- Australia

- /

- Capital Markets

- /

- ASX:MFF

3 Top Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

The Australian market has recently experienced a mixed performance, with the ASX200 closing up 0.56% amid sector fluctuations where IT and Utilities led gains while Energy and Materials faced declines. In this environment, small-cap stocks present unique opportunities as they often react differently to broader market trends, offering potential value especially when insider buying signals confidence in their prospects. Identifying promising small-cap stocks involves looking for those with strong fundamentals and strategic positioning in sectors poised for growth or recovery.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.1x | 1.5x | 42.93% | ★★★★★★ |

| Tabcorp Holdings | NA | 0.4x | 21.95% | ★★★★★☆ |

| Collins Foods | 17.5x | 0.7x | 9.15% | ★★★★☆☆ |

| Dicker Data | 19.5x | 0.7x | -61.38% | ★★★★☆☆ |

| Centuria Capital Group | 20.6x | 4.6x | 47.84% | ★★★★☆☆ |

| Coventry Group | 242.6x | 0.4x | -22.33% | ★★★☆☆☆ |

| Corporate Travel Management | 19.9x | 2.4x | 4.49% | ★★★☆☆☆ |

| Abacus Storage King | 11.7x | 7.3x | -24.75% | ★★★☆☆☆ |

| BSP Financial Group | 7.6x | 2.7x | 4.22% | ★★★☆☆☆ |

| Credit Corp Group | 23.0x | 3.1x | 34.84% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

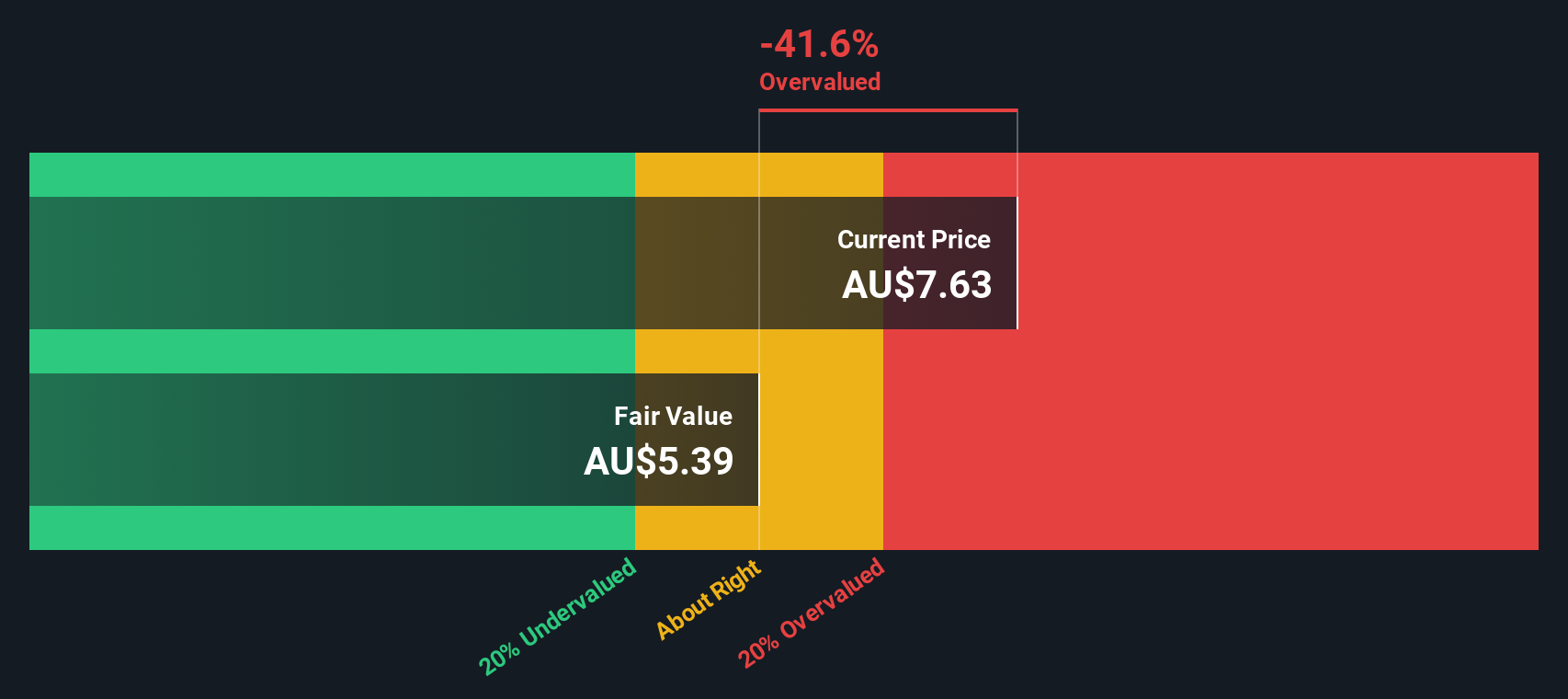

Data#3 (ASX:DTL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Data#3 is a value-added IT reseller and IT solutions provider with operations focused on delivering technology solutions, and it has a market cap of approximately A$1.23 billion.

Operations: The company generates revenue primarily from its operations as a Value-Added IT Reseller and IT Solutions Provider. Over recent periods, the gross profit margin has shown variability, reaching 9.87% in the latest quarter ending June 2024. Operating expenses have been consistently recorded, with general and administrative expenses being a notable component. The net income margin has experienced fluctuations, with a peak of 5.38% observed in the same quarter.

PE: 26.4x

Data#3, a smaller company in Australia, has shown potential for being undervalued with its recent financial performance. For the year ending June 30, 2024, they reported A$815.68 million in revenue and A$43.31 million net income, showing growth from the previous year. Insider confidence is evident as insiders have been purchasing shares over the past few months. The upcoming transition to PwC as their auditor and planned executive changes reflect proactive governance strategies that could influence future growth positively.

- Click here and access our complete valuation analysis report to understand the dynamics of Data#3.

Explore historical data to track Data#3's performance over time in our Past section.

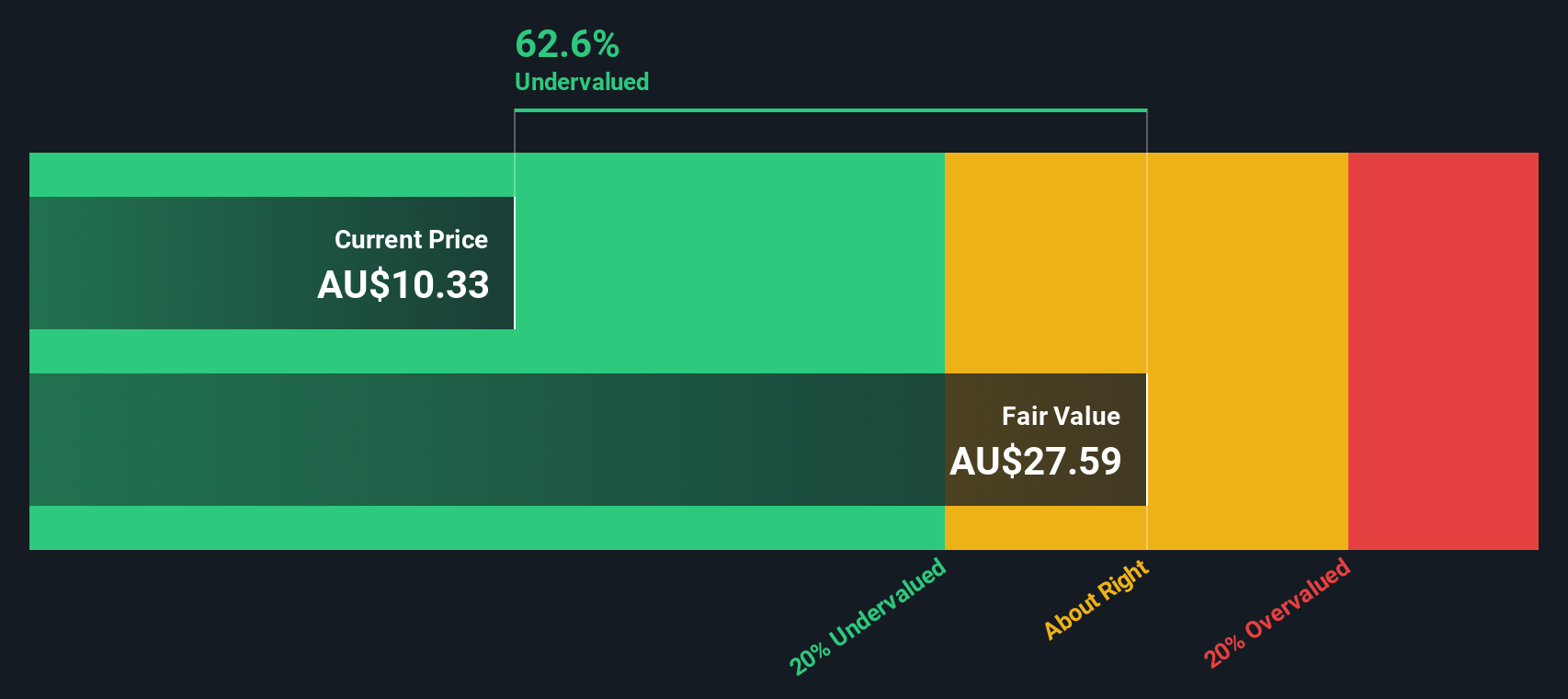

Jumbo Interactive (ASX:JIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jumbo Interactive operates in the lottery industry, providing managed services, lottery retailing, and software-as-a-service solutions, with a market capitalization of A$1.2 billion.

Operations: The company generates revenue primarily from Lottery Retailing and Software-As-A-Service (SaaS), with Managed Services contributing a smaller portion. Operating expenses are dominated by General & Administrative and Sales & Marketing costs. The net income margin has shown variability, reaching 27.20% in recent periods, indicating changes in profitability over time.

PE: 18.9x

Jumbo Interactive, a smaller player in the Australian market, has shown promising financial growth with sales rising to A$159.33 million and net income increasing to A$43.35 million for the year ending June 30, 2024. The company is actively seeking bolt-on acquisitions to enhance scale and capabilities. Insider confidence is evident as the CEO acquired 6,900 shares valued at approximately A$94,813 recently. With earnings projected to grow annually by 7.24%, Jumbo's strategic moves could position it well for future expansion despite reliance on higher-risk external funding sources.

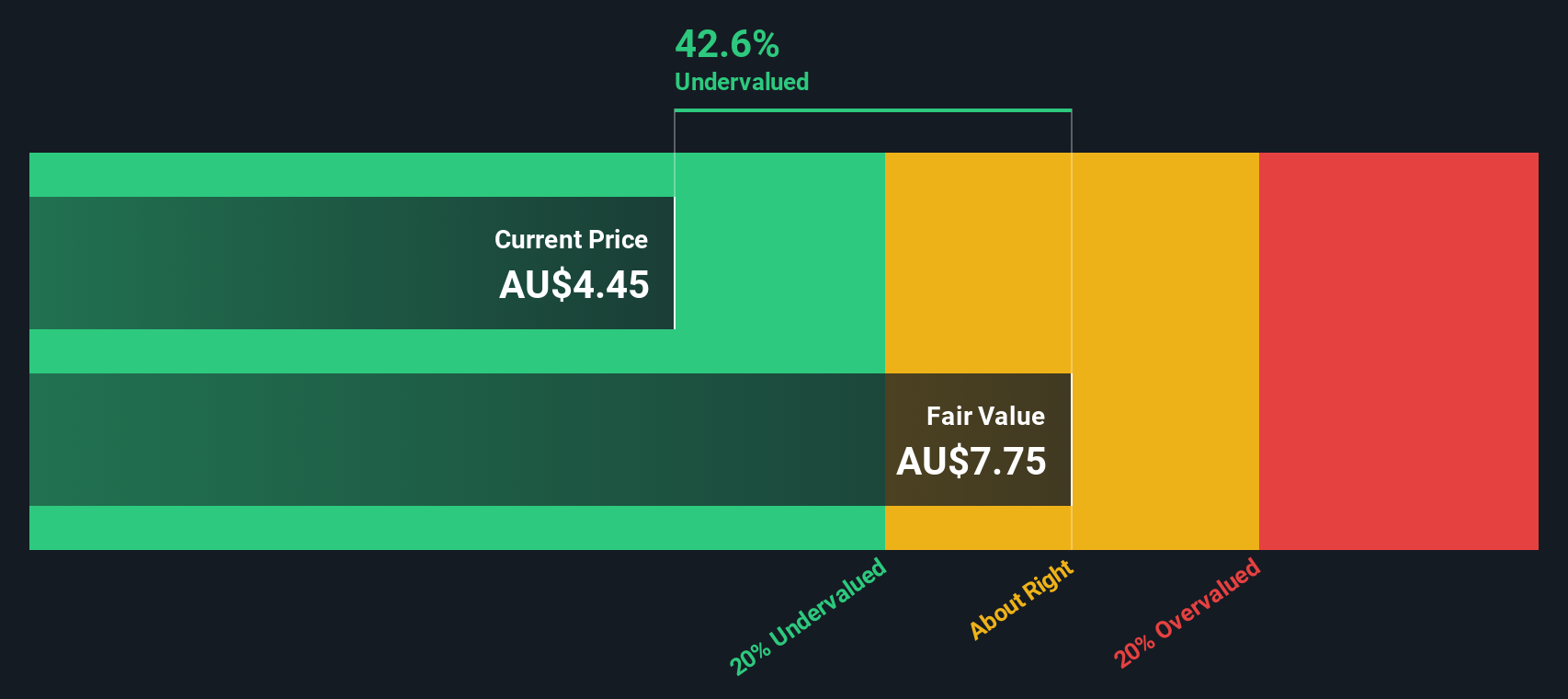

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is an Australian-based investment company focused on managing a portfolio of international equities, with a market capitalization of A$1.92 billion.

Operations: The company generates revenue primarily from equity investments, with recent figures showing A$659.96 million. Operating expenses are relatively low at A$3.89 million, contributing to a net income of A$447.36 million and a net income margin of 67.78%. The gross profit margin consistently stands at 100%, indicating no cost of goods sold impacting the revenue directly.

PE: 5.1x

MFF Capital Investments, a small player in the Australian market, has recently shown signs of being undervalued. Insider confidence is evident as their Managing Director and Portfolio Manager, Christopher MacKay, increased their stake by 1.1%, purchasing shares worth A$5 million between January and September 2024. This move suggests belief in the company's future prospects despite its reliance on external borrowing for funding. Recent shareholder engagements indicate ongoing communication with stakeholders about strategic directions.

- Delve into the full analysis valuation report here for a deeper understanding of MFF Capital Investments.

Assess MFF Capital Investments' past performance with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 24 Undervalued ASX Small Caps With Insider Buying here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Outstanding track record with excellent balance sheet and pays a dividend.