- Australia

- /

- Personal Products

- /

- ASX:BIO

Promising ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Australian market is experiencing volatility as hesitation from the Federal Reserve about U.S. interest rates impacts ASX futures, with a notable decline anticipated. Despite these challenges, investors can still find opportunities by exploring smaller or newer companies that are often categorized as penny stocks. Though the term may seem outdated, these stocks can offer potential value and growth, especially when backed by strong financial health and strategic positioning in their respective industries.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$319.37M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.91 | A$310.98M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.87 | A$237.96M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.565 | A$766.97M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$99.83M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.42M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.94 | A$135.71M | ★★★★★★ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Biome Australia (ASX:BIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biome Australia Limited focuses on the development, commercialization, and marketing of live biotherapeutics and complementary medicines both in Australia and internationally, with a market cap of A$118.33 million.

Operations: The company's revenue is primarily generated from its innovative evidence-based products linking the gut and human health, amounting to A$13.01 million.

Market Cap: A$118.33M

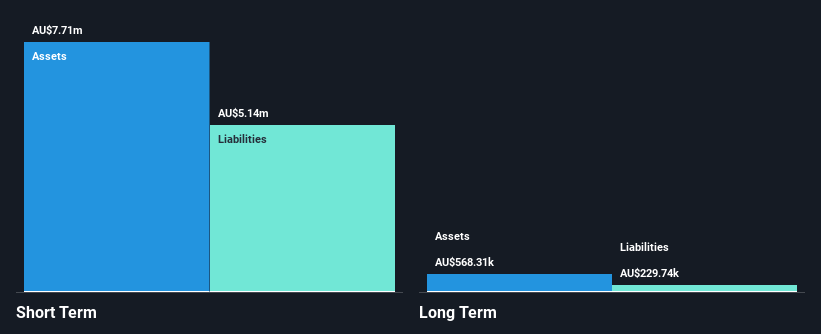

Biome Australia Limited, with a market cap of A$118.33 million, is navigating the penny stock landscape by focusing on innovative biotherapeutics and complementary medicines. Despite being unprofitable, it has shown promising revenue growth, reporting A$13.01 million in sales and forecasting over $4.5 million for Q2 FY2025. The company's cash reserves exceed its debt levels, providing financial stability for more than three years based on current free cash flow trends. Recent strategic board appointments aim to leverage industry expertise to drive further growth and optimize manufacturing processes as Biome expands its presence both locally and internationally.

- Get an in-depth perspective on Biome Australia's performance by reading our balance sheet health report here.

- Understand Biome Australia's earnings outlook by examining our growth report.

Centrepoint Alliance (ASX:CAF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centrepoint Alliance Limited, along with its subsidiaries, offers financial services in Australia and has a market capitalization of A$63.64 million.

Operations: The company's revenue is primarily derived from its Licensee and Advice Services segment, contributing A$285.39 million, followed by Consulting Services at A$1.25 million, and Funds Management and Administration at A$1.99 million.

Market Cap: A$63.64M

Centrepoint Alliance Limited, with a market cap of A$63.64 million, is strategically positioned in the financial services sector. The company has demonstrated solid earnings growth of 22.5% over the past year, surpassing industry averages. Its financial health is underscored by having more cash than total debt and strong interest coverage with EBIT at 20.9 times interest payments. Centrepoint's short-term assets comfortably cover both short and long-term liabilities, highlighting robust liquidity management. However, its dividend history remains unstable and the board lacks extensive experience with an average tenure of just one year, which may impact strategic decision-making stability amidst ongoing acquisition pursuits.

- Click to explore a detailed breakdown of our findings in Centrepoint Alliance's financial health report.

- Gain insights into Centrepoint Alliance's historical outcomes by reviewing our past performance report.

Teaminvest Private Group (ASX:TIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teaminvest Private Group Limited is a private equity firm that focuses on buyout and growth capital transactions for middle market and mature companies, with a market cap of A$56.10 million.

Operations: The company's revenue is primarily derived from its Wealth segment, generating A$3.04 million, and its Education & Corporate segment, contributing A$4.23 million, with a significant portion of A$98.82 million coming from Equity activities excluding education and corporate operations.

Market Cap: A$56.1M

Teaminvest Private Group Limited, with a market cap of A$56.10 million, is focused on buyout and growth capital transactions. Despite being unprofitable, the company maintains strong financial health with short-term assets exceeding both short and long-term liabilities. Its debt is well covered by operating cash flow at a very large ratio, indicating efficient debt management. The board and management team are experienced, which can provide stability in strategic decisions. However, earnings have declined over the past five years by 16.3% annually, reflecting challenges in achieving profitability amidst its significant equity-driven revenue model.

- Dive into the specifics of Teaminvest Private Group here with our thorough balance sheet health report.

- Understand Teaminvest Private Group's track record by examining our performance history report.

Seize The Opportunity

- Reveal the 1,047 hidden gems among our ASX Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biome Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BIO

Biome Australia

Engages in the development, commercialization, and marketing of various live biotherapeutics and complimentary medicines in Australia and internationally.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives