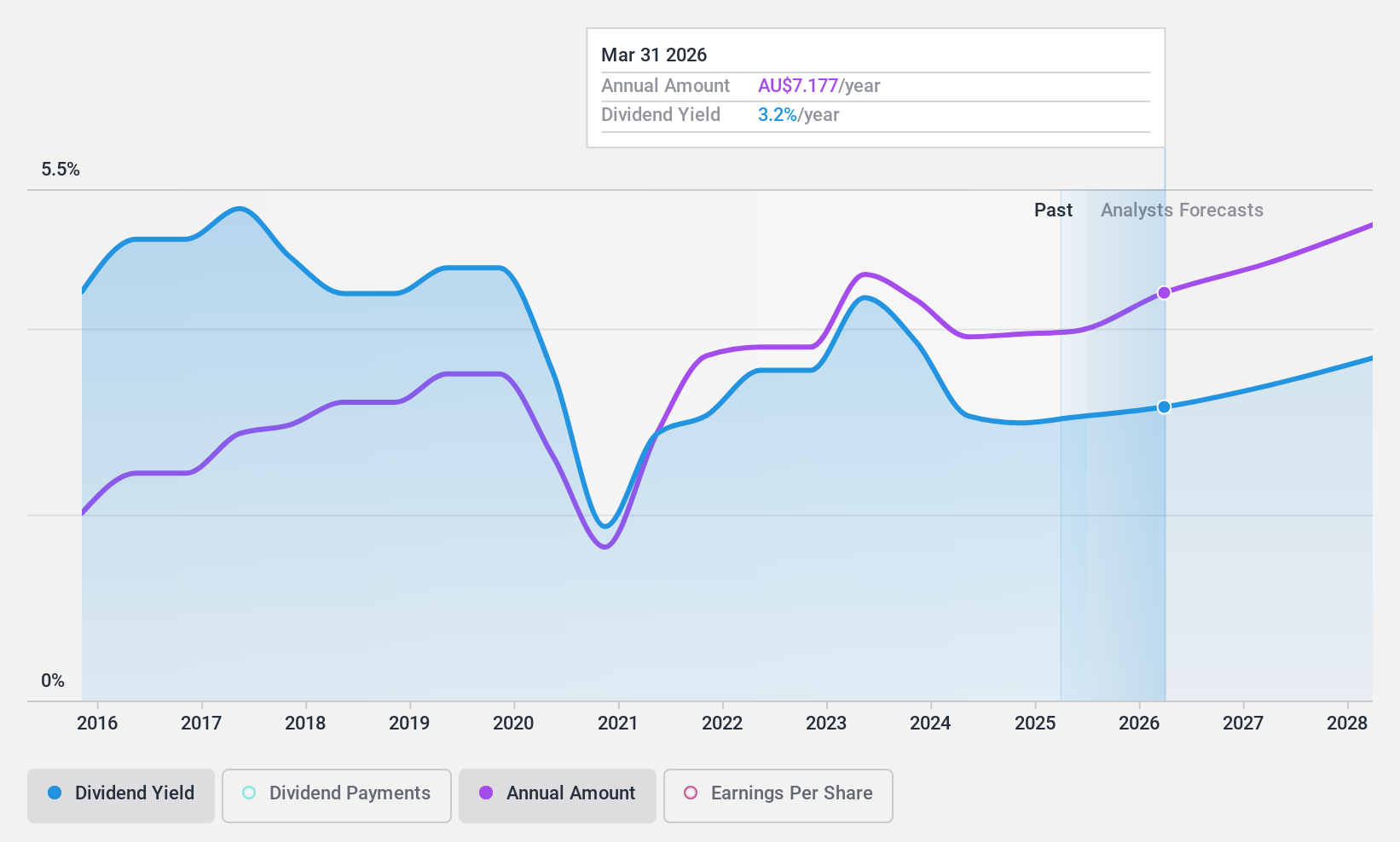

Macquarie Group (ASX:MQG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited is a diversified financial services company operating in Australia, the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of A$76.20 billion.

Operations: Macquarie Group Limited's revenue segments include Corporate (A$990 million), Macquarie Capital (A$2.61 billion), Macquarie Asset Management (A$3.75 billion), Banking and Financial Services (A$3.21 billion), and Commodities and Global Markets (A$6.32 billion).

Dividend Yield: 3%

Macquarie Group has a payout ratio of 69.8%, indicating its dividends are currently covered by earnings, and forecasts suggest this will continue at 63.7% in three years. However, the dividend yield is relatively low at 3.05%, and the dividend payments have been volatile over the past decade. Recent activities include a A$10 million fixed-income offering and interest in acquiring I-MED Holdings for A$3 billion through its infrastructure arm, signaling ongoing strategic expansion efforts.

- Click to explore a detailed breakdown of our findings in Macquarie Group's dividend report.

- Our expertly prepared valuation report Macquarie Group implies its share price may be too high.

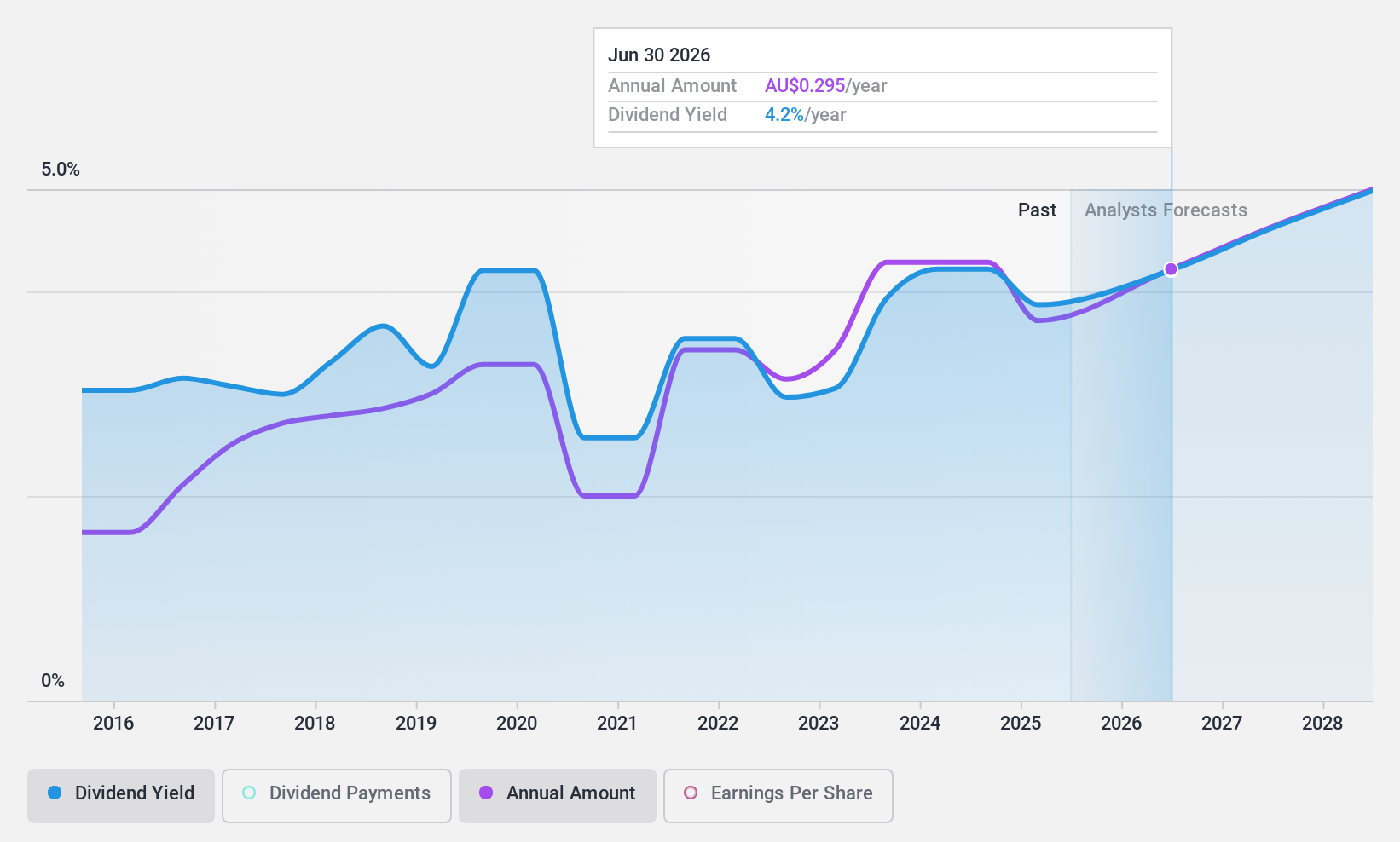

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited, with a market cap of A$3.58 billion, underwrites and distributes private health insurance to residents, international students, and visitors in Australia and New Zealand.

Operations: The revenue segments for nib holdings limited include Australian Residents Health Insurance (A$2.55 billion), New Zealand Insurance (A$351.90 million), International (Inbound) Health Insurance (A$173.20 million), NIB Travel (A$109.10 million), and Nib Thrive (A$38 million).

Dividend Yield: 4.1%

nib holdings has a payout ratio of 67.5%, indicating its dividends are covered by earnings, and the cash payout ratio of 57.9% shows coverage by cash flows as well. However, the dividend yield is relatively low at 4.06%, and payments have been volatile over the past decade despite some growth. Recent news includes CEO Mark Fitzgibbon's retirement announcement, with Ed Close set to take over by year-end, potentially impacting future strategic direction and dividend stability.

- Dive into the specifics of nib holdings here with our thorough dividend report.

- Our valuation report here indicates nib holdings may be undervalued.

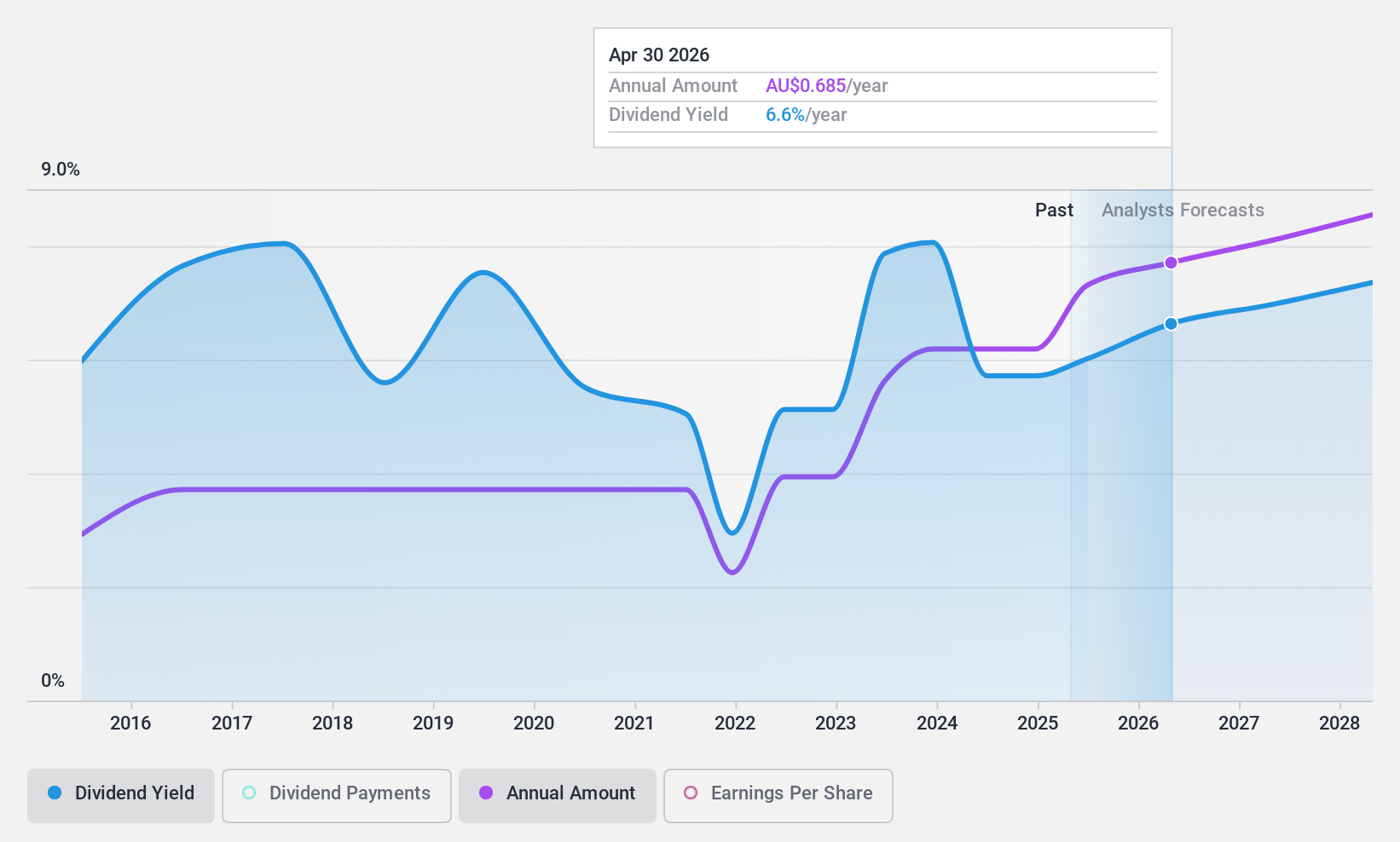

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, with a market cap of A$537.45 million, operates as a rice food company serving markets in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Operations: Ricegrowers Limited generates revenue from several key segments, including Riviana (A$222.01 million), Cop Rice (A$252.75 million), Rice Food (A$121.03 million), Rice Pool (A$498.11 million), Corporate Segment (A$45.79 million), and International Rice (A$894.03 million).

Dividend Yield: 6.5%

Ricegrowers Limited has shown steady earnings growth, with net income rising to A$63.14 million for the year ending April 30, 2024. The company’s dividend yield of 6.48% places it in the top quartile among Australian dividend payers. Dividends are well-covered by both earnings and cash flows, with payout ratios of 56.4% and 44%, respectively. However, Ricegrowers has only a nine-year history of paying dividends, which have been somewhat volatile over this period.

- Navigate through the intricacies of Ricegrowers with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Ricegrowers' current price could be quite moderate.

Summing It All Up

- Take a closer look at our Top ASX Dividend Stocks list of 33 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives