- Australia

- /

- Consumer Services

- /

- ASX:RTE

Would Shareholders Who Purchased Retech Technology's (ASX:RTE) Stock Three Years Be Happy With The Share price Today?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Retech Technology Co., Limited (ASX:RTE) shareholders, since the share price is down 33% in the last three years, falling well short of the market return of around 32%. And more recent buyers are having a tough time too, with a drop of 29% in the last year. Furthermore, it's down 12% in about a quarter. That's not much fun for holders.

See our latest analysis for Retech Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Retech Technology actually managed to grow EPS by 21% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue is actually up 21% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Retech Technology further; while we may be missing something on this analysis, there might also be an opportunity.

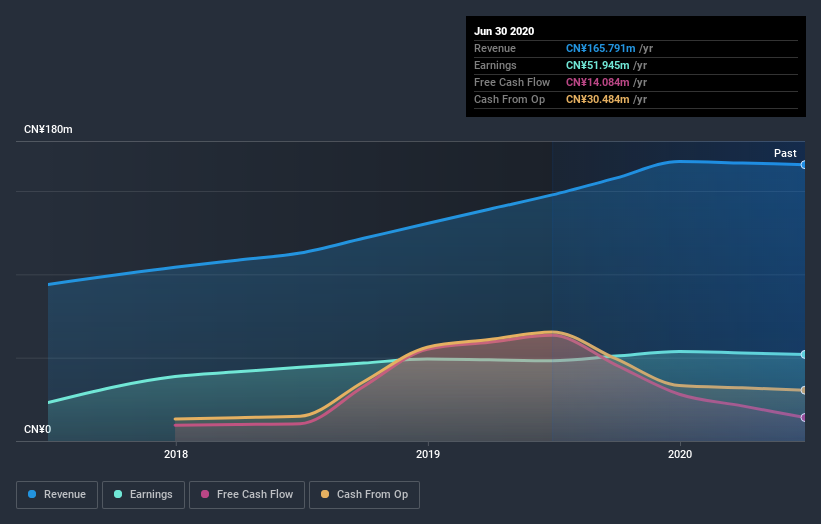

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Retech Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Retech Technology shares, which cost holders 29%, while the market was up about 4.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 10% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Retech Technology better, we need to consider many other factors. Even so, be aware that Retech Technology is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Retech Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RTE

Retech Technology

Retech Technology Co., Limited, an investment holding company, provides technology solutions to corporate customers, vocational schools, ESG related companies, and students in the People’s Republic of China, Hong Kong, and Australia.

Mediocre balance sheet with poor track record.

Market Insights

Community Narratives