- Australia

- /

- Capital Markets

- /

- ASX:AFI

Australian Foundation Investment (ASX:AFI) Has Re-Affirmed Its Dividend Of AU$0.14

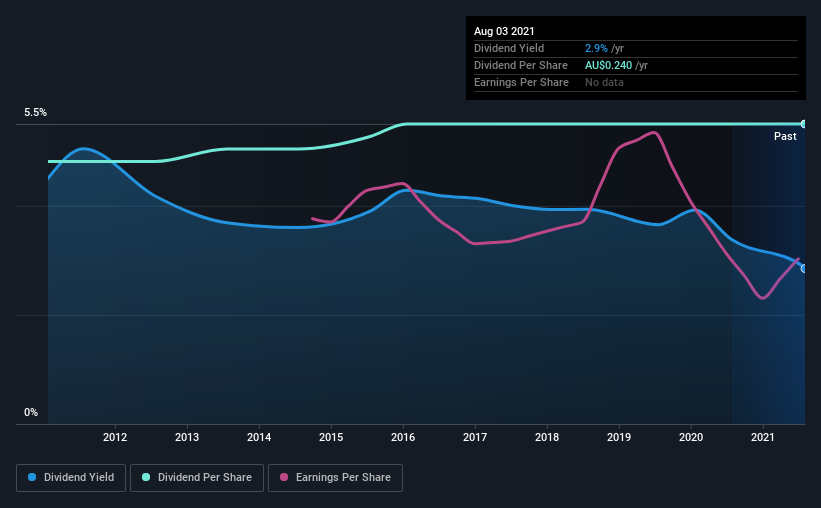

The board of Australian Foundation Investment Company Limited (ASX:AFI) has announced that it will pay a dividend of AU$0.14 per share on the 31st of August. This payment means that the dividend yield will be 2.9%, which is around the industry average.

See our latest analysis for Australian Foundation Investment

Australian Foundation Investment Is Paying Out More Than It Is Earning

We aren't too impressed by dividend yields unless they can be sustained over time. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

If the company can't turn things around, EPS could fall by 4.1% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 131%, which could put the dividend under pressure if earnings don't start to improve.

Australian Foundation Investment Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2011, the dividend has gone from AU$0.21 to AU$0.24. This works out to be a compound annual growth rate (CAGR) of approximately 1.3% a year over that time. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

The Dividend's Growth Prospects Are Limited

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. In the last five years, Australian Foundation Investment's earnings per share has shrunk at approximately 4.1% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Australian Foundation Investment's payments, as there could be some issues with sustaining them into the future. Although they have been consistent in the past, we think the payments are a little high to be sustained. We don't think Australian Foundation Investment is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for Australian Foundation Investment (1 is concerning!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Australian Foundation Investment, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AFI

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives