Undervalued Asian Small Caps With Insider Action In June 2025

Reviewed by Simply Wall St

In June 2025, the Asian markets are navigating a complex landscape marked by trade tensions and economic indicators that suggest both challenges and opportunities. While the U.S. small-cap stocks have shown resilience with notable gains, Asian small caps are drawing attention for their potential value amidst these dynamic conditions. In this environment, identifying promising stocks often involves looking at companies with strong fundamentals and strategic insider actions that signal confidence in future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 38.91% | ★★★★★★ |

| East West Banking | 3.0x | 0.7x | 35.42% | ★★★★★☆ |

| Dicker Data | 18.7x | 0.6x | -15.13% | ★★★★☆☆ |

| Bapcor | NA | 0.9x | 36.57% | ★★★★☆☆ |

| Atturra | 28.0x | 1.2x | 33.75% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.54% | ★★★★☆☆ |

| PWR Holdings | 33.0x | 4.6x | 27.59% | ★★★☆☆☆ |

| Integral Diagnostics | 150.6x | 1.7x | 36.52% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 12.3x | 20.97% | ★★★☆☆☆ |

| AInnovation Technology Group | NA | 2.3x | 47.79% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

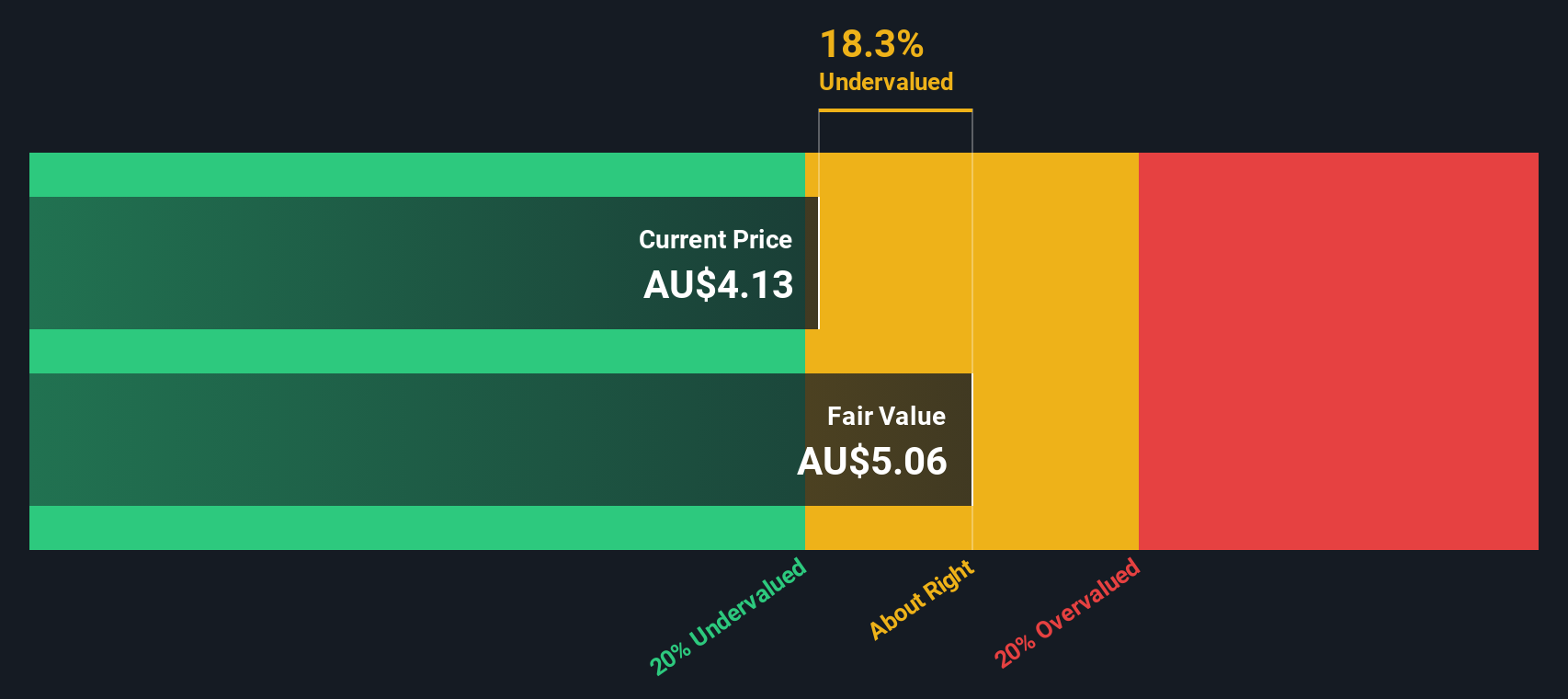

Charter Hall Long WALE REIT (ASX:CLW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Charter Hall Long WALE REIT focuses on investing in high-quality commercial properties with long lease agreements and has a market capitalization of A$3.95 billion.

Operations: The primary revenue stream is derived from its commercial REIT operations, with the latest reported revenue being A$243.09 million. The gross profit margin has shown fluctuations, recently standing at 85.97%. Operating expenses are significant, recorded at A$34.67 million in the latest period, impacting overall net income which was reported as a loss of A$201.22 million due to substantial non-operating expenses amounting to A$375.55 million.

PE: -14.9x

Charter Hall Long WALE REIT, a smaller player in the Asian market, shows potential through insider confidence, with key individuals purchasing shares from January to March 2025. Despite relying on external borrowing for funding, which adds risk, the company maintains investor interest by affirming a quarterly dividend of A$0.0625 per share in March 2025. Earnings are projected to grow annually by over 40%, suggesting room for future expansion and value realization amidst financial challenges.

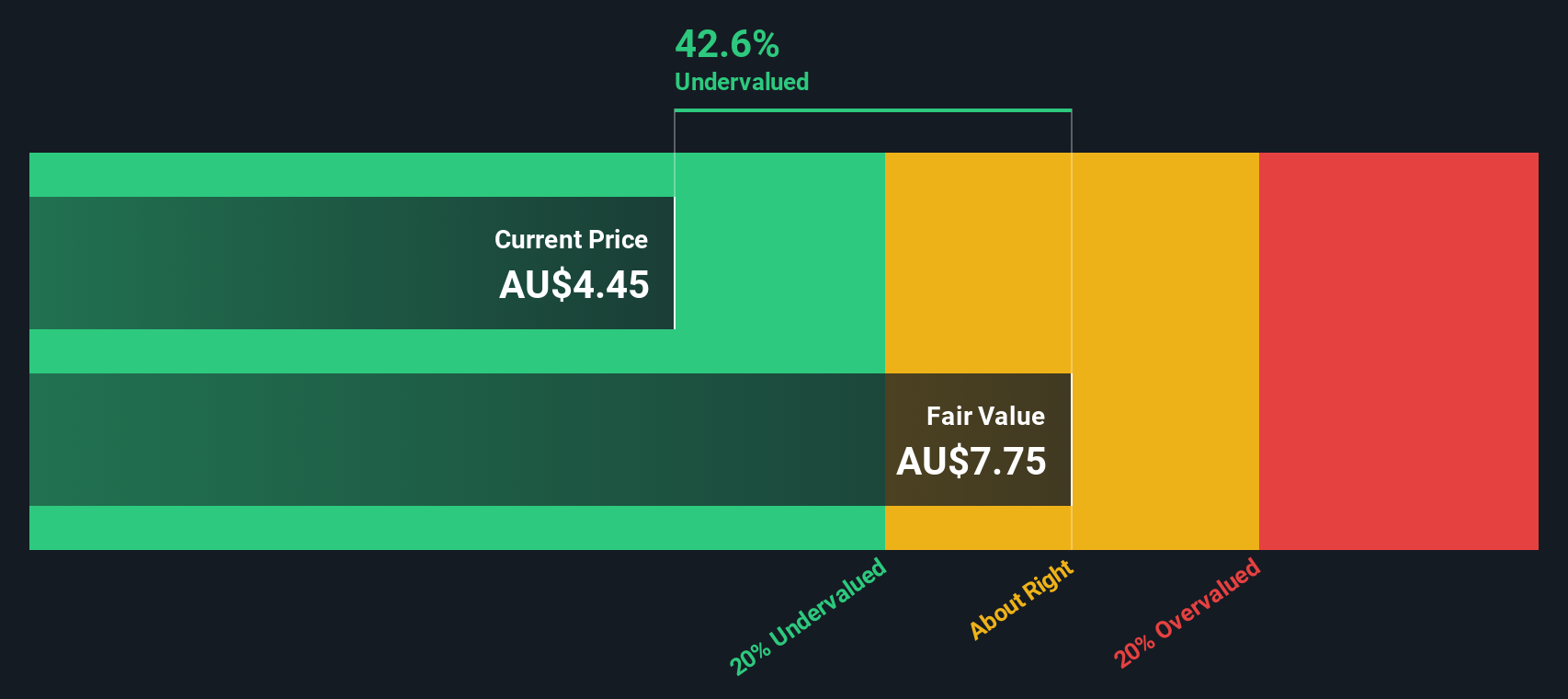

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is a company focused on equity investments with operations involving a significant portfolio valued at A$1.01 billion.

Operations: The company generates revenue primarily through equity investments, consistently achieving a gross profit margin of 100%. Operating expenses have shown a decreasing trend, with the most recent period reporting A$4.05 million. Net income margin has varied over time, reaching 67.44% in the latest period analyzed.

PE: 3.7x

MFF Capital Investments, a company with primarily external borrowing as its funding source, has recently seen insider confidence reflected through significant share purchases by Christopher MacKay. Over A$5 million was invested in acquiring 1.3 million shares, indicating potential belief in the company's prospects. While this investment underscores a positive outlook from insiders, the reliance on higher-risk funding sources may pose challenges. However, such insider activity could suggest optimism about future growth and value realization within the Asian market landscape.

- Click here and access our complete valuation analysis report to understand the dynamics of MFF Capital Investments.

Assess MFF Capital Investments' past performance with our detailed historical performance reports.

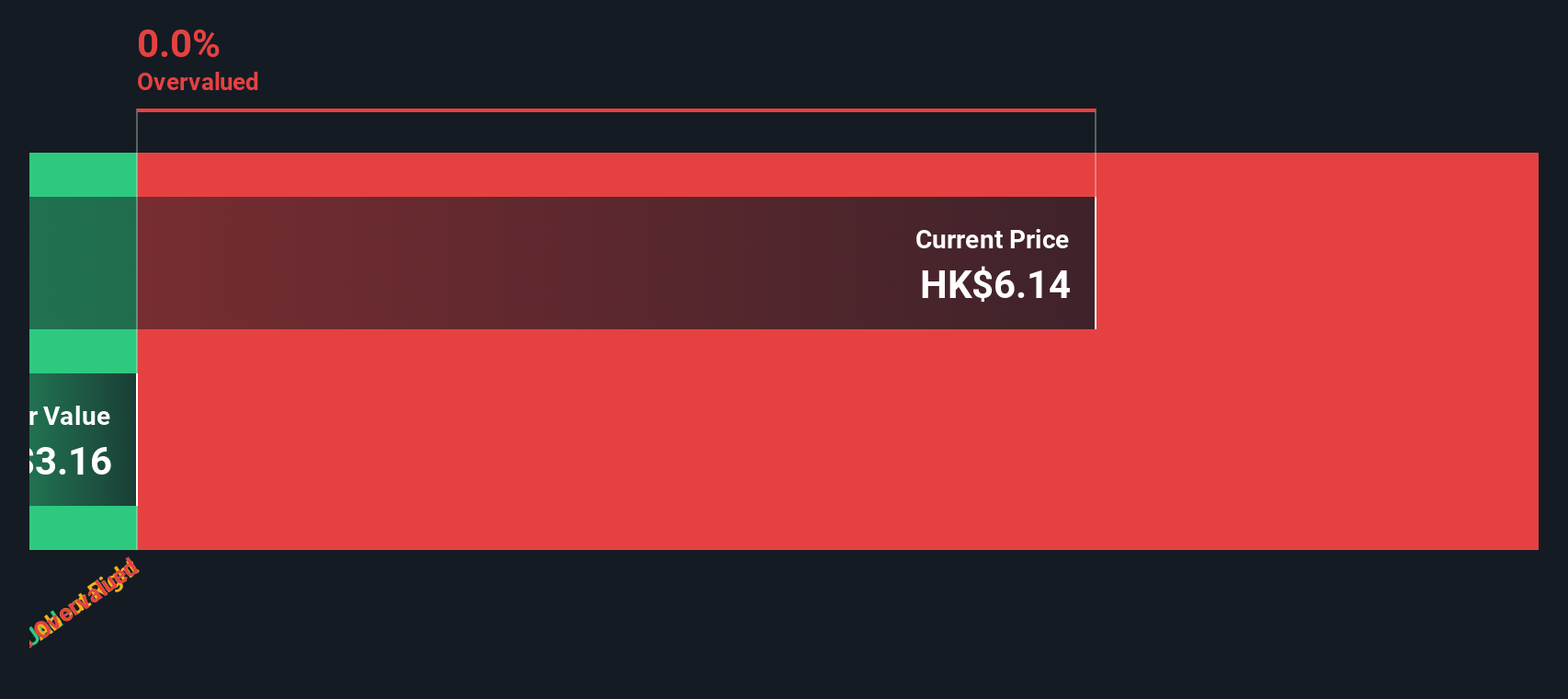

AInnovation Technology Group (SEHK:2121)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: AInnovation Technology Group specializes in providing artificial intelligence services and has a market capitalization of CN¥6.45 billion.

Operations: The company's revenue primarily stems from its Artificial Intelligence Service, with a gross profit margin reaching 34.63% as of December 2024. Operating expenses are significant, including substantial allocations towards R&D and General & Administrative expenses.

PE: -4.8x

AInnovation Technology Group, a small player in the tech industry, has been navigating challenging financial waters with a net loss of CNY 593.81 million for 2024. Despite this, the company is making strategic moves to bolster its position in AI and financial services through partnerships with Hunlicar and DingTalk. Recent insider confidence is evident as they purchased shares from March to May 2025, signaling potential optimism about future prospects despite current unprofitability. Revenue growth is projected at 16.85% annually, hinting at possible recovery avenues ahead.

Turning Ideas Into Actions

- Click here to access our complete index of 63 Undervalued Asian Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2121

AInnovation Technology Group

Engages in the research, development, and sale of artificial intelligence based software and hardware technology solutions in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives