- Australia

- /

- Healthcare Services

- /

- ASX:SLA

Returns On Capital Are Showing Encouraging Signs At SILK Laser Australia (ASX:SLA)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, we've noticed some promising trends at SILK Laser Australia (ASX:SLA) so let's look a bit deeper.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for SILK Laser Australia:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

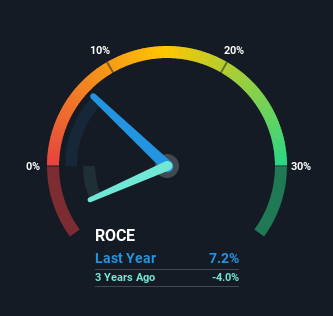

0.072 = AU$10m ÷ (AU$179m - AU$39m) (Based on the trailing twelve months to December 2021).

Thus, SILK Laser Australia has an ROCE of 7.2%. On its own that's a low return on capital but it's in line with the industry's average returns of 6.7%.

View our latest analysis for SILK Laser Australia

In the above chart we have measured SILK Laser Australia's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Tell From SILK Laser Australia's ROCE Trend?

The fact that SILK Laser Australia is now generating some pre-tax profits from its prior investments is very encouraging. Shareholders would no doubt be pleased with this because the business was loss-making three years ago but is is now generating 7.2% on its capital. In addition to that, SILK Laser Australia is employing 327% more capital than previously which is expected of a company that's trying to break into profitability. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, both common traits of a multi-bagger.

The Key Takeaway

Overall, SILK Laser Australia gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. Given the stock has declined 38% in the last year, this could be a good investment if the valuation and other metrics are also appealing. So researching this company further and determining whether or not these trends will continue seems justified.

One more thing, we've spotted 4 warning signs facing SILK Laser Australia that you might find interesting.

While SILK Laser Australia may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SLA

SILK Laser Australia

SILK Laser Australia Limited operates and franchises a network of clinics that offer non-surgical aesthetic services in Australia and New Zealand.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives