- Australia

- /

- Capital Markets

- /

- ASX:HMC

Will HMC Capital’s (ASX:HMC) Expansion Ambitions Reshape Its Long-Term Investment Profile?

Reviewed by Sasha Jovanovic

- HMC Capital recently held its 2025 Annual General Meeting, sharing updates on board changes, performance rights for executives, and key expansion projects including a planned A$400 million redevelopment of Brisbane’s Uptown complex.

- CEO David Di Pilla addressed shareholders’ concerns with a continued focus on long-term investments in data centres and healthcare infrastructure, emphasizing a disciplined approach despite pressure from activist investors and hedge funds.

- We’ll now explore how the company’s commitment to large-scale expansion projects could impact its investment narrative and future outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

HMC Capital Investment Narrative Recap

For HMC Capital, being a shareholder means believing in the company's ability to profitably build and scale new verticals like data centres and private hospitals amid ongoing sector headwinds and market skepticism. While the AGM highlighted continued progress on major projects such as the Uptown redevelopment, it did not represent a material shift to near-term catalysts or reduce the ongoing risk of execution missteps in these emerging businesses.

The most relevant announcement is HMC Capital’s plan to invest A$400 million in redeveloping Brisbane’s Uptown complex, which ties directly to management’s confidence in expanding its retail and digital infrastructure platform. This project reinforces long-term growth potential, yet the true impact on assets under management and recurring management fees, one of the most important catalysts, remains subject to future operational delivery and market demand.

However, investors should also be aware that, in contrast, the company’s rapid growth into new sectors means questions remain about the potential for...

Read the full narrative on HMC Capital (it's free!)

HMC Capital's outlook forecasts A$352.6 million in revenue and A$189.4 million in earnings by 2028. This is based on an expected annual revenue growth rate of 13.5% and represents an earnings increase of about A$42 million from the current earnings of A$147.3 million.

Uncover how HMC Capital's forecasts yield a A$5.06 fair value, a 57% upside to its current price.

Exploring Other Perspectives

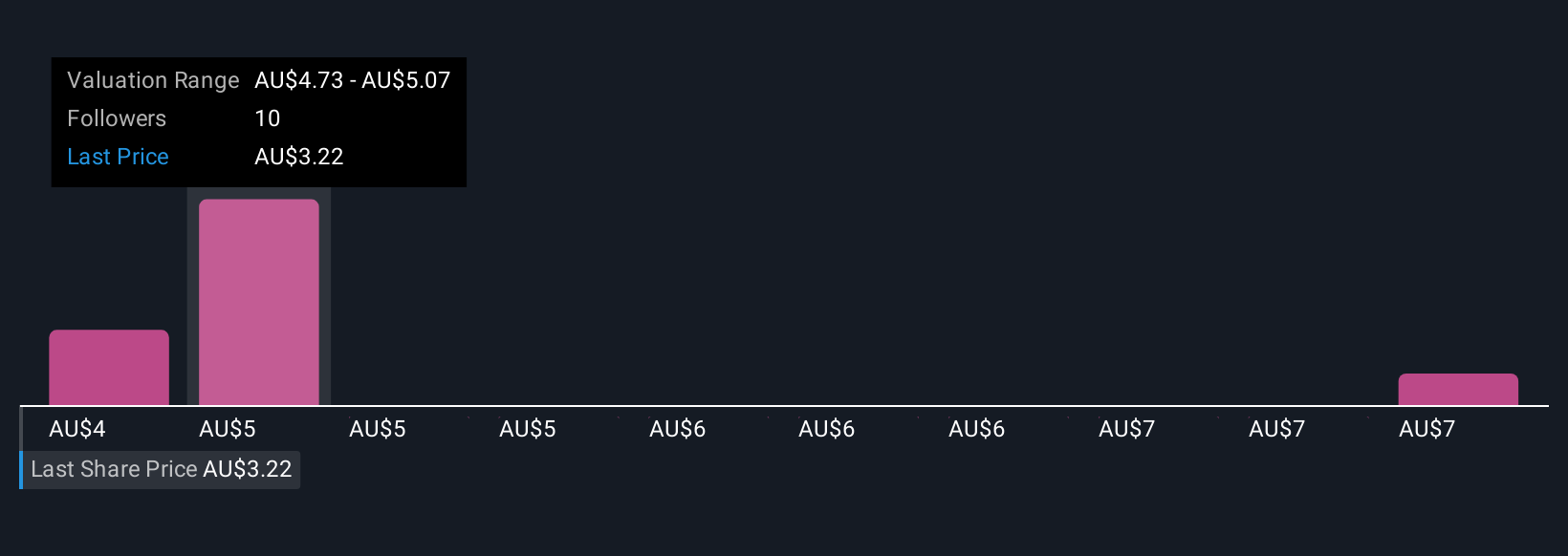

Four different fair value estimates from the Simply Wall St Community span from A$4.40 to A$7.75 per share. With operational execution risk still front of mind, now is the time to consider how varying market convictions could shape your view of HMC’s prospects.

Explore 4 other fair value estimates on HMC Capital - why the stock might be worth over 2x more than the current price!

Build Your Own HMC Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HMC Capital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HMC Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HMC Capital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HMC Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HMC

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives