- Australia

- /

- Diversified Financial

- /

- ASX:FND

Market Participants Recognise Findi Limited's (ASX:FND) Revenues Pushing Shares 33% Higher

Those holding Findi Limited (ASX:FND) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last month tops off a massive increase of 194% in the last year.

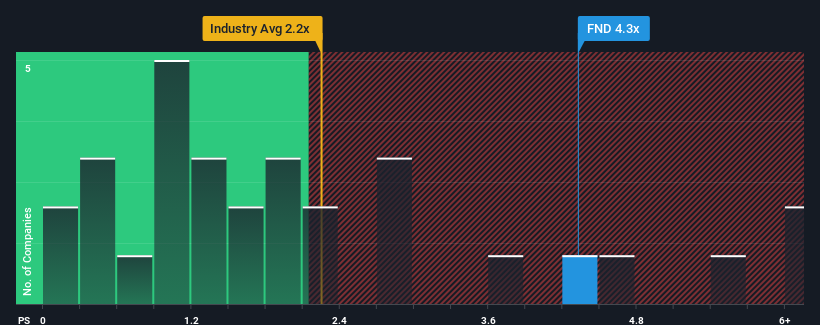

After such a large jump in price, given around half the companies in Australia's Diversified Financial industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider Findi as a stock to avoid entirely with its 4.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Findi

How Findi Has Been Performing

Findi certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Findi's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Findi's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 90% as estimated by the three analysts watching the company. That would be an excellent outcome when the industry is expected to decline by 13%.

With this in consideration, we understand why Findi's P/S is a cut above its industry peers. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Key Takeaway

The strong share price surge has lead to Findi's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we anticipated, our review of Findi's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Findi that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FND

Findi

Through its subsidiaries, engages in the development of digital payment systems in India.

Exceptional growth potential with imperfect balance sheet.

Market Insights

Community Narratives