- Australia

- /

- Diversified Financial

- /

- ASX:FND

Subdued Growth No Barrier To Findi Limited (ASX:FND) With Shares Advancing 27%

Findi Limited (ASX:FND) shares have had a really impressive month, gaining 27% after a shaky period beforehand. This latest share price bounce rounds out a remarkable 812% gain over the last twelve months.

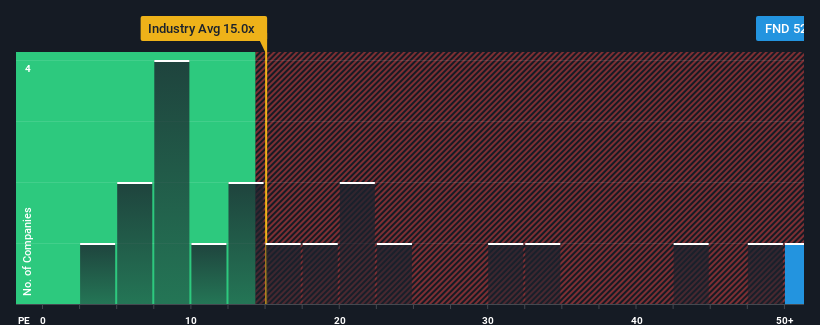

Following the firm bounce in price, given close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may consider Findi as a stock to avoid entirely with its 52.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Findi certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Findi

How Is Findi's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Findi's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 54%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Findi is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Findi's P/E?

Shares in Findi have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Findi currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Findi (of which 1 is significant!) you should know about.

If these risks are making you reconsider your opinion on Findi, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FND

Findi

Through its subsidiaries, engages in the development of digital payment systems in India.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026