- Australia

- /

- Capital Markets

- /

- ASX:MFF

GenusPlus Group And 2 Other Undiscovered Gems In Australia

Reviewed by Simply Wall St

As the ASX200 experiences a downturn, with sectors like materials and real estate facing significant challenges, investors are keenly observing how new listings like DigiCo fare in this fluctuating market environment. In such conditions, identifying promising small-cap stocks requires a focus on companies that demonstrate resilience and potential for growth despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems across Australia, with a market cap of A$442.54 million.

Operations: GenusPlus Group Ltd generates revenue primarily from its Infrastructure segment, contributing A$336.04 million, followed by the Industrial and Communication segments with A$152.62 million and A$71.59 million, respectively.

GenusPlus Group, a nimble player in the infrastructure sector, has shown impressive financial resilience. Over the past year, its earnings surged by 43.7%, outpacing the construction industry's growth of 22.7%. The company's debt-to-equity ratio improved significantly from 16.3% to just 3.5% over five years, indicating prudent financial management. Trading at nearly half its estimated fair value suggests potential undervaluation in the market. Recent strategic moves include a proposed A$6 million acquisition of CommTel Network Solutions to enhance its national presence and communications division, showcasing GenusPlus's ambition to expand and innovate within its industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of GenusPlus Group.

Gain insights into GenusPlus Group's past trends and performance with our Past report.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.73 billion.

Operations: MFF Capital Investments generates revenue primarily through equity investments, amounting to A$659.96 million.

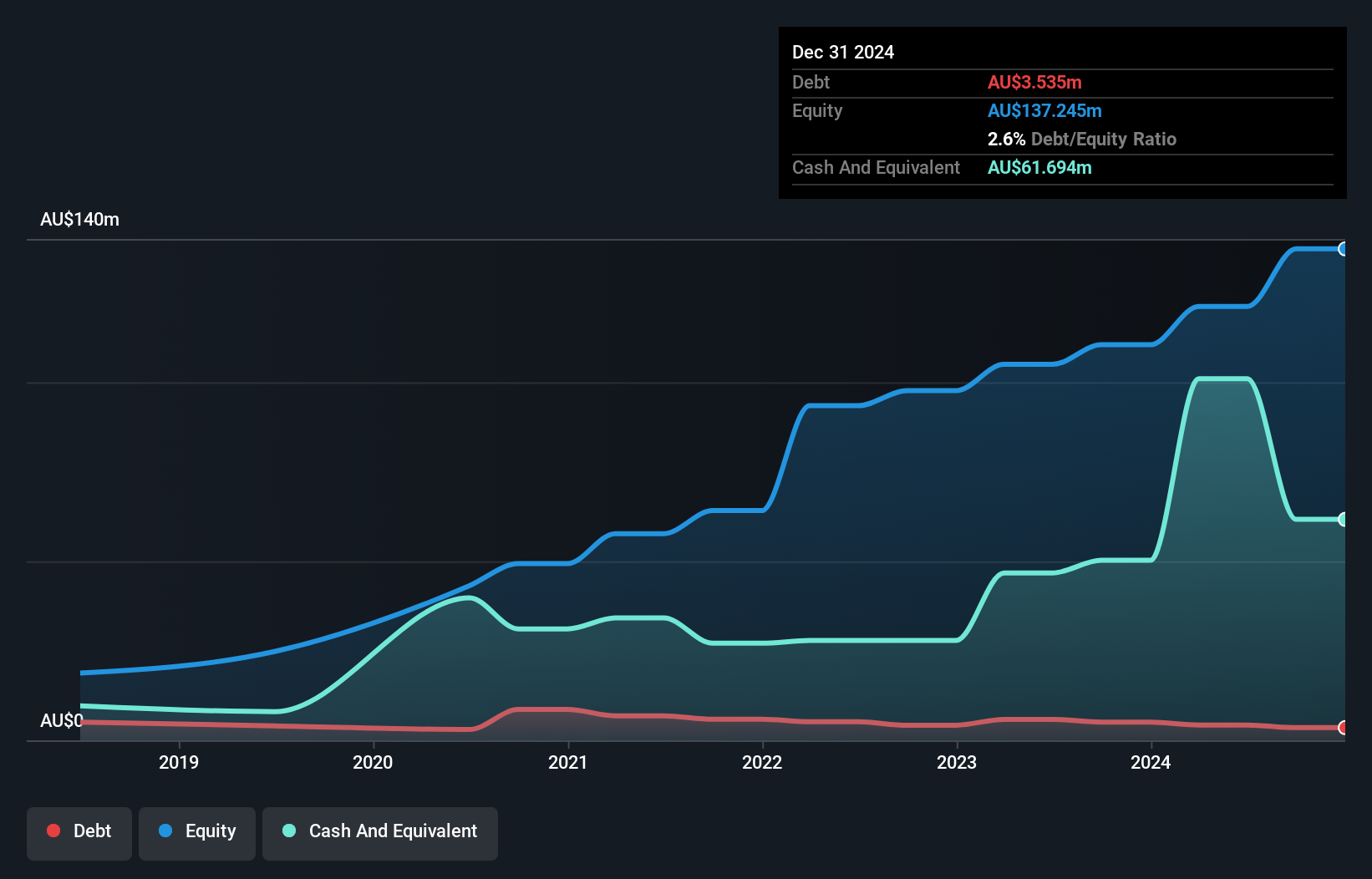

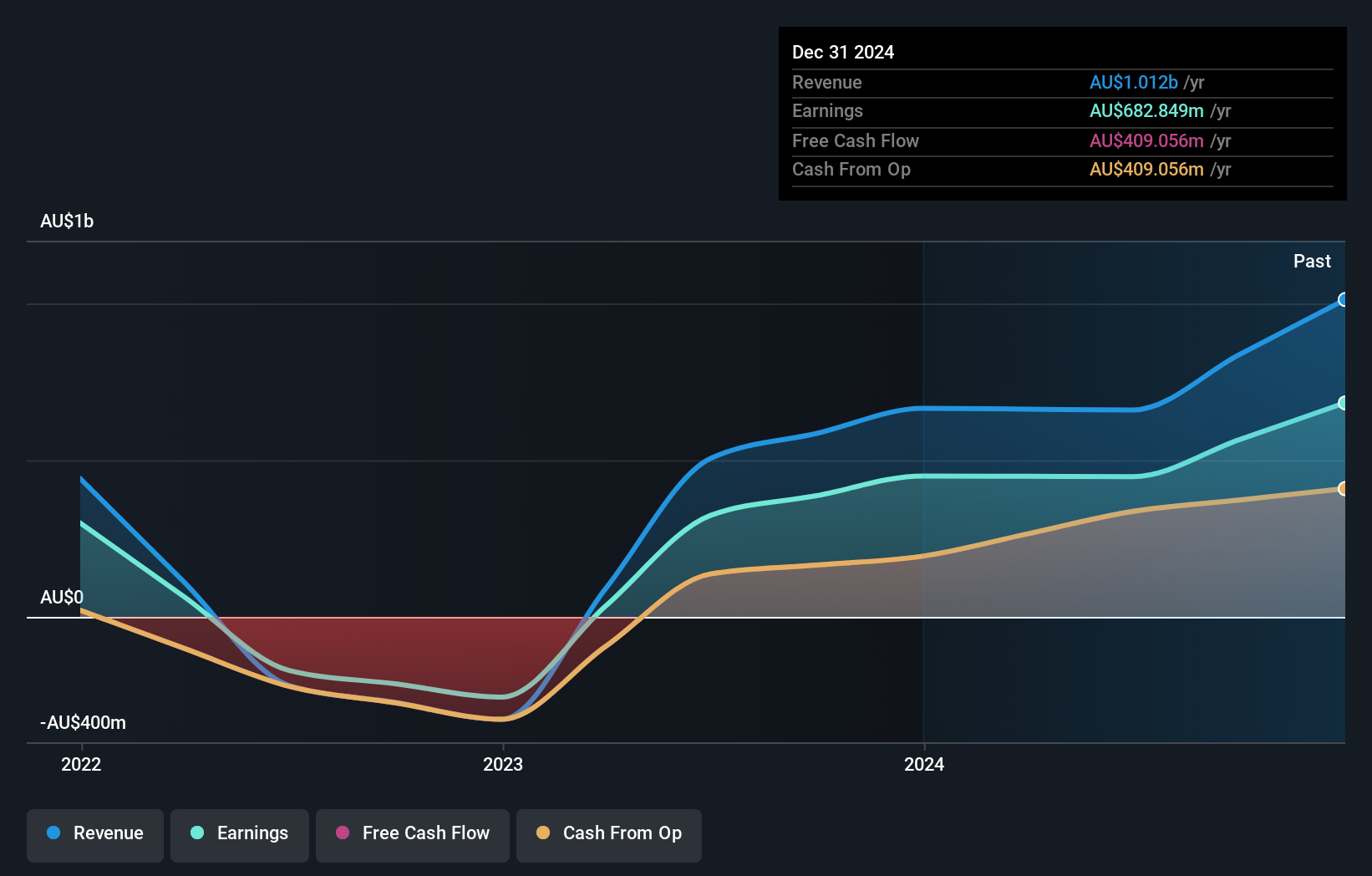

MFF Capital Investments, a small player in the Australian market, shows promising financial health with its high-quality earnings and profitability. The company is trading 30.3% below its estimated fair value, suggesting potential undervaluation. Over the past year, MFF's earnings surged by 38%, outpacing the Capital Markets industry's growth of 15.6%. Despite an increase in debt to equity from 2.8% to 7.9% over five years, it remains well-covered by EBIT at a ratio of 28x interest payments. With more cash than total debt and no immediate cash runway concerns, MFF seems positioned for continued stability and potential growth.

- Take a closer look at MFF Capital Investments' potential here in our health report.

Learn about MFF Capital Investments' historical performance.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tasmea Limited is an Australian company specializing in shutdown, maintenance, emergency breakdown, and capital upgrade services with a market capitalization of approximately A$669.70 million.

Operations: Tasmea's primary revenue streams come from Mechanical Services and Electrical Services, generating A$141.42 million and A$129.44 million respectively. The company also earns from Water & Fluid, Civil Services, and Corporate Services. Net profit margin trends provide insights into the company's profitability over time.

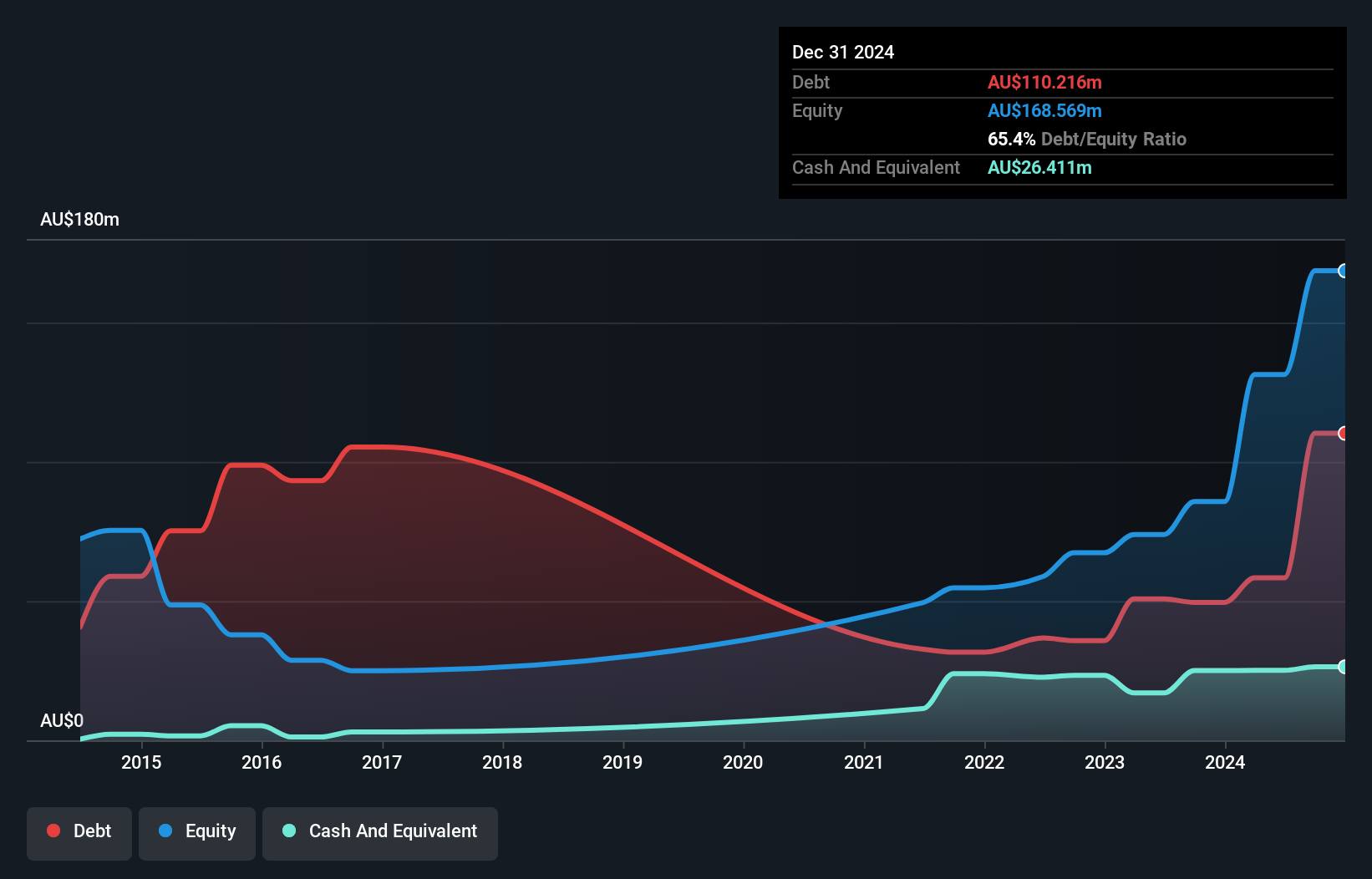

Tasmea, a promising player in the Australian market, showcases strong financial health with its debt to equity ratio significantly reduced from 168.5% to 44.4% over five years and a net debt to equity ratio at a satisfactory 25.3%. The company seems undervalued, trading at 73.8% below fair value estimates. Tasmea's earnings growth of 57.1% last year outpaced the construction industry's average of 22.7%, highlighting robust performance and high-quality earnings. Recently added to the S&P/ASX Emerging Companies Index, Tasmea is anticipated to maintain momentum with an expected annual earnings growth rate of 22.71%.

- Delve into the full analysis health report here for a deeper understanding of Tasmea.

Evaluate Tasmea's historical performance by accessing our past performance report.

Key Takeaways

- Dive into all 58 of the ASX Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MFF Capital Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives