- Australia

- /

- Capital Markets

- /

- ASX:ASX

Is APRA’s Home Loan Cap and Regulatory Scrutiny Reshaping the Investment Case for ASX (ASX:ASX)?

Reviewed by Sasha Jovanovic

- A recent rally on Wall Street lifted Australian stocks, while APRA revealed it will introduce a 20 percent cap on high debt-to-income home loans starting February next year to pre-emptively manage housing system risks.

- Meanwhile, Bendigo & Adelaide Bank identified shortcomings in its anti-money laundering controls, drawing regulatory scrutiny and contributing to weaker sentiment in the ASX Financial Sector.

- We'll explore how APRA's new home loan restrictions and heightened regulatory environment may reshape ASX's investment outlook going forward.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

ASX Investment Narrative Recap

To be a shareholder in ASX Limited, you need to believe in the company's long-term ability to drive recurring revenue growth through innovation in market infrastructure and data products, while maintaining its core role in the Australian financial system. The recent APRA home loan cap and regulatory scrutiny on financial institutions have not had a material direct impact on ASX’s current primary revenue catalysts, but the broader focus on compliance and governance heightens attention on regulatory risks for the exchange itself. Among recent company announcements, the June 2025 news that ASIC would commence a compliance assessment into ASX’s market licensee operations stands out. This directly ties into the most important risk for the business: higher regulatory scrutiny, which may require additional investment in risk management and could tighten revenue flexibility, especially if oversight intensifies in response to sector-wide events like Bendigo & Adelaide Bank’s recent compliance issues. However, actual costs and impacts from these assessments and potential new requirements remain an open question for investors who should be aware of the possibility that...

Read the full narrative on ASX (it's free!)

ASX is expected to deliver A$1.3 billion in revenue and A$547.2 million in earnings by 2028. This projection assumes an annual revenue growth rate of 4.9% and an increase in earnings of A$44.6 million from the current A$502.6 million.

Uncover how ASX's forecasts yield a A$65.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

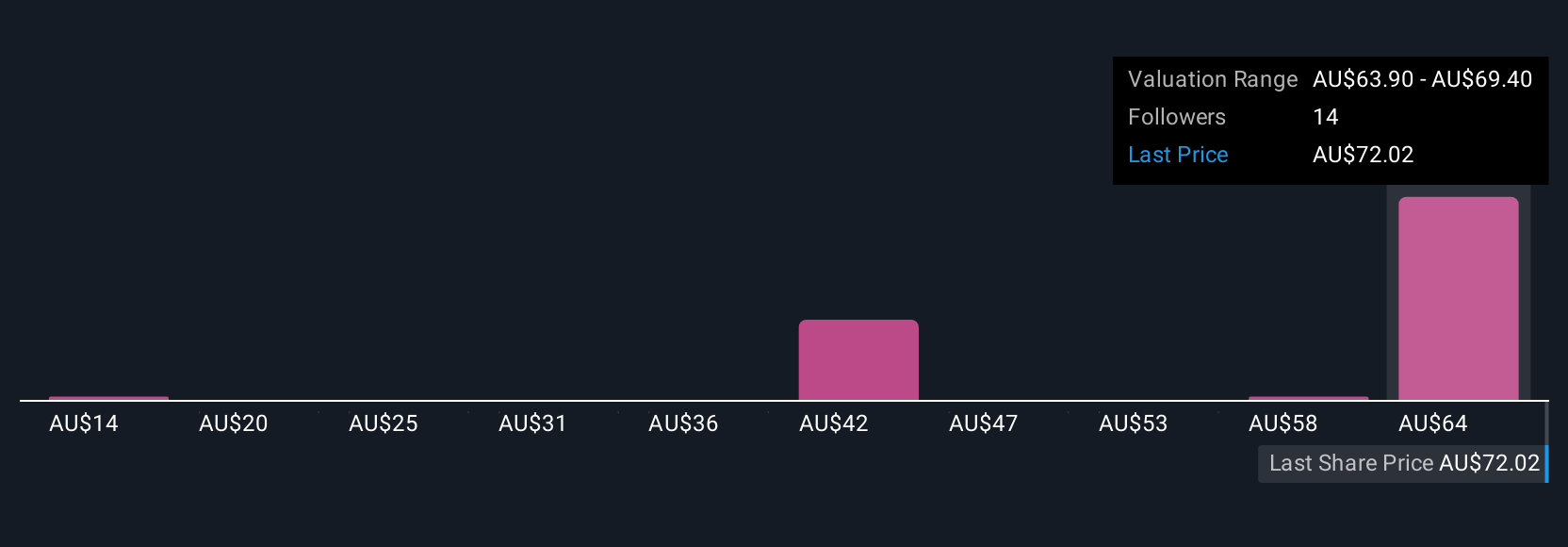

Fair value estimates from 5 Simply Wall St Community members for ASX Limited span from as low as A$14.48 to as high as A$1,398.50. With regulatory scrutiny rising following ASIC’s compliance review, consider how these widely different outlooks reflect diverse confidence in the company’s ability to balance compliance costs with growth potential.

Explore 5 other fair value estimates on ASX - why the stock might be a potential multi-bagger!

Build Your Own ASX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASX research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free ASX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASX's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASX

ASX

Operates as a multi-asset class and integrated exchange company in Australia and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success