- Australia

- /

- Capital Markets

- /

- ASX:DJW

Undiscovered Gems In Australia Featuring Djerriwarrh Investments And Two More Small Caps

Reviewed by Simply Wall St

As the Australian market navigates a mixed landscape, with the ASX 200 slightly down at 8,396 points and sectors like Energy showing resilience amid recent government approvals, investors are keenly observing small-cap stocks for potential opportunities. In this environment of fluctuating indices and sector performances, identifying promising investments often involves looking beyond immediate headlines to uncover companies with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Value Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market capitalization of approximately A$799.68 million.

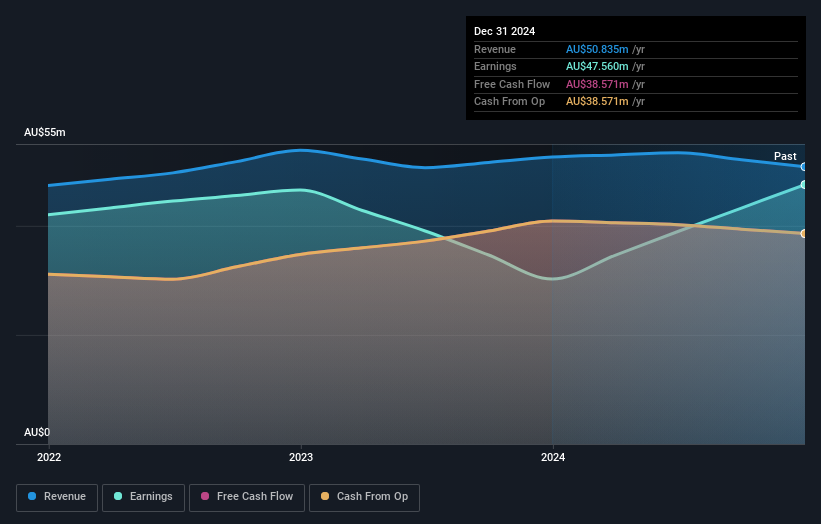

Operations: Djerriwarrh generates revenue primarily from its portfolio of investments, amounting to A$50.84 million.

Djerriwarrh Investments shines with its debt to equity ratio dropping from 9.7% to 1.1% over five years, showcasing solid financial management. The company's earnings surged by 57%, outpacing the Capital Markets industry growth of 24%. With a price-to-earnings ratio of 16.8x, it offers better value than the Australian market average of 17.9x. Its interest payments are comfortably covered by EBIT at a rate of 21 times, indicating robust operational health. Recent updates in shareholder calls highlighted investment activities and market conditions, reinforcing DJW's proactive engagement with its investors and strategic positioning in the market landscape.

- Get an in-depth perspective on Djerriwarrh Investments' performance by reading our health report here.

Explore historical data to track Djerriwarrh Investments' performance over time in our Past section.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments, operating under HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$833.14 million.

Operations: HFA Holdings Limited generates revenue primarily from its Lighthouse segment, contributing A$137.95 million. The company's market capitalization stands at A$833.14 million.

Navigator Global Investments, a nimble player in the Australian fund management scene, has caught attention with its recent 306.8% earnings growth over the past year. This surge was partly fueled by a one-off gain of A$53.8 million, impacting its financial results significantly as of December 2024. The company trades at an enticing 51.1% below estimated fair value, suggesting potential upside for investors who see beyond temporary gains and focus on long-term prospects. However, with earnings expected to decline by an average of 11.8% annually over the next three years and reliance on variable performance fees posing risks, cautious optimism is advised when considering this stock's future trajectory.

West African Resources (ASX:WAF)

Simply Wall St Value Rating: ★★★★★★

Overview: West African Resources Limited is involved in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa and has a market capitalization of A$3.04 billion.

Operations: West African Resources derives its revenue primarily from mining operations, contributing A$726.63 million. The company's financial performance is highlighted by a net profit margin of 24%.

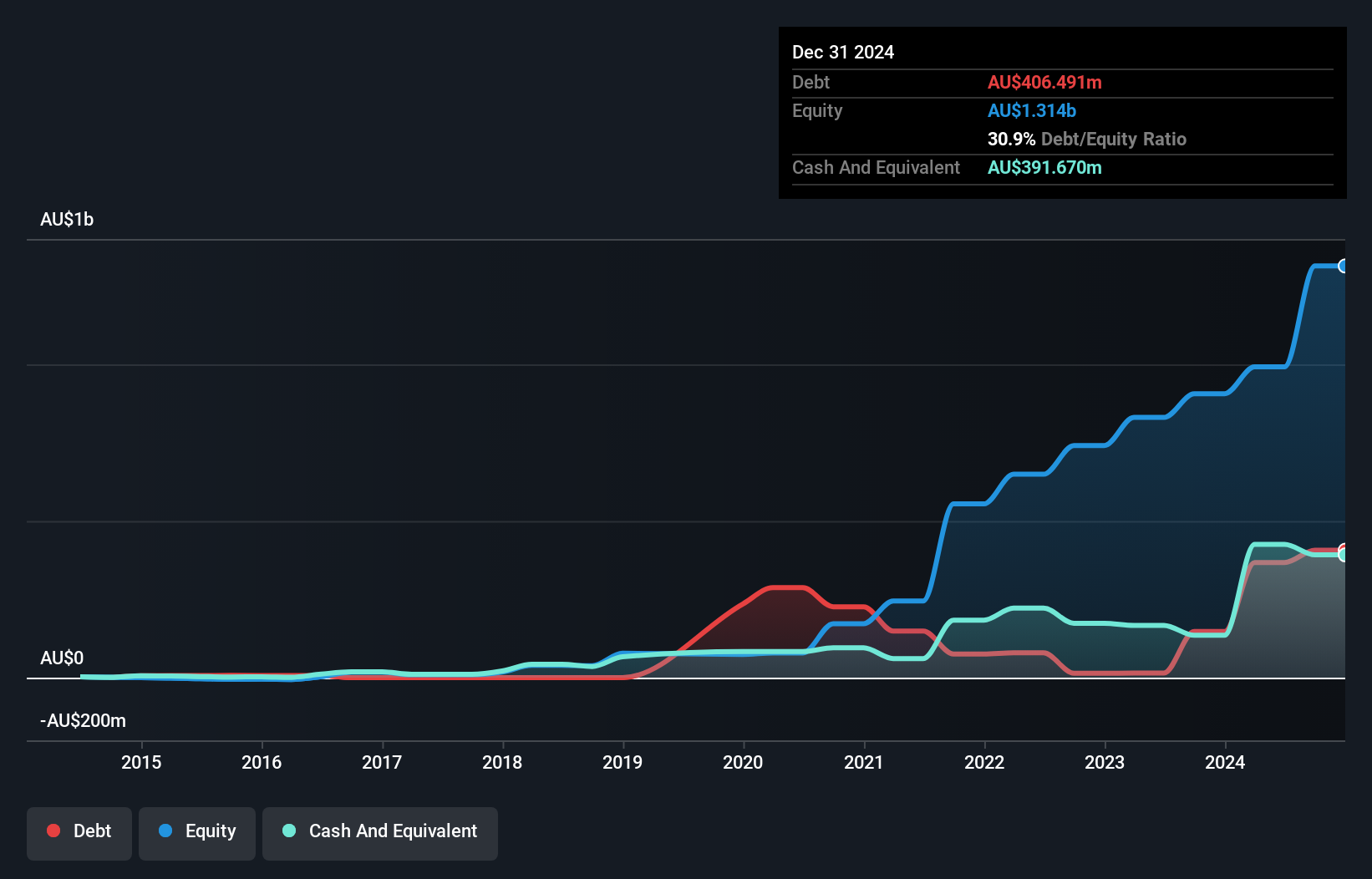

West African Resources is gearing up for a transformative phase with its Kiaka project, slated to boost gold production to 420,000 ounces annually by Q3 2025. The firm's net debt to equity ratio stands at a satisfactory 1.1%, reflecting financial prudence as it reduced from 316.7% over five years. Recent quarterly results showed gold production of 50,033 ounces and sales of 48,338 ounces at an average price of US$2,832 per ounce. Despite facing regulatory risks in Burkina Faso and potential infrastructure delays, analysts predict annual revenue growth of 41.5% over three years with profit margins improving to an estimated 33.2%.

Seize The Opportunity

- Click through to start exploring the rest of the 44 ASX Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DJW

Flawless balance sheet with solid track record.