- Australia

- /

- Capital Markets

- /

- ASX:MAF

Here's Why I Think MA Financial Group (ASX:MAF) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like MA Financial Group (ASX:MAF). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for MA Financial Group

MA Financial Group's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Over twelve months, MA Financial Group increased its EPS from AU$0.18 to AU$0.20. That amounts to a small improvement of 8.9%.

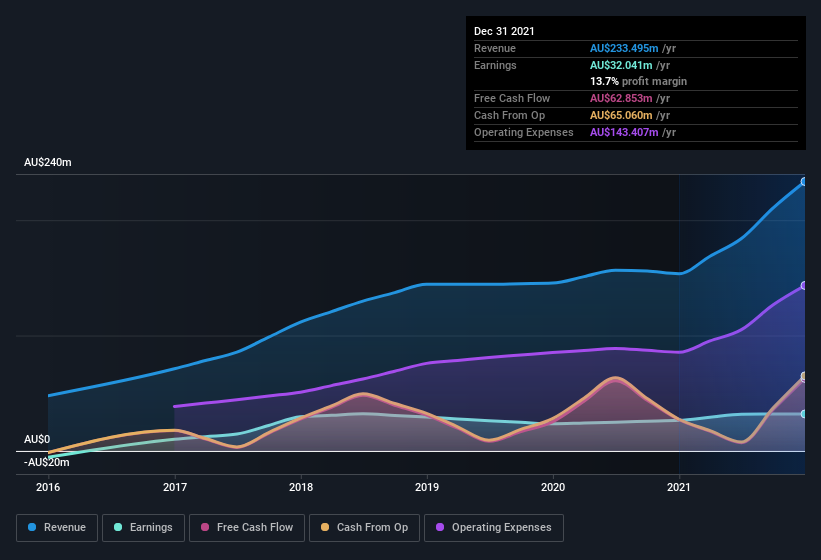

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that MA Financial Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. MA Financial Group maintained stable EBIT margins over the last year, all while growing revenue 52% to AU$233m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are MA Financial Group Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that MA Financial Group insiders own a significant number of shares certainly appeals to me. Actually, with 40% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. And their holding is extremely valuable at the current share price, totalling AU$547m. That means they have plenty of their own capital riding on the performance of the business!

Should You Add MA Financial Group To Your Watchlist?

As I already mentioned, MA Financial Group is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. We should say that we've discovered 2 warning signs for MA Financial Group (1 is a bit unpleasant!) that you should be aware of before investing here.

Although MA Financial Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MAF

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives