- Australia

- /

- Consumer Finance

- /

- ASX:HMY

Alchemy Resources And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 rise by 0.6%, buoyed by strong performances in sectors like Industrials and Financials, despite some losses in IT and Materials. In this context, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies with potential for growth when backed by solid financials. By focusing on those with robust balance sheets, investors can uncover promising opportunities among these under-the-radar stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.83 | A$91.04M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.475 | A$297.67M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.04 | A$252.05M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.06 | A$330.52M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.86 | A$103.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.21 | A$334.56M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alchemy Resources (ASX:ALY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alchemy Resources Limited focuses on the discovery, exploration, and development of mineral properties in Australia, with a market cap of A$9.42 million.

Operations: The company generates revenue primarily from mineral exploration and prospecting for minerals, amounting to A$0.01 million.

Market Cap: A$9.42M

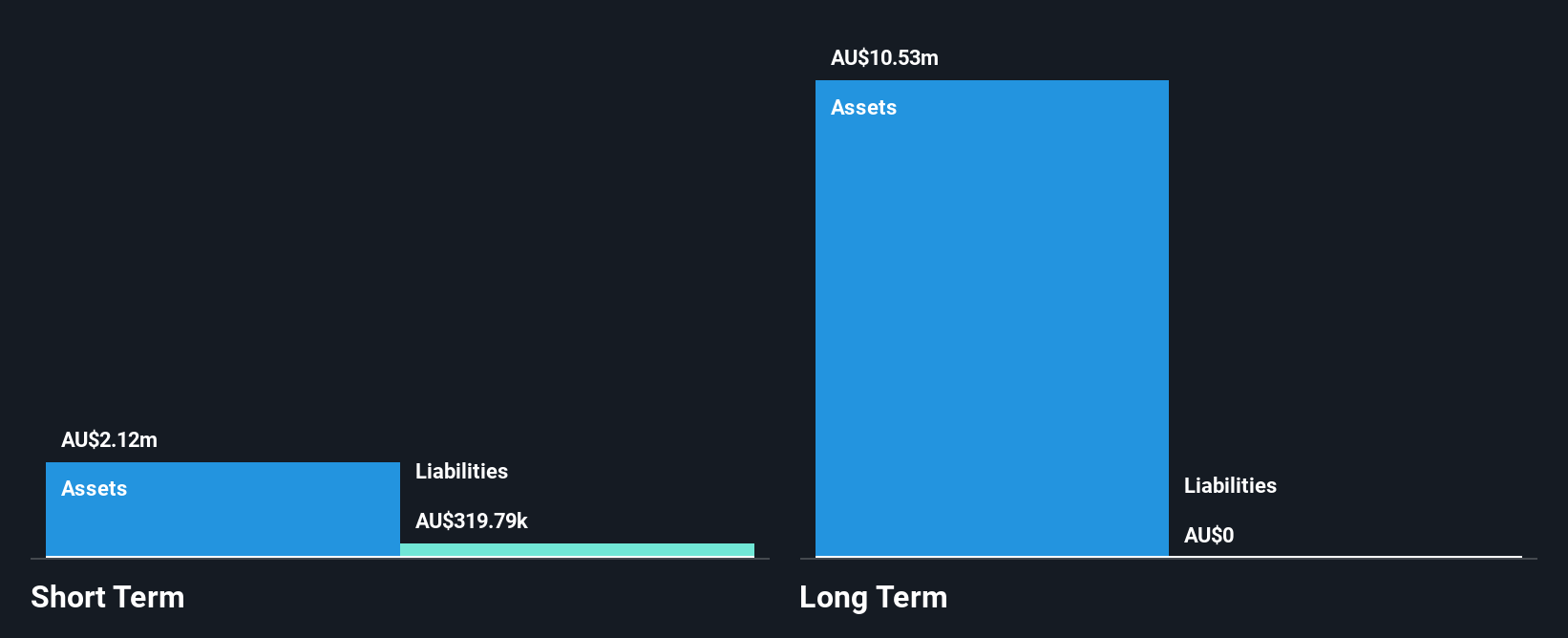

Alchemy Resources Limited, with a market cap of A$9.42 million, is pre-revenue and focused on mineral exploration in Australia. The company is debt-free and has not diluted shareholders over the past year. Its seasoned board boasts an average tenure of 13.3 years, enhancing governance stability. Alchemy has a sufficient cash runway for over three years if historical cash flow reductions persist, despite its high share price volatility and negative return on equity (-11.18%). Short-term assets (A$3.1M) comfortably cover liabilities (A$239.7K), providing financial flexibility amidst ongoing unprofitability but reduced losses over five years.

- Take a closer look at Alchemy Resources' potential here in our financial health report.

- Examine Alchemy Resources' past performance report to understand how it has performed in prior years.

Harmoney (ASX:HMY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Harmoney Corp Limited operates as an online provider of secured and unsecured personal loans in Australia and New Zealand, with a market cap of A$55.06 million.

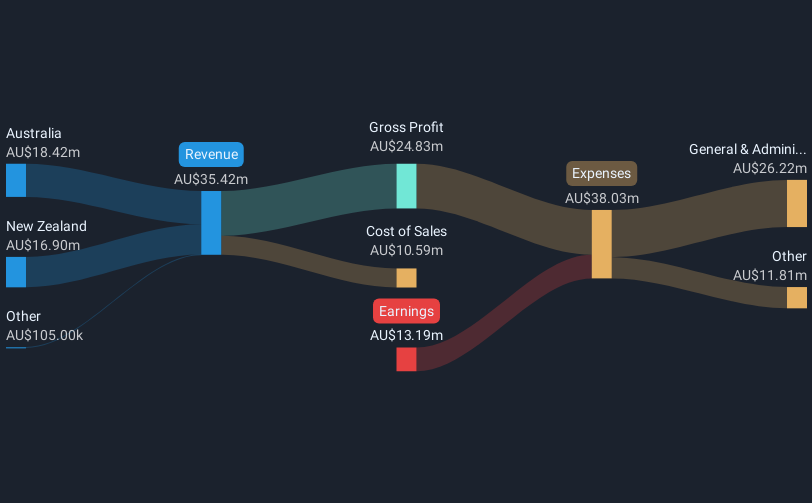

Operations: The company generates revenue from its Financial Services - Consumer segment, amounting to A$35.42 million.

Market Cap: A$55.06M

Harmoney Corp Limited, with a market cap of A$55.06 million, operates in the online personal loan sector across Australia and New Zealand. Despite being unprofitable, it has a positive cash flow and sufficient cash runway for over three years. Its net debt to equity ratio is very high at 1923.5%, raising concerns about leverage despite short-term assets exceeding liabilities significantly (A$766.1M vs A$5.6M). The company has reduced losses by 12.6% annually over five years, indicating progress toward profitability, while its seasoned management team adds operational stability without recent shareholder dilution concerns.

- Jump into the full analysis health report here for a deeper understanding of Harmoney.

- Review our growth performance report to gain insights into Harmoney's future.

PPK Group (ASX:PPK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PPK Group Limited, with a market cap of A$34.87 million, operates in Australia offering nanomaterials, artificial intelligence, and energy solutions through its subsidiaries.

Operations: The company's revenue is primarily derived from its energy storage segment, which generated A$27.47 million, complemented by a minor contribution of A$0.01 million from technology-focused subsidiary companies.

Market Cap: A$34.87M

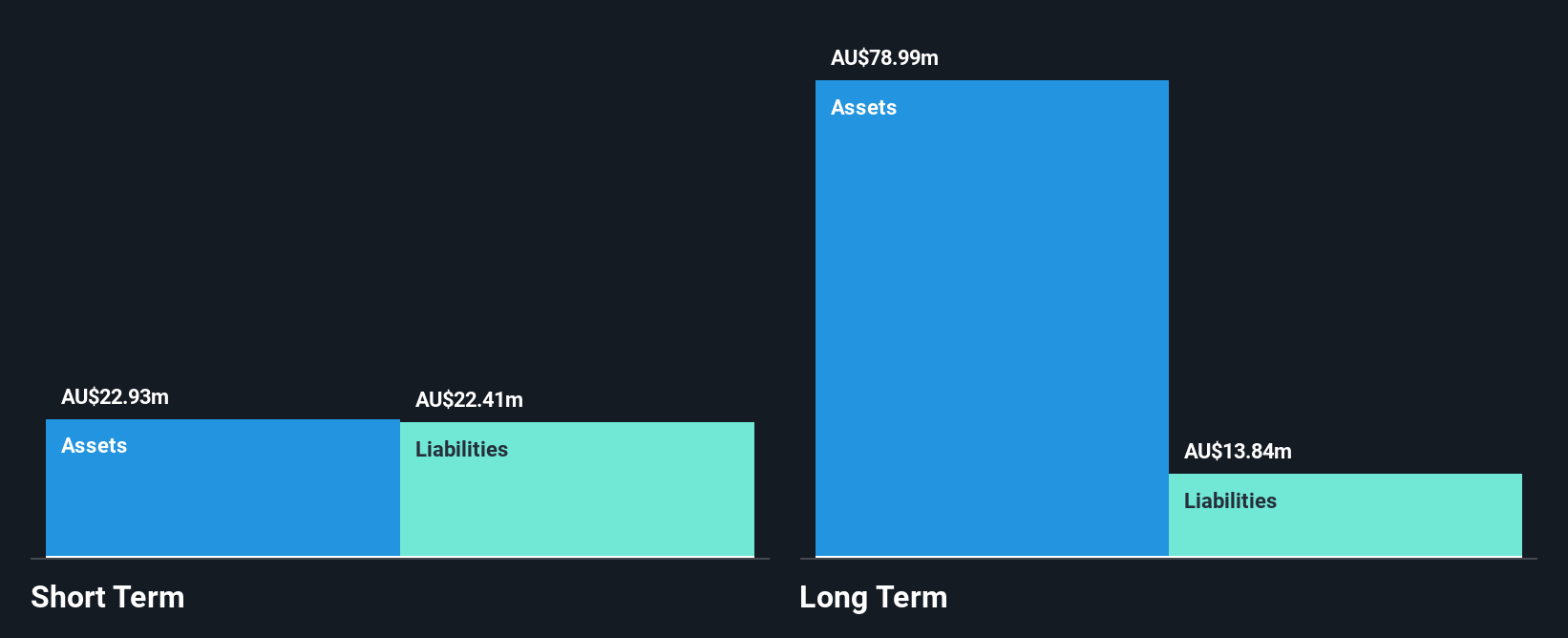

PPK Group Limited, with a market cap of A$34.87 million, is currently pre-revenue in its operations across nanomaterials and energy solutions. The company is unprofitable, with earnings declining by 56.4% annually over the past five years and losses increasing at the same rate. However, PPK maintains a strong balance sheet where short-term assets (A$42.6M) comfortably exceed both short-term (A$21.8M) and long-term liabilities (A$7.1M). Its cash position surpasses total debt levels, although it faces less than a year of cash runway if free cash flow continues to decrease historically by 39.1% annually.

- Dive into the specifics of PPK Group here with our thorough balance sheet health report.

- Understand PPK Group's track record by examining our performance history report.

Key Takeaways

- Discover the full array of 1,030 ASX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Harmoney, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harmoney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HMY

Harmoney

Provides secured and unsecured personal loans through online in Australia and New Zealand.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives