- Australia

- /

- Entertainment

- /

- ASX:SP8

ASX Penny Stock Opportunities For November 2024

Reviewed by Simply Wall St

The Australian market remains buoyant, with the ASX200 closing up 0.84% at 8,295 points, driven by optimism surrounding global political events and potential economic stimuli from China. In this context of market enthusiasm, investors might consider exploring penny stocks—companies that are often smaller or newer but can offer unique opportunities when backed by strong financials. While the term "penny stocks" may seem outdated, these investments still hold potential for those looking to discover under-the-radar companies with promising growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$70.33M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.885 | A$301.21M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.565 | A$344.18M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$100.68M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.145 | A$58.82M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.49 | A$132.44M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.34 | A$112.68M | ★★★★★☆ |

Click here to see the full list of 1,037 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Global Lithium Resources (ASX:GL1)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Lithium Resources Limited focuses on the evaluation, exploration, and development of lithium resources in Australia, with a market cap of A$56.03 million.

Operations: Global Lithium Resources Limited does not report any revenue segments.

Market Cap: A$56.03M

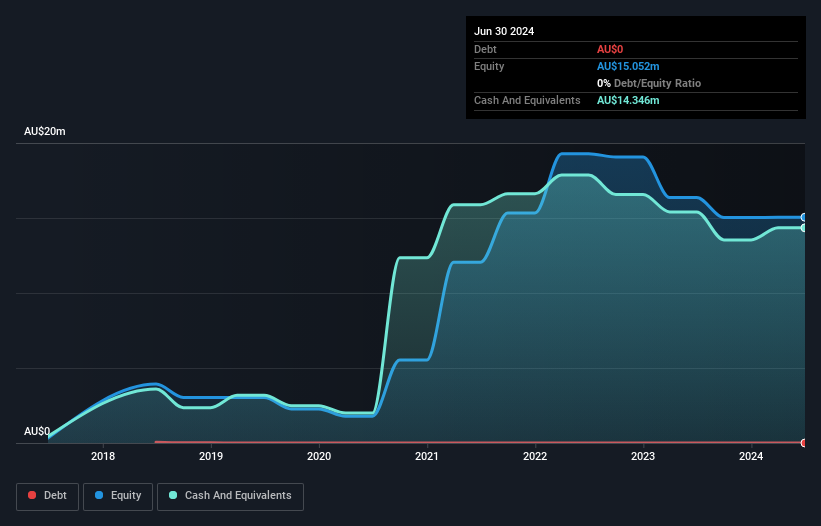

Global Lithium Resources Limited, with a market cap of A$56.03 million, is navigating significant internal changes amidst its pre-revenue status. Recent board restructuring and investor activism highlight governance challenges as the company focuses on cost-cutting to maintain financial stability. Despite no debt and sufficient short-term assets exceeding liabilities, the company faces volatility with a highly unstable share price over the past three months. The management team and board members are relatively inexperienced, potentially impacting strategic execution. Earnings forecasts suggest a decline in profitability over the next three years, underscoring challenges in achieving sustainable growth in a competitive sector.

- Unlock comprehensive insights into our analysis of Global Lithium Resources stock in this financial health report.

- Review our growth performance report to gain insights into Global Lithium Resources' future.

NGE Capital (ASX:NGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NGE Capital Limited is an investment company based in Australia with a market capitalization of A$41.95 million.

Operations: The company generates its revenue from investment activities amounting to A$4.10 million.

Market Cap: A$41.95M

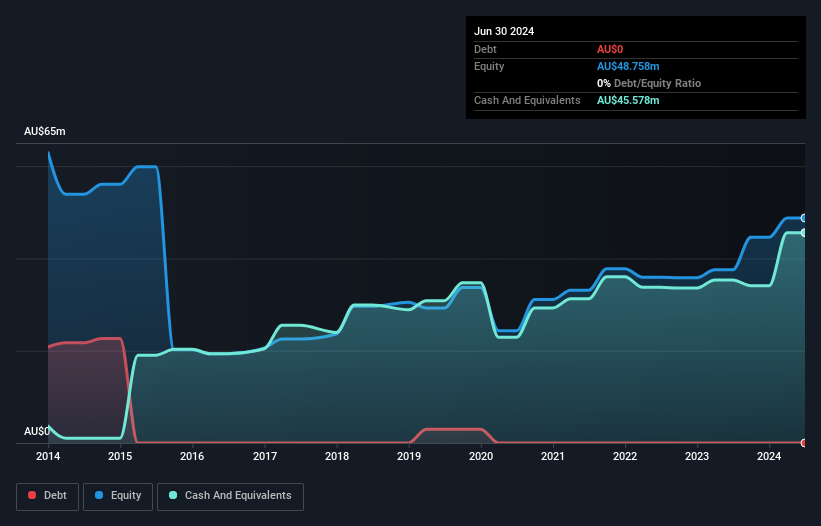

NGE Capital, with a market cap of A$41.95 million, demonstrates financial stability through its debt-free status and robust short-term assets of A$46.1 million exceeding liabilities of A$713K. Despite limited revenue generation at A$4.10 million, the company has experienced significant earnings growth of 601% over the past year, partly due to a large one-off gain of A$8.7 million. The recent decrease in its equity buyback plan signals strategic adjustments while extending it till August 2025 reflects a commitment to shareholder value enhancement. With an experienced management team and board, NGE is trading below estimated fair value by 60%.

- Get an in-depth perspective on NGE Capital's performance by reading our balance sheet health report here.

- Gain insights into NGE Capital's historical outcomes by reviewing our past performance report.

StreamPlay Studio (ASX:SP8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: StreamPlay Studio Limited operates social gaming platform technology for eSports and gaming experiences, with a market cap of A$9.20 million.

Operations: The company generates revenue of A$1.81 million from its technology platform operations.

Market Cap: A$9.2M

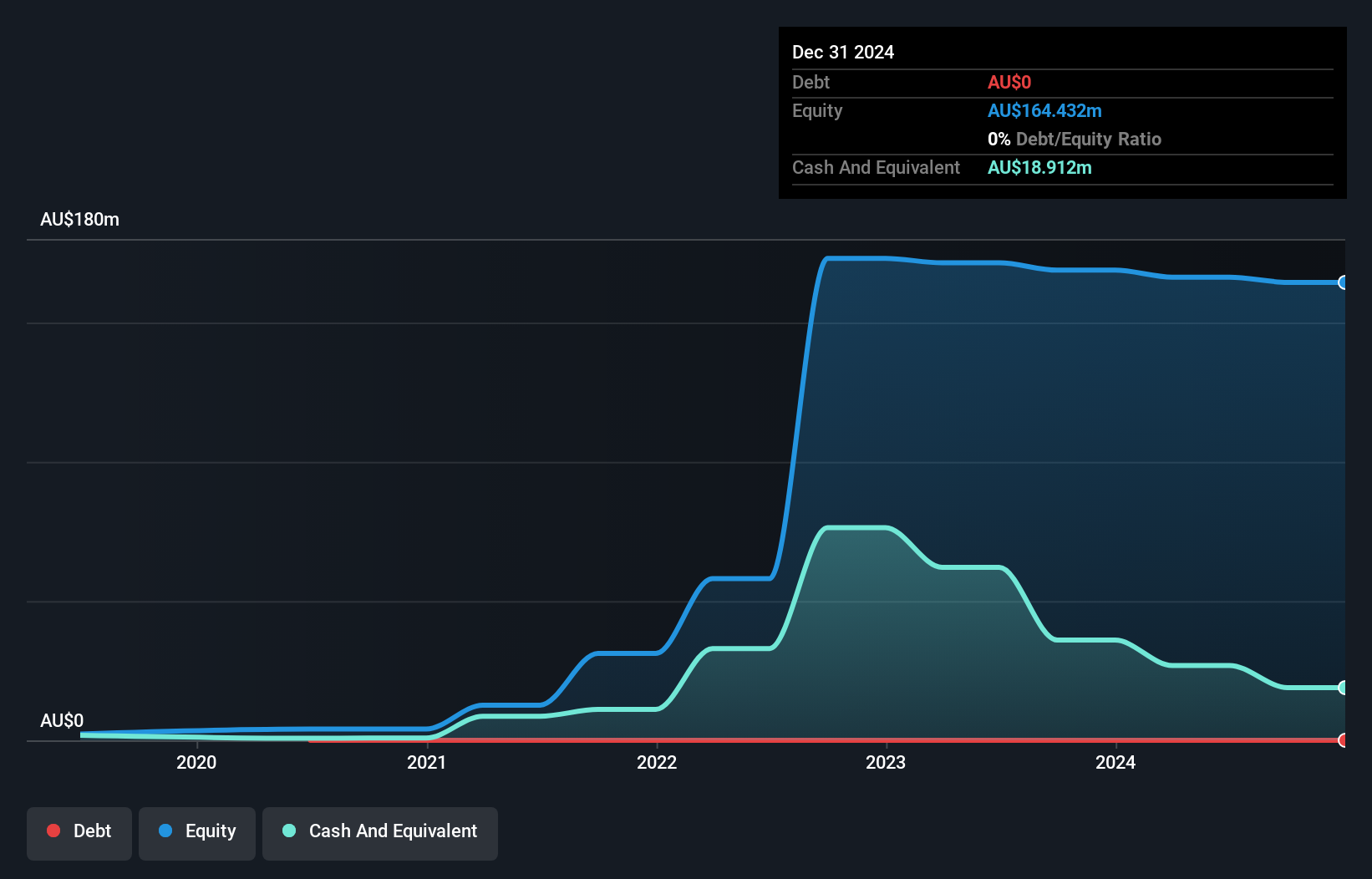

StreamPlay Studio has a market cap of A$9.20 million and operates in the social gaming platform sector, generating A$1.81 million in revenue but remains unprofitable. The company is debt-free with sufficient cash runway for over three years, supported by short-term assets of A$14.7 million exceeding liabilities of A$1.4 million. Recent board changes include the appointment of Paolo Privitera, a seasoned entrepreneur with extensive experience in technology and strategic growth, enhancing StreamPlay's potential for international expansion and M&A activities. Despite high volatility, these developments position StreamPlay for strategic growth opportunities in competitive markets.

- Take a closer look at StreamPlay Studio's potential here in our financial health report.

- Gain insights into StreamPlay Studio's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Embark on your investment journey to our 1,037 ASX Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SP8

StreamPlay Studio

Operates social gaming platform technology for eSports and gaming experiences.

Flawless balance sheet low.

Market Insights

Community Narratives