- Australia

- /

- Real Estate

- /

- ASX:SRV

Exploring Australian Ethical Investment And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

The Australian market has experienced a mixed performance recently, with the ASX200 closing slightly down and sectors like Real Estate and Utilities facing notable declines, while Discretionary and Telecommunication showed resilience. Amidst these fluctuations, small-cap stocks are drawing attention for their potential to thrive in specific niches, especially as investors seek opportunities that align with emerging trends such as ethical investing. Identifying promising small caps requires a keen understanding of their growth potential within current economic conditions and sector dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$572.77 million.

Operations: The company generates revenue primarily from its funds management segment, amounting to A$100.49 million.

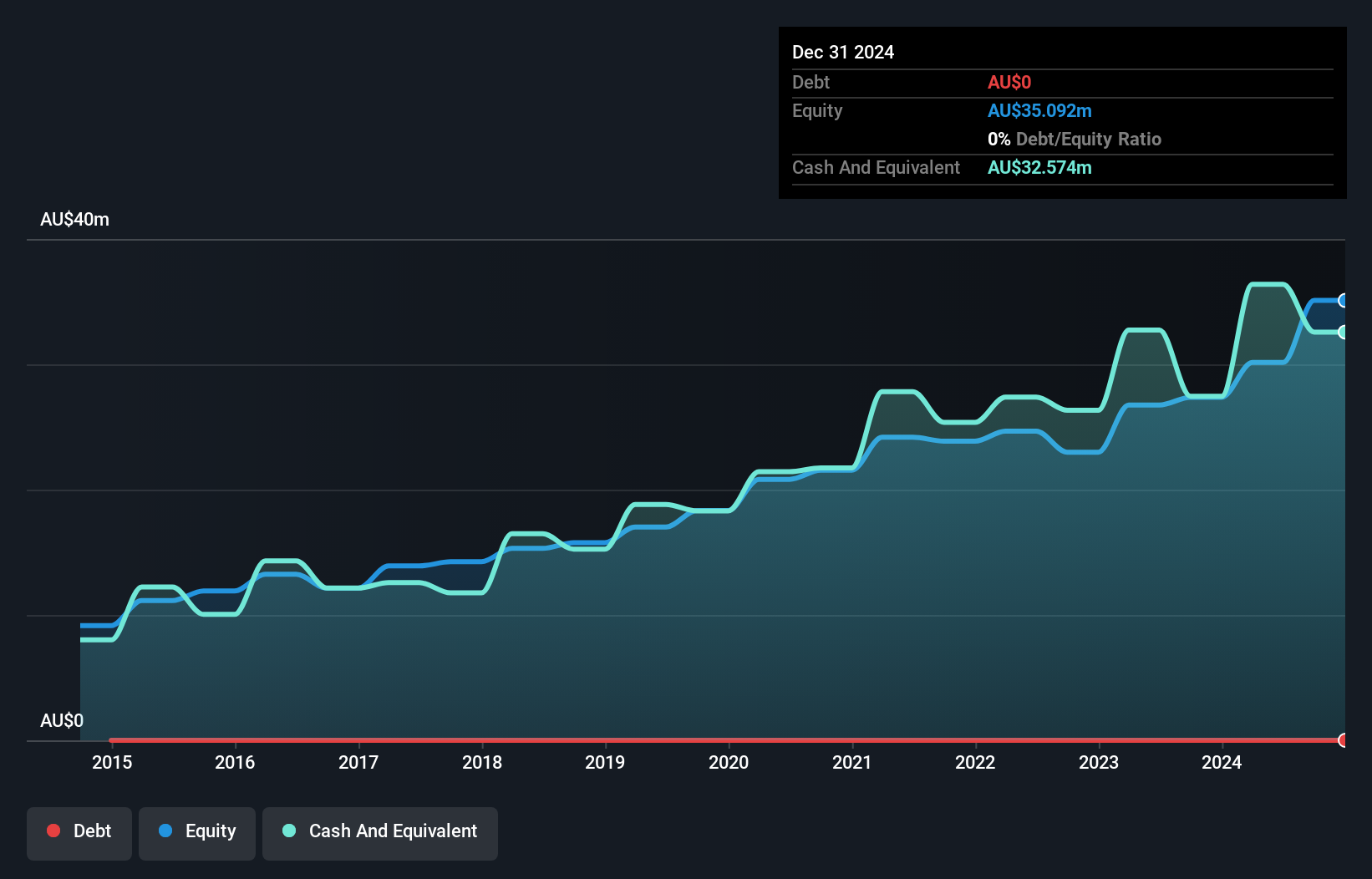

Australian Ethical Investment, a smaller player in the market, has shown impressive earnings growth of 75% over the past year, outpacing the Capital Markets industry's 18%. Despite a notable one-off loss of A$8.6M affecting recent results, its debt-free status for five years and positive free cash flow reflect strong financial health. The company seems poised for continued growth with forecasts predicting a 24% annual increase in earnings. While challenges exist due to non-recurring expenses, its ethical investment focus and robust performance metrics suggest potential for future value creation in this niche sector.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing sectors both in Australia and globally, with a market capitalization of A$461.44 million.

Operations: GR Engineering Services Limited generates revenue primarily from the mineral processing segment, contributing A$346.21 million, and the oil and gas segment, which adds A$77.86 million.

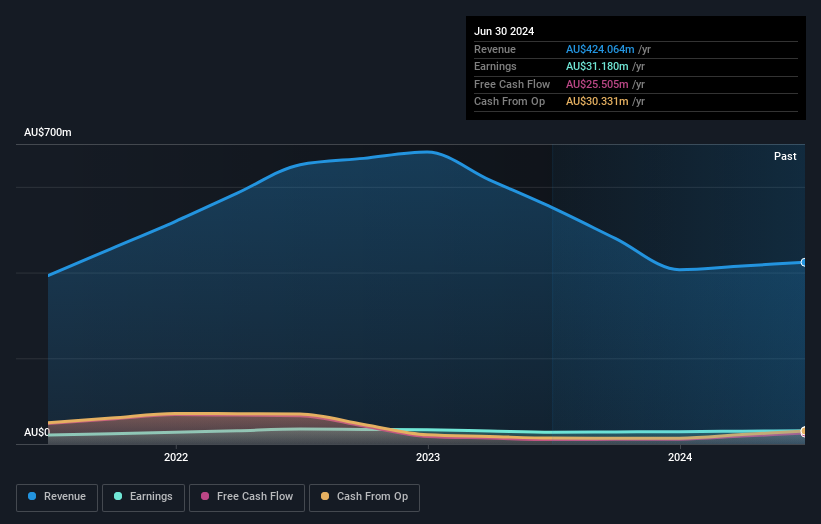

GR Engineering Services, a nimble player in the industry, showcases a Price-To-Earnings ratio of 14.8x, undercutting the broader Australian market's 19.3x. The company impressively outpaces its peers with an earnings growth rate of 13.4% over the past year compared to the Metals and Mining sector's modest 3.9%. With no debt on its books for five years, GNG is well-positioned financially and boasts high-quality earnings alongside positive free cash flow generation. Recent discussions at their Annual General Meeting included financial reviews and director elections, highlighting ongoing governance focus amidst solid operational performance.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market capitalization of A$494.35 million.

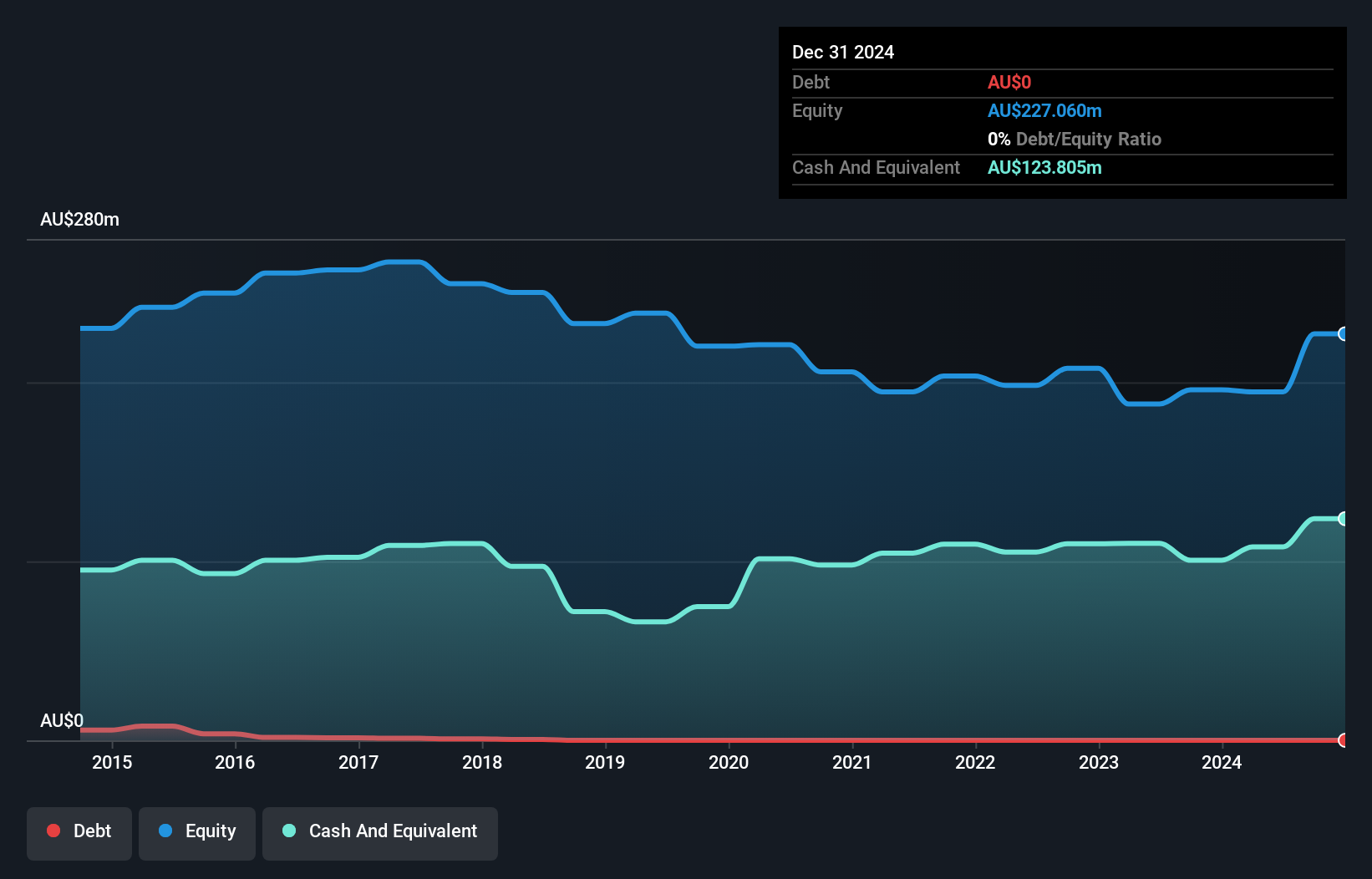

Operations: Servcorp Limited generates revenue primarily from real estate rental, amounting to A$314.89 million.

Servcorp, a nimble player in the office space sector, has demonstrated impressive financial health with earnings surging 252.7% last year, outpacing the Real Estate industry's growth of 26.4%. The company is debt-free, eliminating any concerns over interest coverage and positioning it as a solid entity in terms of financial stability. Trading at 83.2% below its estimated fair value suggests potential for appreciation against peers and industry standards. With high-quality earnings consistently reported, Servcorp seems poised to capitalize on future growth opportunities without the burden of debt weighing it down.

- Take a closer look at Servcorp's potential here in our health report.

Assess Servcorp's past performance with our detailed historical performance reports.

Where To Now?

- Dive into all 49 of the ASX Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives