The ASX 200 recently closed down amid heightened tensions in the Middle East, which have unsettled investors and driven up oil prices, while sectors like Industrials and Materials faced significant sell-offs. Despite these challenges, certain investment opportunities remain attractive for those looking to explore beyond the large-cap stocks. Penny stocks, though an outdated term, continue to offer potential for growth by highlighting smaller or newer companies with strong financials that could yield substantial returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.47 | A$116.52M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.34M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.68 | A$413.21M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.21 | A$2.52B | ✅ 4 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.735 | A$458.75M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.26 | A$768.13M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.02 | A$679.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.685 | A$217.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.25 | A$154.21M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.84 | A$148.2M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,007 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Atlas Pearls (ASX:ATP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Pearls Limited produces and sells South Sea pearls in Australia and Indonesia, with a market cap of A$69.76 million.

Operations: The company generates revenue from the sale of loose pearls, with A$30.03 million coming from Australia and A$27.74 million from Indonesia.

Market Cap: A$69.76M

Atlas Pearls Limited shows financial stability with more cash than debt and a high Return on Equity at 35.8%. Its operating cash flow significantly exceeds its debt, indicating strong coverage. The company has not diluted shareholders recently, and its Price-To-Earnings ratio of 2.9x suggests good value compared to the Australian market average. However, significant insider selling in the past three months raises caution. Despite negative earnings growth over the past year, Atlas Pearls maintains high profit margins and has improved net profit margins from last year to 70%. The management team is seasoned with an average tenure of 12.5 years.

- Jump into the full analysis health report here for a deeper understanding of Atlas Pearls.

- Gain insights into Atlas Pearls' historical outcomes by reviewing our past performance report.

CTI Logistics (ASX:CLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CTI Logistics Limited, along with its subsidiaries, offers transport and logistics services across Australia and has a market cap of A$148.20 million.

Operations: The company generates revenue primarily from its Transport segment at A$228.92 million and Logistics segment at A$124.18 million, with additional contributions from its Property segment totaling A$8.13 million.

Market Cap: A$148.2M

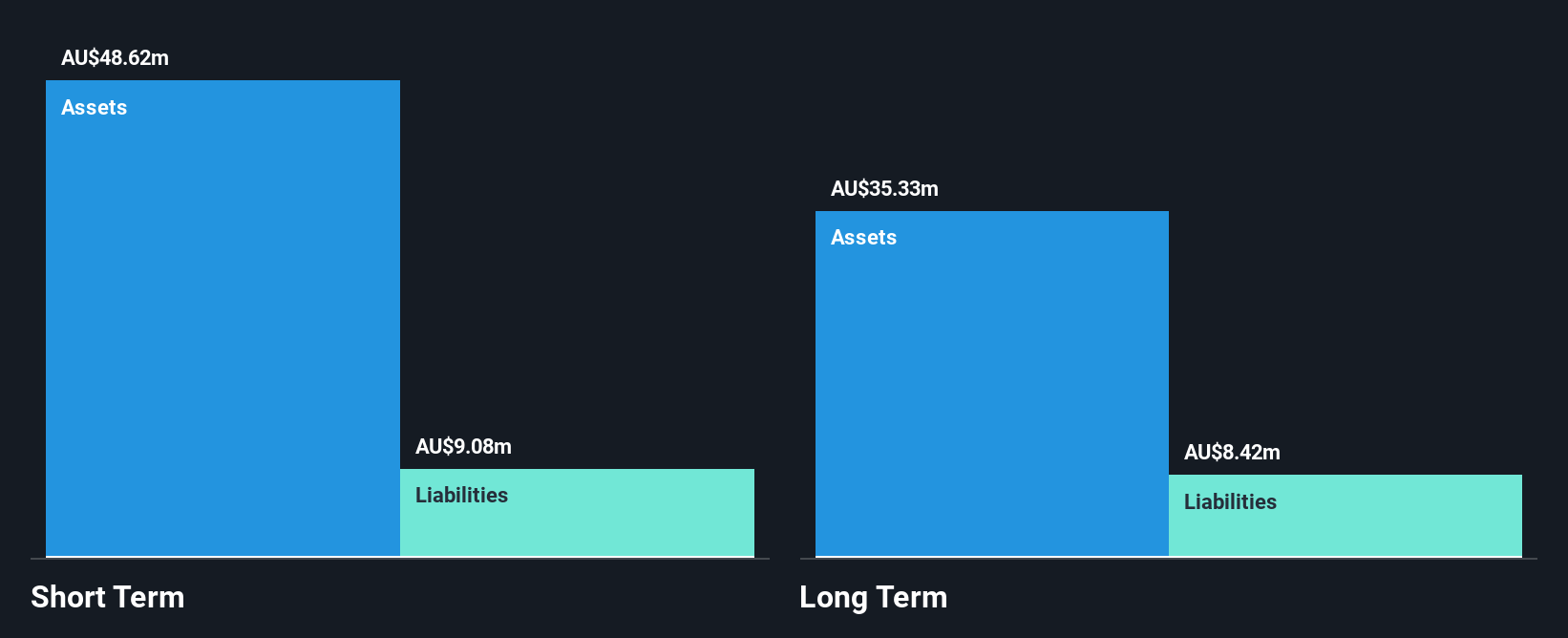

CTI Logistics Limited, with a market cap of A$148.20 million, is experiencing stable earnings growth, having increased by 9.3% over the past year and outperforming the logistics industry average. The company's debt management is prudent, with a net debt to equity ratio of 36.5% and interest payments well covered by EBIT at 3.9x coverage. However, its short-term assets do not fully cover liabilities, posing potential liquidity concerns. Despite trading at a substantial discount to its estimated fair value and offering high-quality earnings, its dividend sustainability remains questionable due to insufficient free cash flow coverage.

- Unlock comprehensive insights into our analysis of CTI Logistics stock in this financial health report.

- Explore CTI Logistics' analyst forecasts in our growth report.

Retail Food Group (ASX:RFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Retail Food Group Limited is a food and beverage company that manages a multi-brand retail food and beverage franchise both in Australia and internationally, with a market cap of A$120.20 million.

Operations: The company's revenue is primarily generated from its Café, Coffee & Bakery segment, which accounts for A$126.53 million, and its QSR Systems segment, contributing A$17.34 million.

Market Cap: A$120.2M

Retail Food Group Limited, with a market cap of A$120.20 million, has recently turned profitable and is trading at a significant discount to its estimated fair value. The company's debt management shows improvement, with a reduced debt-to-equity ratio from 29.4% to 11.5% over five years and satisfactory net debt levels at 1.6%. However, short-term assets (A$64.6M) do not cover long-term liabilities (A$106.5M), posing potential risks despite strong cash flow coverage of its debt at 78.4%. While earnings growth is forecasted at 11.11% annually, recent results were impacted by a large one-off gain of A$7M.

- Take a closer look at Retail Food Group's potential here in our financial health report.

- Evaluate Retail Food Group's prospects by accessing our earnings growth report.

Make It Happen

- Take a closer look at our ASX Penny Stocks list of 1,007 companies by clicking here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ATP

Atlas Pearls

Produces and sells south sea pearls in Australia and Indonesia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026