- Australia

- /

- Capital Markets

- /

- ASX:ASW

Is Advanced Share Registry Limited (ASX:ASW) A Smart Pick For Income Investors?

Could Advanced Share Registry Limited (ASX:ASW) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

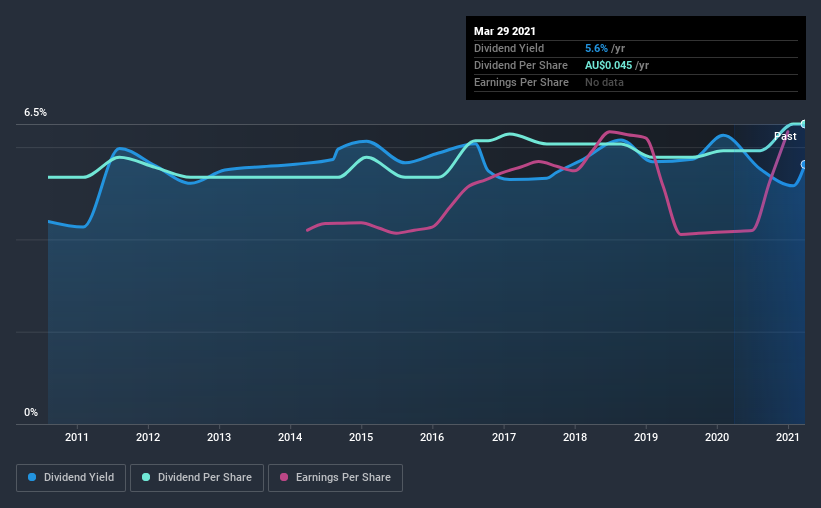

With Advanced Share Registry yielding 5.6% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Advanced Share Registry paid out 84% of its profit as dividends. It's paying out most of its earnings, which limits the amount that can be reinvested in the business. This may indicate limited need for further capital within the business, or highlight a commitment to paying a dividend.

Remember, you can always get a snapshot of Advanced Share Registry's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Advanced Share Registry has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was AU$0.04 in 2011, compared to AU$0.04 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.0% a year over that time.

Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think is seriously impressive.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Earnings have grown at around 8.2% a year for the past five years, which is better than seeing them shrink! Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Advanced Share Registry's payout ratio is within an average range for most market participants. That said, we were glad to see it growing earnings and paying a fairly consistent dividend. Advanced Share Registry has a credible record on several fronts, but falls slightly short of our standards for a dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Advanced Share Registry (of which 1 is potentially serious!) you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade Advanced Share Registry, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ASW

Advanced Share Registry

Advanced Share Registry Limited provides registry services, including registry maintenance, capital raisings, corporate actions, company meetings, employee share plans, shareholder communications and in-house printing offering.

Flawless balance sheet medium.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026