- Australia

- /

- Diversified Financial

- /

- ASX:CCL

Undiscovered Gems in Australia To Explore This July 2025

Reviewed by Simply Wall St

As the Australian market navigates a complex landscape marked by cautious sentiment following the Reserve Bank's rate decisions and looming international trade uncertainties, investors are keeping a close eye on sectors like Health Care, which have shown resilience amid fluctuating conditions. In this dynamic environment, identifying promising small-cap stocks requires a focus on robust fundamentals and strategic positioning to weather economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Cuscal (ASX:CCL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cuscal Limited, with a market cap of A$599.59 million, offers payment and regulated data products and services to financial and consumer-focused institutions in Australia.

Operations: Cuscal Limited generates revenue primarily from providing payment and regulated data services to financial institutions in Australia. The company's business model focuses on leveraging its expertise in the payments sector to support various consumer-centric institutions.

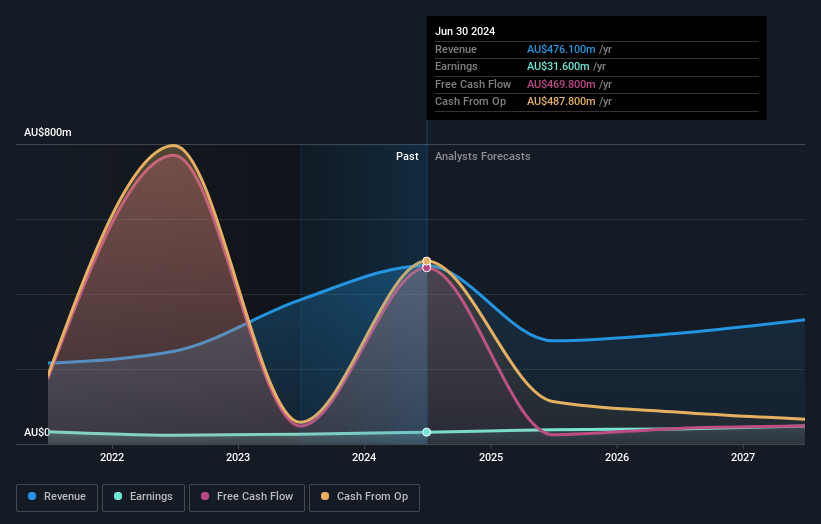

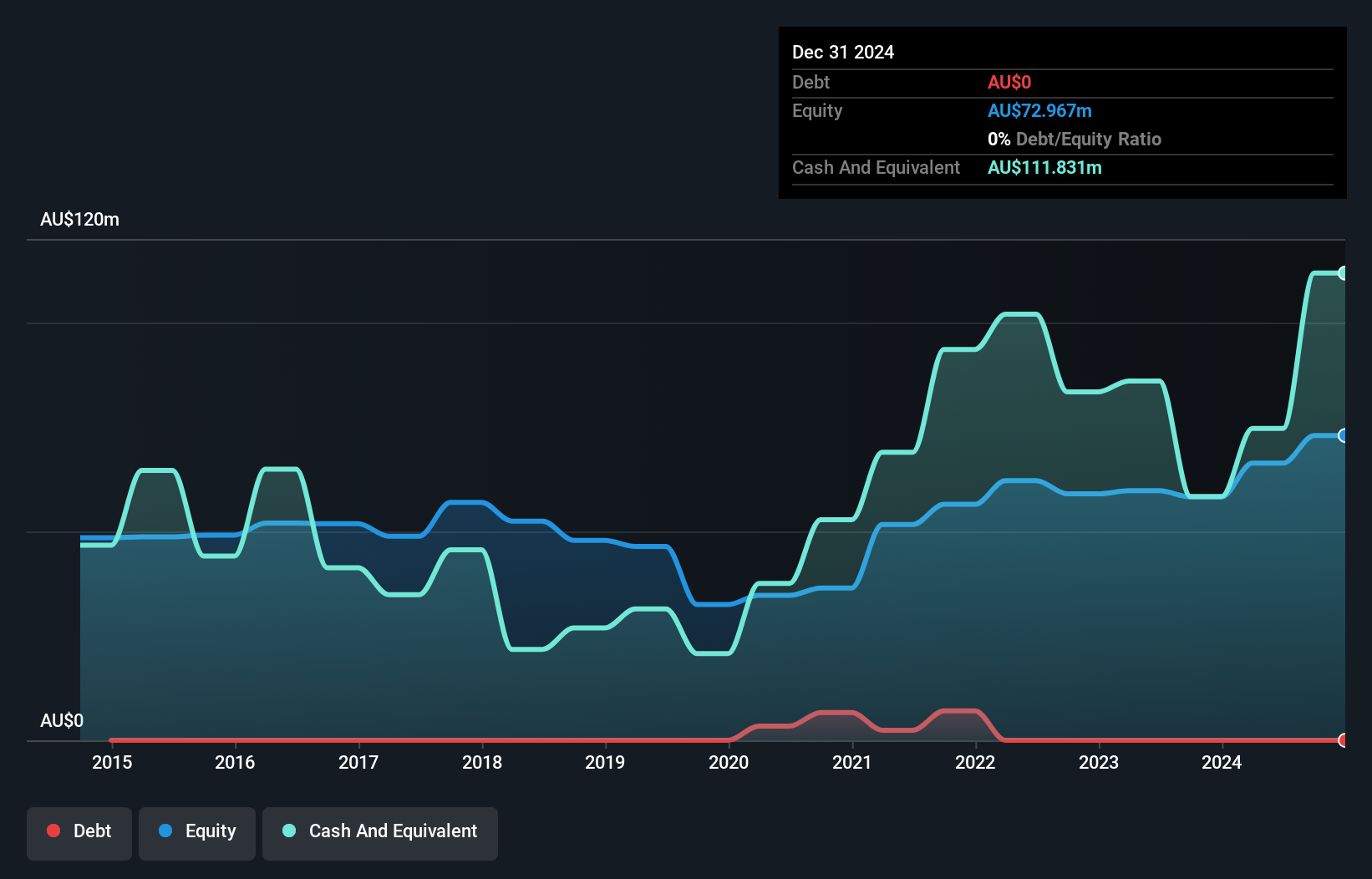

Cuscal, a financial player in Australia, shows potential with a Price-To-Earnings ratio of 19.9x, undercutting the industry average of 23.3x. Over the past year, earnings grew by 4.3%, outpacing the sector's -6.8%. The company's debt-to-equity ratio has impressively decreased from 154% to 41% over five years, indicating improved financial health. Despite having more cash than total debt and being free cash flow positive, Cuscal's interest coverage is only at 1.3x EBIT—an area needing attention for long-term stability as it was recently added to the S&P Global BMI Index on June 22nd, enhancing its visibility in global markets.

- Click here to discover the nuances of Cuscal with our detailed analytical health report.

Understand Cuscal's track record by examining our Past report.

Energy One (ASX:EOL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Energy One Limited offers software solutions, outsourced operations, and advisory services for wholesale energy and environmental markets across Australasia and Europe, with a market cap of A$407.29 million.

Operations: Energy One Limited generates revenue primarily from the energy software industry, amounting to A$55.81 million.

Energy One, a nimble player in the software space, has seen its debt to equity ratio improve significantly from 58.6% to 27.1% over five years, reflecting prudent financial management. Its interest payments are comfortably covered by EBIT at 4.5 times, indicating solid operational efficiency. Earnings have surged by an impressive 273%, outpacing the industry average of 5.6%. The company’s focus on cybersecurity and European expansion could bolster future growth prospects despite potential margin pressures from rising costs and competition. With a net debt to equity ratio of just 22.7%, Energy One's financial footing appears satisfactory for ongoing strategic endeavors.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services primarily to the mining and mineral processing industries both in Australia and internationally, with a market cap of A$611.04 million.

Operations: GR Engineering Services derives its revenue primarily from two segments: Mineral Processing, which contributed A$412.30 million, and Oil and Gas, generating A$96.61 million.

GR Engineering Services, a small player in the engineering sector, is trading at 94.8% below its estimated fair value, making it an intriguing option for investors seeking undervalued opportunities. The company boasts high-quality earnings and has demonstrated impressive growth, with earnings surging by 34.3% over the past year. Notably, GR Engineering remains debt-free over the past five years and continues to generate positive free cash flow. This financial stability positions it well against industry peers in Metals and Mining where its growth rate outpaces the sector's average of 14.3%.

- Click to explore a detailed breakdown of our findings in GR Engineering Services' health report.

Evaluate GR Engineering Services' historical performance by accessing our past performance report.

Make It Happen

- Delve into our full catalog of 50 ASX Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCL

Cuscal

Provides payment and regulated data related products and services for financial and consumer centric institutions in Australia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives