- Australia

- /

- Hospitality

- /

- ASX:SGR

Why Investors Shouldn't Be Surprised By The Star Entertainment Group Limited's (ASX:SGR) 28% Share Price Plunge

The Star Entertainment Group Limited (ASX:SGR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

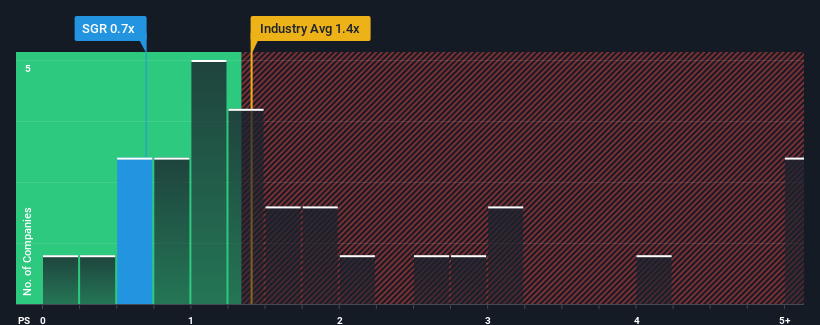

After such a large drop in price, given about half the companies operating in Australia's Hospitality industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Star Entertainment Group as an attractive investment with its 0.7x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Star Entertainment Group

What Does Star Entertainment Group's Recent Performance Look Like?

Star Entertainment Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Star Entertainment Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Star Entertainment Group's Revenue Growth Trending?

Star Entertainment Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 46% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 0.9% each year over the next three years. With the industry predicted to deliver 7.0% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Star Entertainment Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Star Entertainment Group's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Star Entertainment Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Star Entertainment Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SGR

Star Entertainment Group

Operates and manages integrated resorts in Australia.

Fair value with very low risk.

Similar Companies

Market Insights

Community Narratives