- Australia

- /

- Capital Markets

- /

- ASX:MQG

Assessing Macquarie Group (ASX:MQG)’s Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Macquarie Group (ASX:MQG) has been drifting after a mixed few months, with the stock sliding about 11% over the past 3 months even as annual revenue and net income both continued to grow.

See our latest analysis for Macquarie Group.

Zooming out, the picture is more balanced, with the recent 11.2% 3 month share price pullback sitting against a 1 year total shareholder return of minus 8.9%, but a solid 5 year total shareholder return of 68.4%. This suggests long term momentum is still intact even as sentiment cools near A$197.60.

If Macquarie’s recent moves have you rethinking where the real growth stories might be, this could be a good moment to explore fast growing stocks with high insider ownership.

With analysts seeing upside to A$224.87 while Macquarie continues to grow revenue and profits, investors now face a key question: is the current share price a hidden entry point or already factoring in its future growth?

Most Popular Narrative: 12% Undervalued

With Macquarie last closing at A$197.60 versus a narrative fair value of about A$224.48, the valuation argument leans in favour of patient optimists.

The business is positioned to benefit from potential performance fees and asset realization gains in key investment areas like data centers and green energy projects, potentially impacting earnings growth and improving return on equity as these assets mature.

Curious how steady but unspectacular growth assumptions can still back a higher valuation? The narrative leans on disciplined margins, maturing assets and a punchy future earnings multiple. Want to see exactly how those moving parts combine into that fair value call?

Result: Fair Value of $224.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on execution, with competitive margin pressure and lower commodities client activity both capable of extending the earnings trough and undermining recovery hopes.

Find out about the key risks to this Macquarie Group narrative.

Another Angle on Value

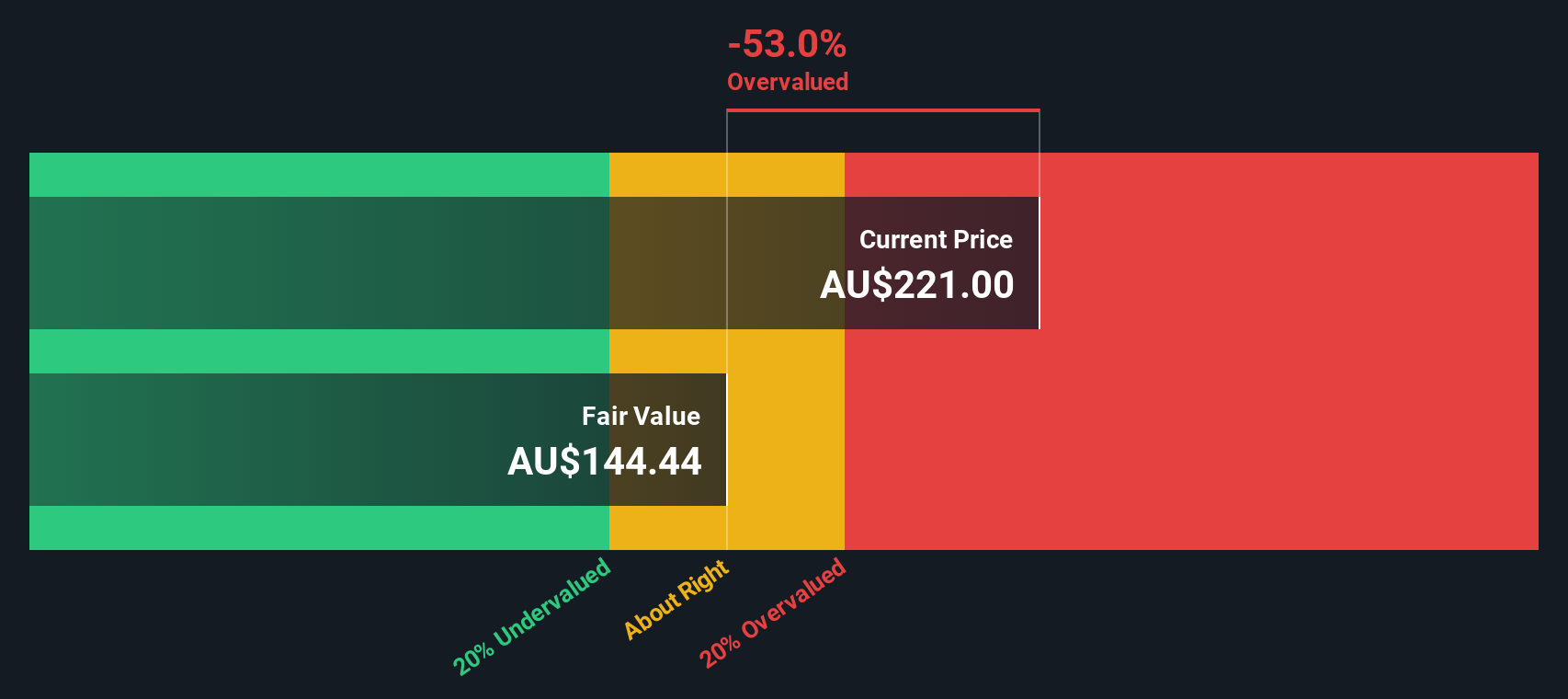

Not everyone agrees Macquarie is cheap. Our SWS DCF model, which projects future cash flows and discounts them back, suggests fair value closer to A$153.20. This implies the shares might actually be overvalued at current levels. Which story do you trust more, cash flows or consensus?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macquarie Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macquarie Group Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A great starting point for your Macquarie Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move again, you can give yourself an edge by using the Simply Wall St Screener to spot fresh opportunities that most investors are still overlooking.

- Target income potential by reviewing established payers among these 13 dividend stocks with yields > 3% that may help support your returns through different market cycles.

- Position for long term innovation by scanning these 24 AI penny stocks at the forefront of automation, machine learning, and intelligent software.

- Strengthen your growth watchlist with these 913 undervalued stocks based on cash flows where current prices may not yet reflect future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion