- Australia

- /

- Entertainment

- /

- ASX:EVT

Exploring ASX Stocks Estimated To Be Undervalued In July 2024

Reviewed by Simply Wall St

The Australian market has recently experienced a downturn, with the ASX200 index closing down by 1.3% across all sectors, signaling widespread investor caution. Amidst this broader market retreat, certain stocks have demonstrated resilience or noteworthy performance, such as Tissue Repair and Newmont Corporation showing gains in challenging conditions. In such a market environment, identifying undervalued stocks can be particularly compelling as they may represent opportunities for investors to acquire assets at prices that do not fully reflect their underlying value or potential for recovery.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Fenix Resources (ASX:FEX) | A$0.39 | A$0.77 | 49.5% |

| Ansell (ASX:ANN) | A$26.77 | A$51.19 | 47.7% |

| Count (ASX:CUP) | A$0.61 | A$1.18 | 48.3% |

| ReadyTech Holdings (ASX:RDY) | A$3.21 | A$6.21 | 48.3% |

| IPH (ASX:IPH) | A$5.91 | A$11.80 | 49.9% |

| VEEM (ASX:VEE) | A$1.80 | A$3.55 | 49.3% |

| hipages Group Holdings (ASX:HPG) | A$1.055 | A$2.06 | 48.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| EVT (ASX:EVT) | A$10.85 | A$21.02 | 48.4% |

| MedAdvisor (ASX:MDR) | A$0.54 | A$1.07 | 49.5% |

Let's uncover some gems from our specialized screener.

Bell Financial Group (ASX:BFG)

Overview: Bell Financial Group Limited, operating in Australia, offers a range of services including broking, online broking, corporate finance, and financial advisory to various clients with a market capitalization of approximately A$466.68 million.

Operations: The company generates revenue from four primary segments: retail broking (A$103.58 million), institutional broking (A$50.36 million), financial products and services (A$48.10 million), and technology and platform services (A$26.20 million).

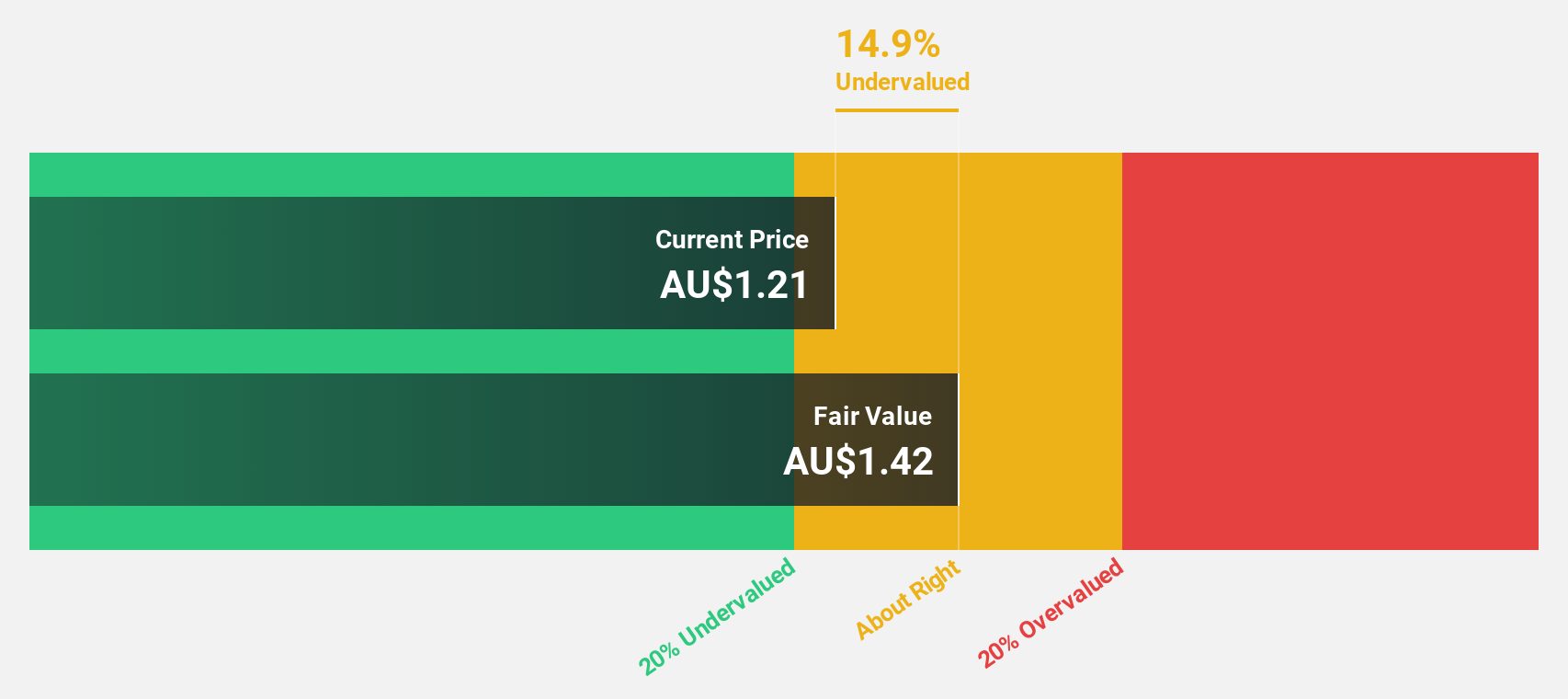

Estimated Discount To Fair Value: 19.3%

Bell Financial Group is currently undervalued based on discounted cash flow, priced at A$1.44 against a fair value of A$1.78. Despite this, its dividend coverage by earnings and free cash flows is weak. However, BFG's earnings are expected to grow significantly at 26.95% annually over the next three years, outpacing the Australian market's forecast of 13.3%. Revenue growth projections also exceed market averages, indicating potential for increased financial health and stock revaluation.

- Our expertly prepared growth report on Bell Financial Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Bell Financial Group stock in this financial health report.

Credit Corp Group (ASX:CCP)

Overview: Credit Corp Group Limited, operating in Australia and the United States, specializes in debt ledger purchase and collection as well as consumer lending services, with a market capitalization of approximately A$1.05 billion.

Operations: Credit Corp Group's revenue is derived from debt ledger purchasing in the United States and Australia/New Zealand, totaling A$40.32 million and A$235.28 million respectively, alongside consumer lending across Australia, New Zealand, and the United States, which contributes A$164.48 million.

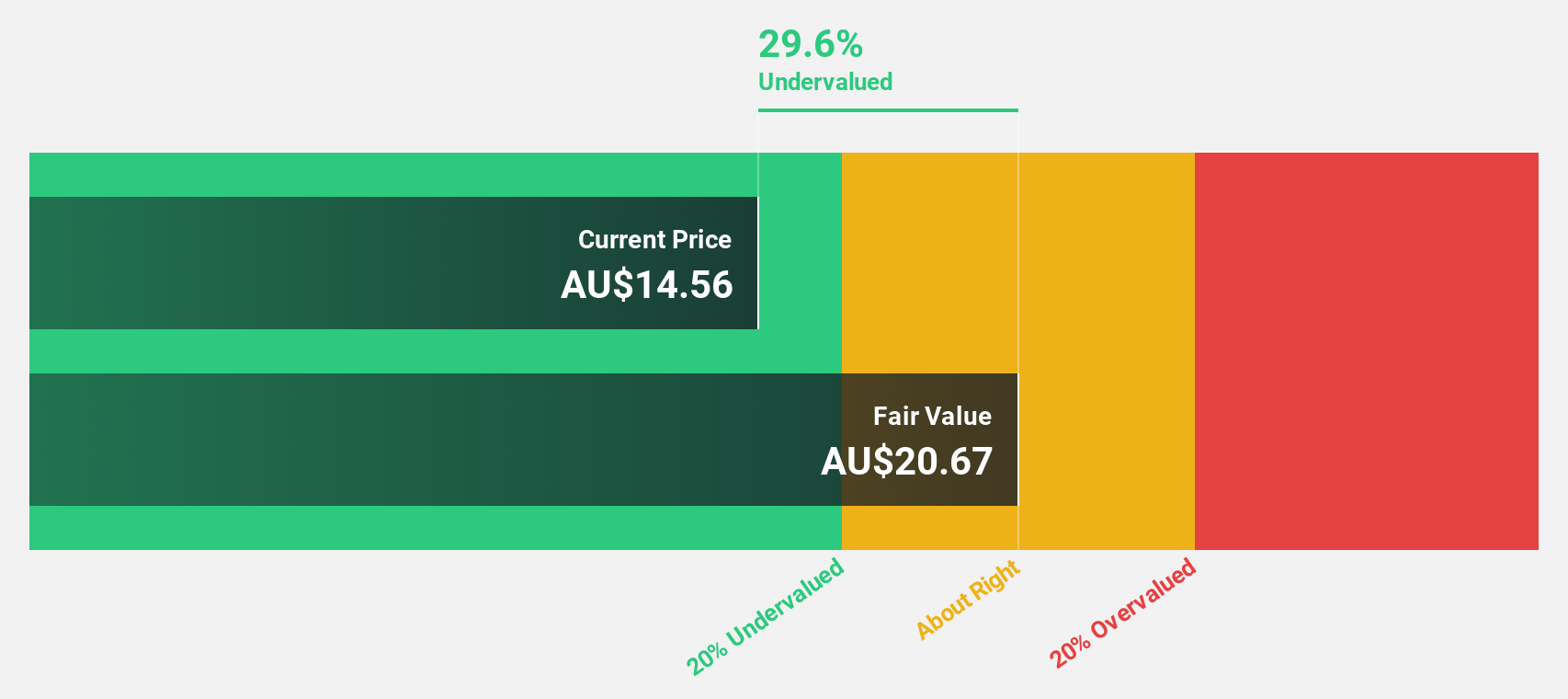

Estimated Discount To Fair Value: 42.5%

Credit Corp Group, priced at A$14.61, appears undervalued with a fair value estimate of A$25.39 based on discounted cash flow analysis, indicating a significant undervaluation. While the company's debt is poorly covered by operating cash flow and its dividend sustainability is questionable due to inadequate free cash flow coverage, CCP's earnings are expected to grow by 24.9% annually over the next three years, surpassing the Australian market forecast of 13.3%. However, its profit margins have declined from last year's figures.

- According our earnings growth report, there's an indication that Credit Corp Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Credit Corp Group.

EVT (ASX:EVT)

Overview: EVT Limited is an entertainment, hospitality, and leisure company operating in Australia, New Zealand, and Germany with a market capitalization of A$1.74 billion.

Operations: The company generates revenue through several segments, including Hotels and Resorts at A$377.63 million, Thredbo Alpine Resort at A$88.36 million, Entertainment in Germany at A$272.54 million, and Entertainment in Australia and New Zealand at A$474.26 million, alongside a smaller contribution from Property at A$10.62 million.

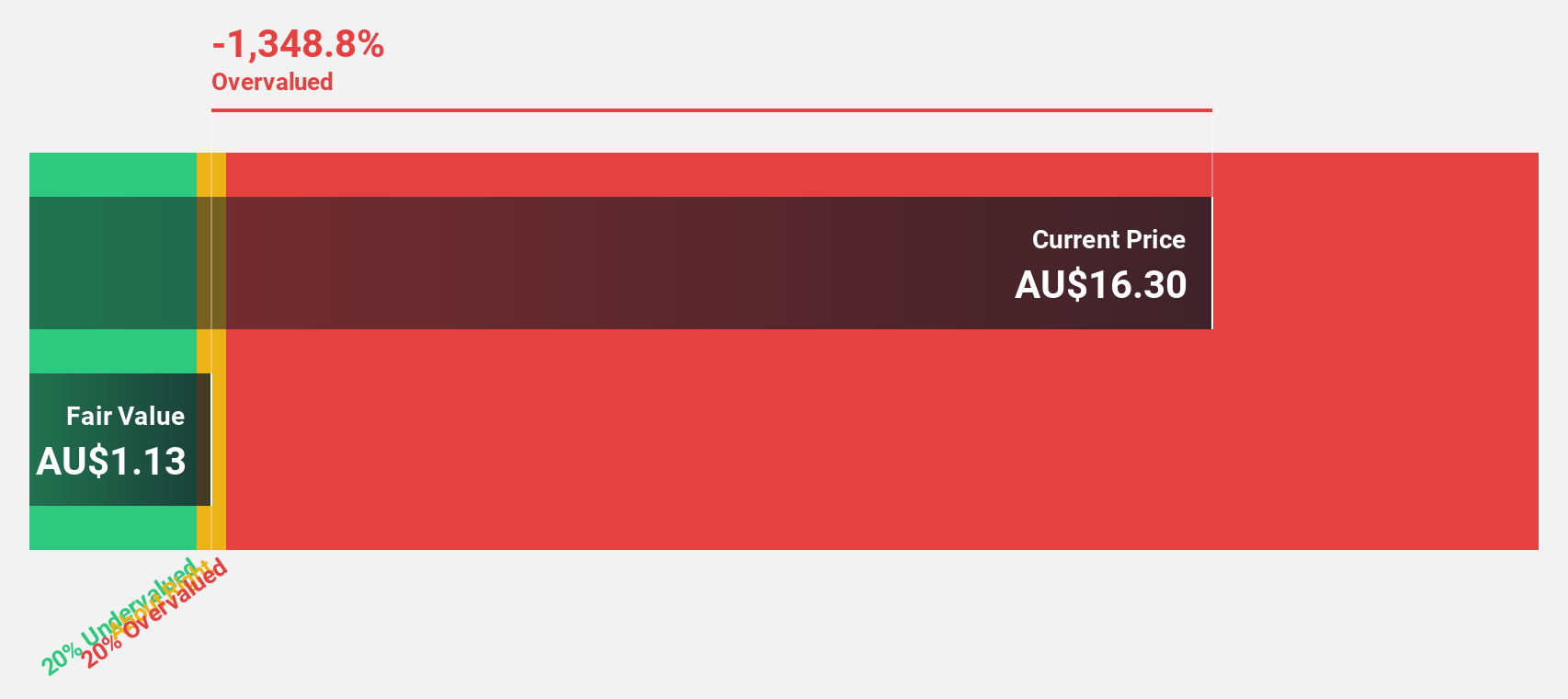

Estimated Discount To Fair Value: 48.4%

EVT, priced at A$10.85, is significantly undervalued with a fair value estimate of A$21.02, reflecting a 48.4% undervaluation based on discounted cash flow analysis. Expected to outpace the Australian market with an annual earnings growth rate of 30% over the next three years, EVT's revenue growth also exceeds market forecasts at 5.5%. However, its current profit margins have decreased to 3%, and its dividend coverage by earnings remains weak at a rate of 3.13%.

- The analysis detailed in our EVT growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of EVT.

Summing It All Up

- Embark on your investment journey to our 43 Undervalued ASX Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EVT

EVT

Engages in the entertainment business in Australia, New Zealand, Singapore, and Germany.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives