- Australia

- /

- Capital Markets

- /

- ASX:DJW

Undiscovered Gems in Australia to Watch This February 2025

Reviewed by Simply Wall St

As the Australian market faces a challenging period with the ASX200 down 1.33% and ongoing selloffs in major banks, investors are keenly observing sectors like Telecommunications and Energy, which have shown resilience amid broader economic uncertainties. In this environment, identifying promising small-cap stocks requires looking beyond immediate market fluctuations to find companies with strong fundamentals and growth potential that align well with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Bell Financial Group (ASX:BFG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bell Financial Group Limited provides full-service and online broking, corporate finance, and financial advisory services to a diverse clientele across Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur with a market cap of A$439.42 million.

Operations: The company's primary revenue streams include broking (A$173.47 million), products and services (A$51.01 million), and technology and platforms (A$29.89 million).

Bell Financial Group, a notable player in Australia's financial scene, has shown impressive growth with earnings rising 26.4% last year, outpacing the Capital Markets industry's 17.2%. The company reported A$276 million in revenue for 2024, up from A$247 million the previous year, and net income climbed to A$30.74 million from A$24.32 million. Trading at a good value compared to peers and industry standards, BFG's debt-to-equity ratio improved significantly over five years from 83.9% to just 17.7%, suggesting prudent financial management despite not being free cash flow positive recently.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Value Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market cap of A$809.61 million.

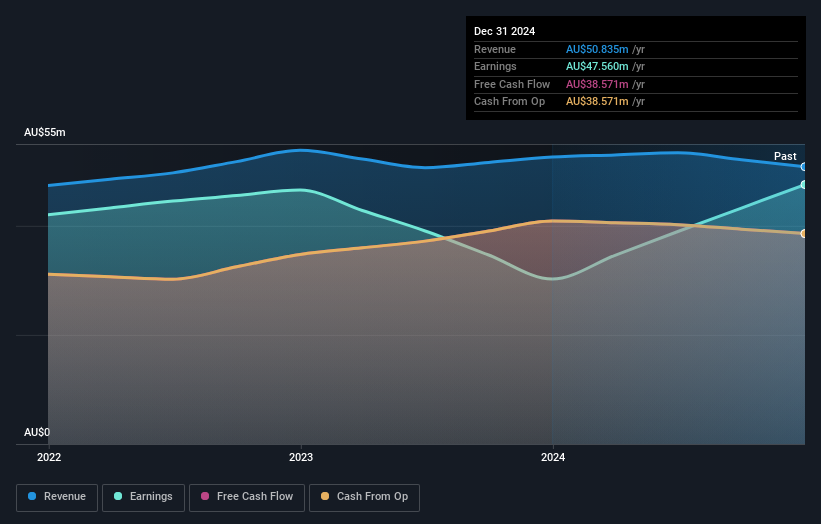

Operations: Djerriwarrh Investments generates revenue primarily from its portfolio of investments, amounting to A$50.84 million.

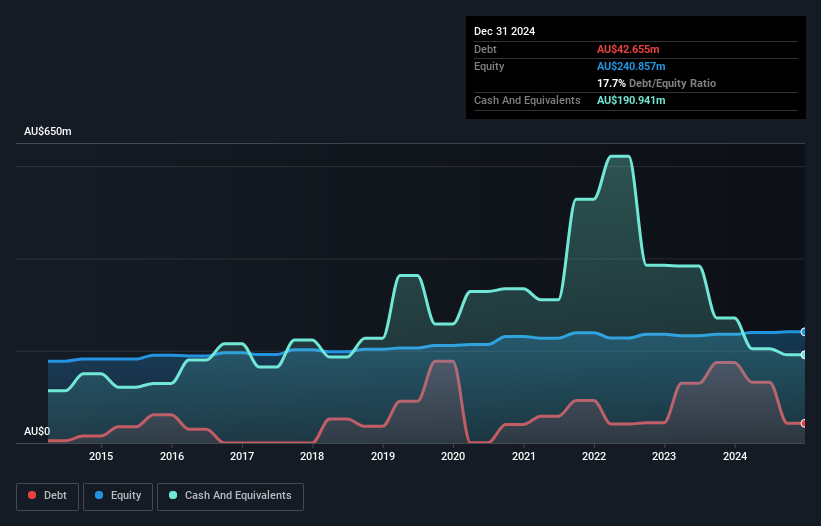

Djerriwarrh Investments, a smaller player in the Australian market, has shown impressive financial health. Over the past five years, its debt to equity ratio dropped significantly from 9.7% to 1.1%, indicating effective debt management. The company boasts high-quality earnings with a robust EBIT covering interest payments 21 times over, reflecting strong operational efficiency. Despite revenue slipping to A$26.34 million from A$28.89 million last year, net income surged to A$21.44 million from A$12.84 million due to improved cost management or other factors likely enhancing profitability margins significantly over time and maintaining a lower price-to-earnings ratio at 17x compared to the market's 19x offers potential value for investors seeking growth opportunities in capital markets outperforming industry averages by growing earnings at an impressive rate of about fifty-seven percent annually while ensuring sustained cash flow positivity without concerns regarding cash runway issues given profitability status remains intact amidst challenging economic conditions globally impacting broader sectors worldwide today still seeing dividends maintained steady levels previously declared periods alike continuing attractively yielding returns shareholders benefiting ongoing commitment rewarding investments made long-term strategic vision focused sustainable outcomes future success endeavors ahead promising prospects remain bright horizon foreseeable future indeed encouraging confidence stakeholders involved directly indirectly associated business operations daily basis moving forward collectively together towards achieving common goals objectives set forth originally inception date established initially founded many years ago now standing testament resilience adaptability ever-changing environments encountered along journey thus far experienced firsthand every step way learning valuable lessons applied contextually relevant situations arise necessitating adjustments course necessary ensure continued progress advancement desired results ultimately attained end day satisfaction guaranteed all parties concerned satisfied expectations met exceeded beyond wildest dreams imaginable possible reality realized fruition materialized eventually come pass sooner later eventually inevitably happens naturally occurs spontaneously organically as nature intended happen unfold naturally occurring events transpire occur sequentially order predetermined destiny fate aligned stars universe cosmos celestial bodies align perfectly orchestrated symphony harmony balance equilibrium achieved universally accepted truths known mankind throughout ages timeless wisdom passed down generations ancestors predecessors forefathers foremothers alike sharing knowledge gained accumulated collective experience shared humanity whole entirety existence planet earth home living beings inhabit coexist peacefully harmoniously coexistence mutual respect understanding cooperation collaboration unity diversity inclusion acceptance tolerance compassion empathy kindness love peace joy happiness prosperity abundance wealth health wellness wellbeing overall general sense fulfillment contentment satisfaction life lived fullest extent capabilities potentialities inherent within us all waiting unlocked unleashed tapped into accessed utilized maximized optimized leveraged advantage benefit greater good society community world large global scale planetary level cosmic proportions universal scope infinite possibilities endless opportunities await those willing take leap faith trust process believe themselves others around them support network system infrastructure framework foundation built upon solid ground stable footing secure base launch pad springboard catalyst change transformation evolution revolution innovation creativity imagination ingenuity resourcefulness problem-solving skills critical thinking analytical reasoning logical deduction inference interpretation comprehension insight perception awareness mindfulness consciousness self-awareness introspection reflection contemplation meditation prayer spirituality transcendence enlightenment awakening realization actualization manifestation dreams aspirations ambitions desires intentions purposes missions visions goals objectives targets aims milestones benchmarks standards criteria measures metrics indicators performance evaluation assessment appraisal review feedback constructive criticism praise recognition acknowledgment appreciation gratitude thanks giving receiving reciprocating exchanging sharing caring nurturing fostering cultivating growing developing expanding evolving progressing advancing improving enhancing enriching empowering enabling inspiring motivating encouraging uplifting elevating raising elevating lifting boosting propelling accelerating momentum driving force energy power strength courage bravery determination perseverance persistence tenacity resilience fortitude grit resolve willpower discipline dedication commitment devotion loyalty allegiance fidelity faithfulness trustworthiness reliability dependability consistency stability security safety protection defense preservation conservation safeguarding guarding shielding sheltering harboring refuge sanctuary haven oasis retreat escape getaway vacation holiday rest relaxation rejuvenation restoration recovery healing renewal rebirth regeneration revitalization reinvigoration reenergization recharge refuel refresh revitalize reinvigorate renew restore heal recover recuperate convalesce mend repair fix patch up make amends reconcile resolve settle agree negotiate compromise mediate arbitrate adjudicate litigate sue prosecute defend advocate champion support endorse back sponsor promote advertise market sell distribute supply provide deliver furnish equip outfit stock inventory store warehouse house accommodate lodge board quarter billet camp bivouac encamp reside dwell inhabit occupy live stay remain abide linger loiter tarry dawdle dally delay procrastinate postpone defer suspend adjourn recess intermission break pause halt stop cease desist terminate end conclude finish complete wrap up finalize close shut seal lock fasten secure tie bind knot tether hitch attach connect link join unite combine merge blend mix amalgamate integrate incorporate assimilate absorb encompass include contain comprise consist constitute form compose make up build construct create design develop produce manufacture fabricate assemble put together piece together fit together slot into place position situate locate site station deploy arrange organize plan prepare schedule timetable program plot chart map outline draft sketch draw illustrate depict portray represent symbolize signify denote indicate express convey communicate transmit relay broadcast telecast air stream beam project cast shine illuminate light brighten lighten glow gleam glimmer shimmer sparkle twinkle flicker flash flare blaze burst explode erupt ignite combust burn smolder smoke steam vaporize evaporate condense precipitate drizzle sprinkle shower rain pour flood deluge inundate swamp submerge immerse soak saturate drench wet damp moisten hydrate quench

- Navigate through the intricacies of Djerriwarrh Investments with our comprehensive health report here.

Explore historical data to track Djerriwarrh Investments' performance over time in our Past section.

K&S (ASX:KSC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: K&S Corporation Limited operates in the transportation and logistics, warehousing, and fuel distribution sectors across Australia and New Zealand, with a market capitalization of approximately A$481.71 million.

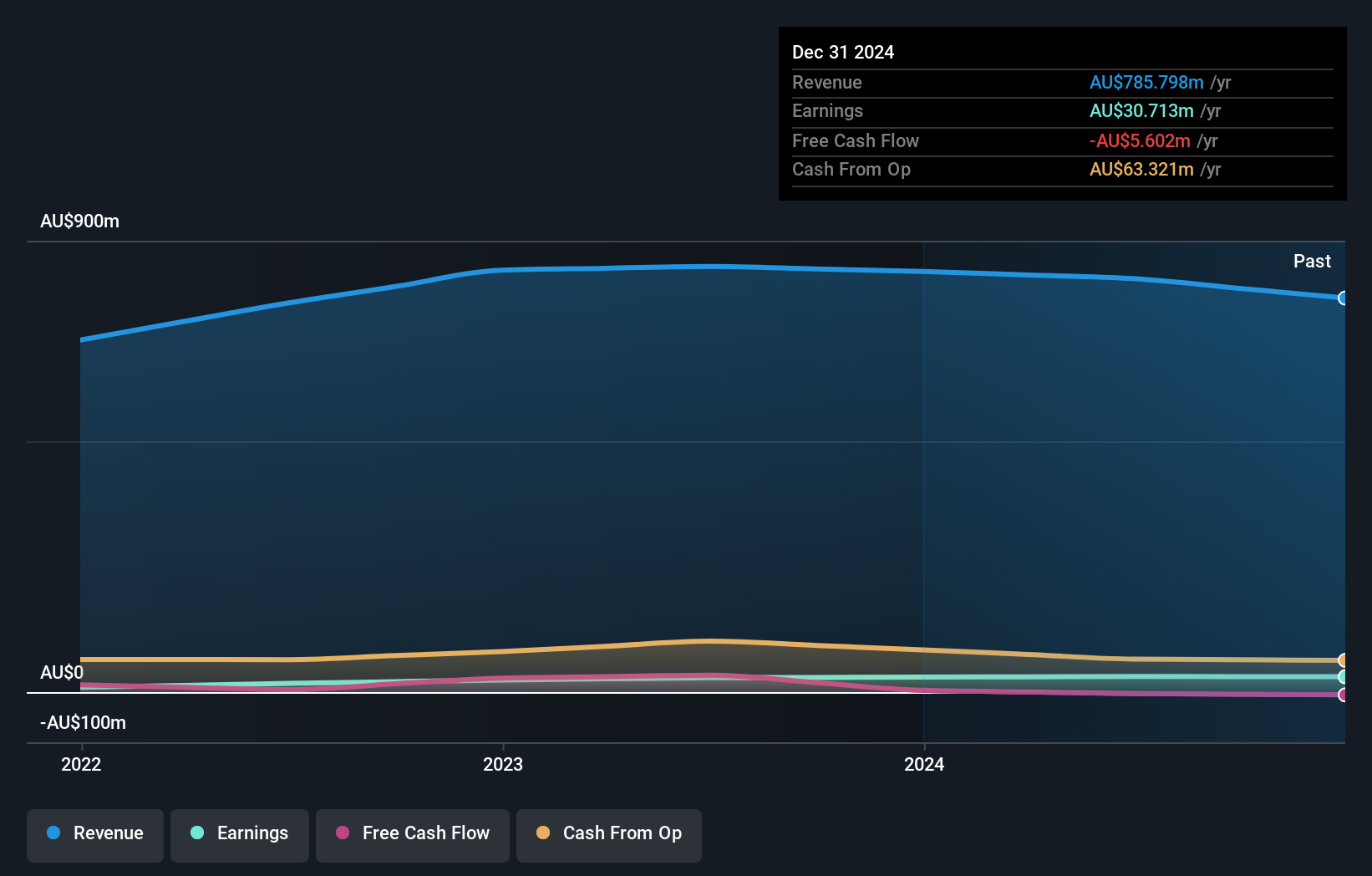

Operations: K&S generates revenue primarily from its Australian Transport and Fuel segments, contributing A$582.80 million and A$230.79 million respectively. The New Zealand Transport segment adds A$72.93 million to the revenue stream, highlighting its diversified geographical presence in the region.

K&S offers a compelling snapshot with its earnings growth of 9.1% over the past year, outpacing the logistics industry's -7%. Trading at 11.5% below estimated fair value, it seems undervalued in its sector. The company's debt to equity ratio rose from 12.5% to 16.1% in five years, yet interest payments are comfortably covered by EBIT at 10.2x coverage, indicating solid financial health despite not being free cash flow positive. With high-quality earnings and a satisfactory net debt to equity ratio of 6.7%, K&S presents an intriguing opportunity for investors seeking value in the logistics space without immediate liquidity concerns.

Turning Ideas Into Actions

- Explore the 48 names from our ASX Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DJW

Flawless balance sheet with solid track record.

Market Insights

Community Narratives