- Australia

- /

- Diversified Financial

- /

- ASX:IAM

Positive Sentiment Still Eludes Income Asset Management Group Limited (ASX:IAM) Following 27% Share Price Slump

Unfortunately for some shareholders, the Income Asset Management Group Limited (ASX:IAM) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

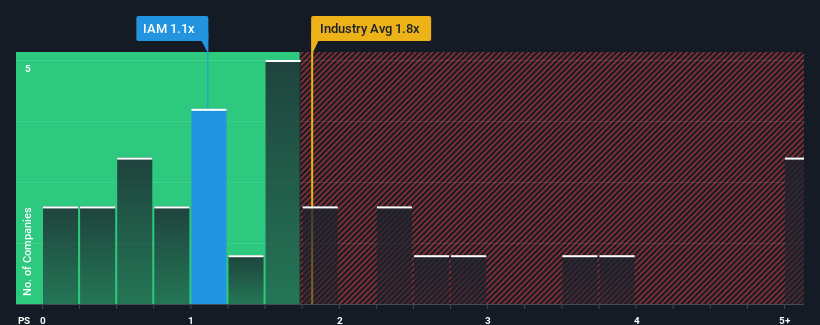

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Income Asset Management Group's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Diversified Financial industry in Australia is also close to 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Income Asset Management Group

How Income Asset Management Group Has Been Performing

There hasn't been much to differentiate Income Asset Management Group's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Income Asset Management Group will help you uncover what's on the horizon.How Is Income Asset Management Group's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Income Asset Management Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 156% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 22% as estimated by the lone analyst watching the company. Meanwhile, the broader industry is forecast to contract by 27%, which would indicate the company is doing very well.

With this information, we find it odd that Income Asset Management Group is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What Does Income Asset Management Group's P/S Mean For Investors?

Income Asset Management Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Income Asset Management Group currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Income Asset Management Group (1 is potentially serious!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IAM

Income Asset Management Group

Provides financial product solutions in cash/deposits and fixed income in Australia.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026