Amidst fluctuating commodity prices and a mixed performance in global markets, the Australian small-cap sector presents a unique landscape for investors seeking potential opportunities. Given the current economic backdrop, identifying undervalued small-cap stocks requires a keen eye on companies with solid fundamentals and strategic market positions that can navigate through volatile conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.1x | 2.6x | 45.97% | ★★★★★★ |

| Tabcorp Holdings | NA | 0.6x | 31.11% | ★★★★★★ |

| Magellan Financial Group | 7.4x | 3.7x | 38.01% | ★★★★★☆ |

| Eagers Automotive | 9.2x | 0.3x | 30.78% | ★★★★☆☆ |

| GWA Group | 13.3x | 1.5x | 16.27% | ★★★★☆☆ |

| Fiducian Group | 17.4x | 3.1x | 9.16% | ★★★☆☆☆ |

| Tasmea | 13.1x | 0.9x | 19.52% | ★★★☆☆☆ |

| Coventry Group | 278.5x | 0.4x | -28.60% | ★★★☆☆☆ |

| Lynch Group Holdings | NA | 0.4x | -3.73% | ★★★☆☆☆ |

| Star Entertainment Group | NA | 0.8x | -11.20% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

FleetPartners Group (FPR)

Simply Wall St Value Rating: ★★★★☆☆

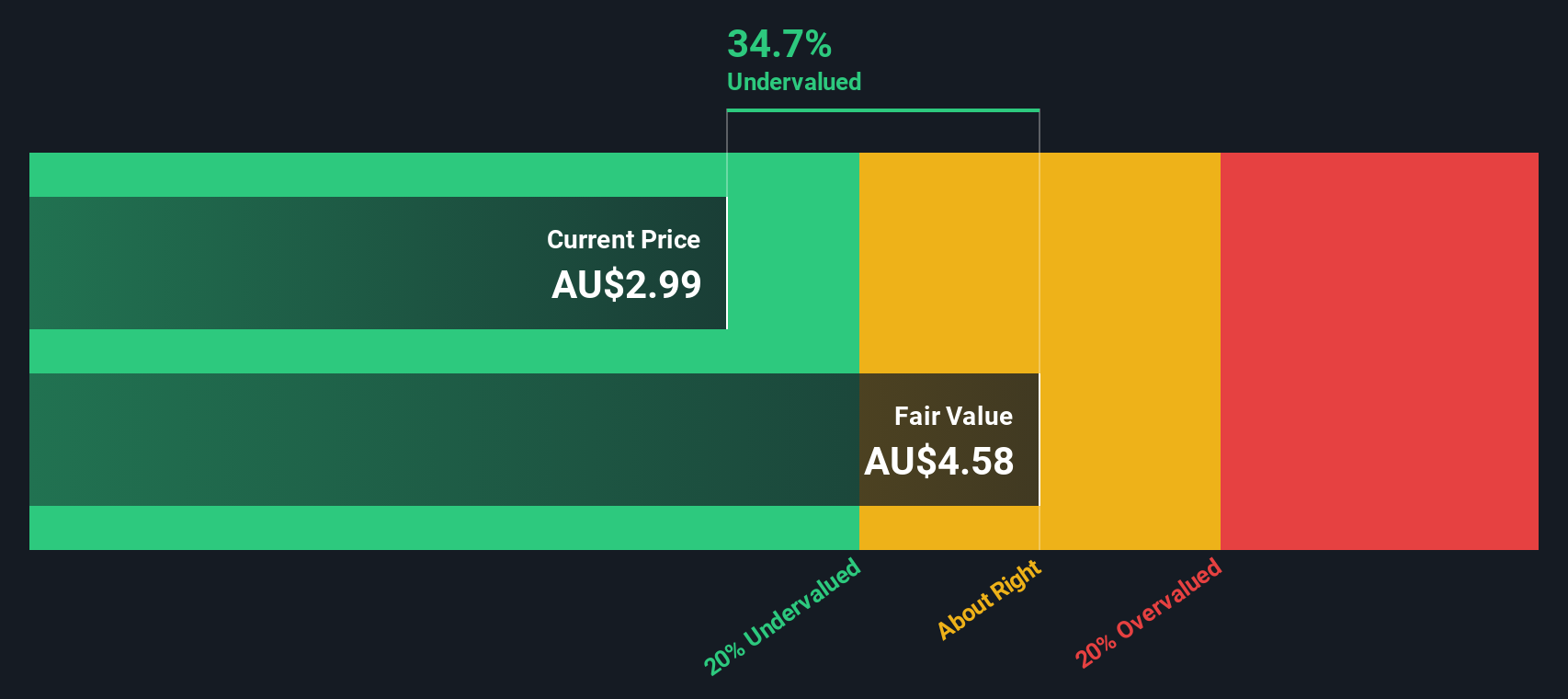

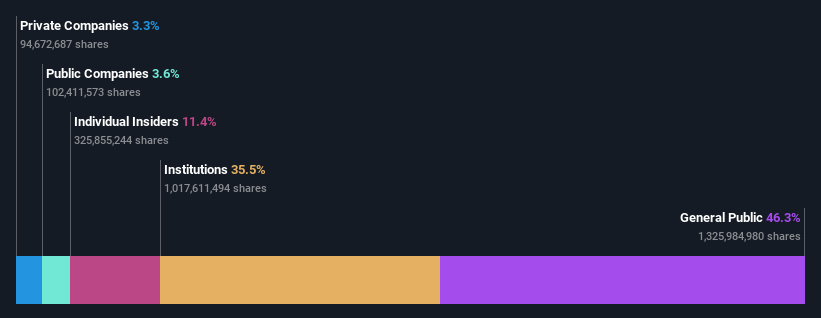

Overview: FleetPartners Group is a company specializing in vehicle leasing and fleet management services, with a market capitalization of approximately A$1.07 billion.

Operations: FPR's gross profit margin has shown variability over the years, peaking at 0.42% in September 2017 and experiencing a notable decline to 0.24% by December 2018, before slightly recovering to around 0.31% by June 2024. The company's net income has fluctuated accordingly, with a significant increase observed from A$27.59 million in December 2018 to A$78.09 million by June 2024, reflecting changes in operational efficiency and cost management strategies.

PE: 10.8x

FleetPartners Group Limited, a lesser-known entity in Australia's investment landscape, recently reported a slight dip in net income from A$39.39 million to A$36.46 million for the half-year ended March 31, 2024, despite an increase in sales to A$367.5 million from A$326.94 million previously. With earnings per share also seeing marginal growth and revenue expected to rise by 7.44% annually, the company's reliance on external borrowing—its sole funding source—poses a risk yet reflects a straightforward financial structure without the complexity of customer deposits. This scenario suggests room for strategic maneuvers that could enhance value, making FleetPartners an intriguing prospect.

NRW Holdings (NWH)

Simply Wall St Value Rating: ★★★★☆☆

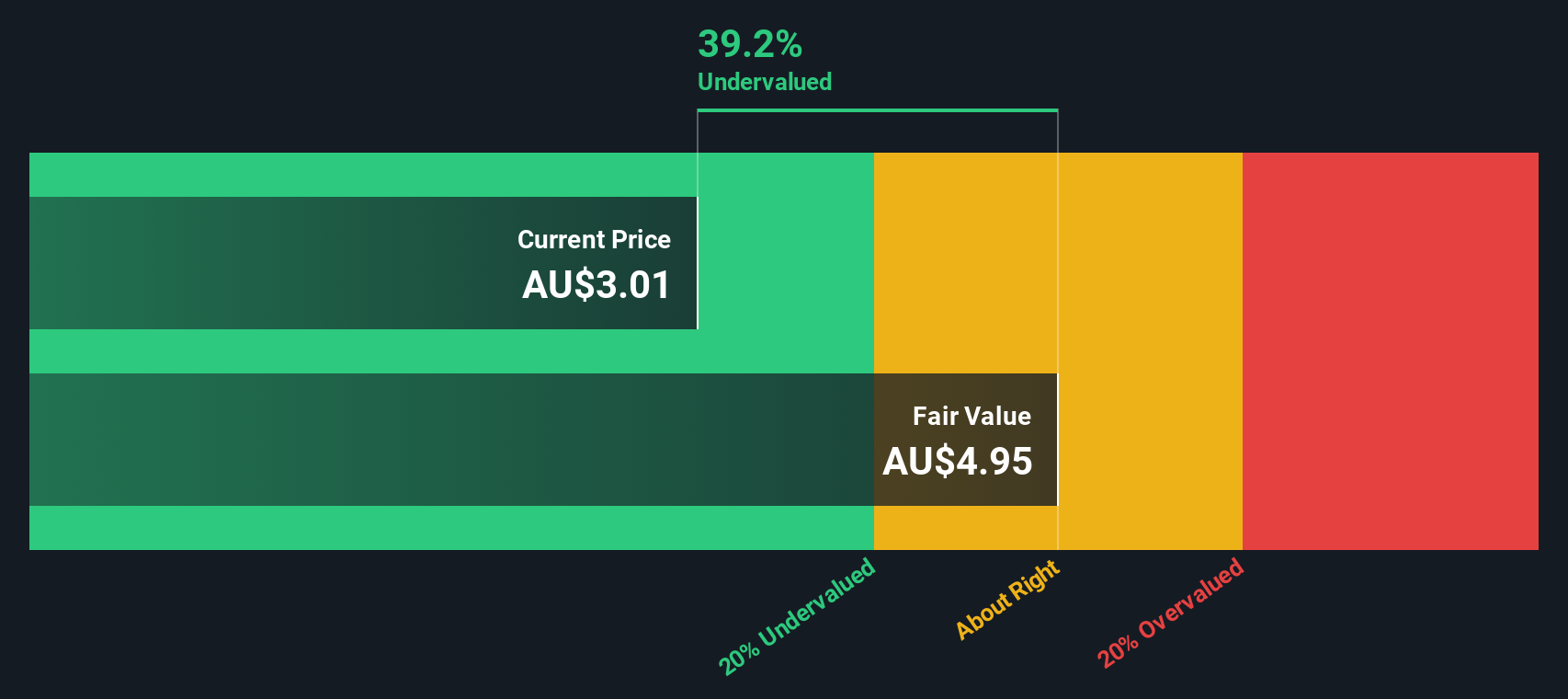

Overview: NRW Holdings is a diversified provider of mining and civil construction services with a market capitalization of approximately A$1.20 billion.

Operations: The company generates its highest revenue from the Mining segment, amounting to A$1.49 billion, followed by MET and Civil segments at A$739.07 million and A$593.62 million respectively. The gross profit margin has seen a recent increase to 47.41% as of the latest reporting period in 2024.

PE: 15.4x

NRW Holdings, a lesser-known entity in Australia's bustling market, has demonstrated notable financial prudence with no customer deposits and liabilities solely from external borrowings. Recently, insiders have shown their confidence by acquiring shares, signaling a positive outlook. With earnings expected to climb by 15% annually, this reflects not just growth potential but also a strategic alignment by management amidst challenging economic conditions. This blend of insider activity and earnings growth paints NRW as an intriguing prospect for discerning investors looking beyond mainstream options.

- Click here and access our complete valuation analysis report to understand the dynamics of NRW Holdings.

-

Explore historical data to track NRW Holdings' performance over time in our Past section.

Star Entertainment Group (SGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Star Entertainment Group is a company engaged in the operation of integrated resorts, including casinos and hotels, in Sydney, Brisbane, and the Gold Coast, with a market capitalization of approximately A$2 billion.

Operations: Sydney, Brisbane, and Gold Coast are the primary locations contributing to a total revenue of A$1.72 billion. The company has recently recorded a gross profit margin of 49.02%.

PE: -1.2x

Amidst a flurry of executive changes, The Star Entertainment Group's confidence shines through with recent insider acquisitions signaling strong belief in its strategic direction. With earnings expected to surge by nearly 98% annually, this entity stands out in the Australian market. Despite relying solely on external borrowing—a higher risk funding method—there’s no shareholder dilution over the past year, underscoring a stable ownership structure. The appointment of seasoned executives like Jeannie Mok and Anne Ward further positions The Star for robust governance and operational excellence moving forward.

- Delve into the full analysis valuation report here for a deeper understanding of Star Entertainment Group.

-

Gain insights into Star Entertainment Group's past trends and performance with our Past report.

Where To Now?

- Investigate our full lineup of 27 Undervalued ASX Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FPR

FleetPartners Group

Provides fleet management services in Australia and New Zealand.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives