- Australia

- /

- Hospitality

- /

- ASX:RFG

3 ASX Penny Stocks With Market Caps Below A$400M

Reviewed by Simply Wall St

The Australian market is showing resilience as the ASX200 is set to open slightly higher, even amid global economic concerns following cautious fiscal guidance from major US retailers. In this context, investors might find value in exploring lesser-known opportunities such as penny stocks, which often represent smaller or newer companies with potential for growth. While the term "penny stock" may seem outdated, these investments can still offer intriguing prospects when backed by solid financials and strategic positioning.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.93 | A$91.04M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.455 | A$282.17M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.20 | A$340.76M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.06 | A$335.4M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.03 | A$64.14M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.525 | A$103.1M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.78 | A$98.46M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.77 | A$98.48M | ★★★★★★ |

Click here to see the full list of 1,034 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Horizon Oil Limited, with a market cap of A$333.49 million, is involved in the exploration, development, and production of oil and gas properties across China, New Zealand, and Australia.

Operations: Horizon Oil's revenue is primarily derived from its operations in China, generating $76.83 million, followed by New Zealand with $34.24 million, and Australia contributing $0.39 million.

Market Cap: A$333.49M

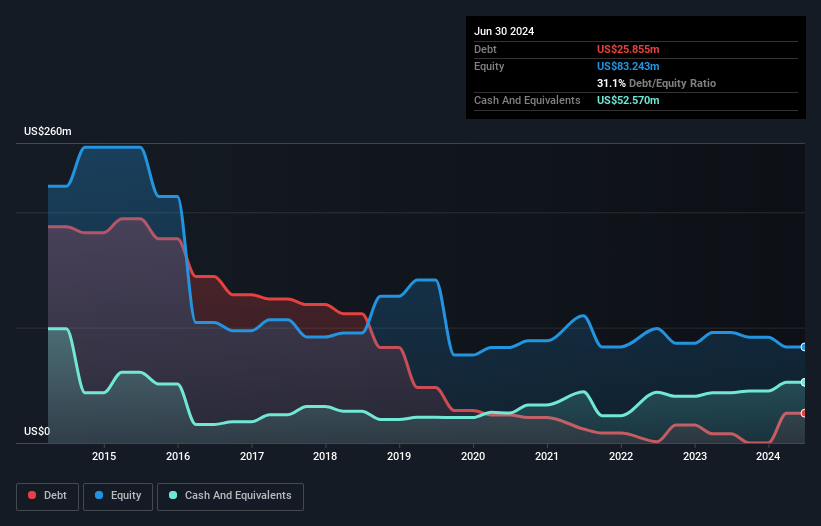

Horizon Oil Limited, with a market cap of A$333.49 million, is involved in the exploration, development, and production of oil and gas properties across China, New Zealand, and Australia. Horizon Oil's revenue is primarily derived from its operations in China, generating $76.83 million, followed by New Zealand with $34.24 million, and Australia contributing $0.39 million. The company may also be pre-revenue if it has revenues less than US$1m and there appear to be no significant lines of revenue from the business description. Horizon Oil presents a mixed investment case within the penny stock domain due to its stable weekly volatility (5%) over the past year and high Return on Equity (31.1%). It trades at 70.6% below estimated fair value but faces challenges such as negative earnings growth (-40.9%) over the past year despite having grown profits by 14.9% annually over five years prior. While debt levels are well-managed with cash exceeding total debt and operating cash flow covering debt substantially (248%), short-term assets do not fully cover long-term liabilities ($91.4M). Additionally, dividends are unsustainable at 14%, not being supported by earnings or free cash flows.

- Take a closer look at Horizon Oil's potential here in our financial health report.

- Gain insights into Horizon Oil's future direction by reviewing our growth report.

Retail Food Group (ASX:RFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Retail Food Group Limited is a food and beverage company that manages a multi-brand retail food and beverage franchise both in Australia and internationally, with a market cap of A$130.84 million.

Operations: Retail Food Group Limited has not reported any specific revenue segments.

Market Cap: A$130.84M

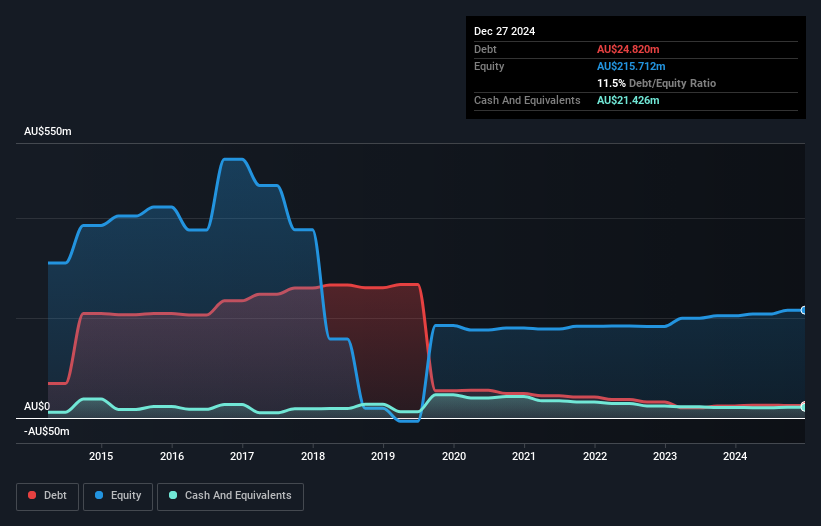

Retail Food Group Limited, with a market cap of A$130.84 million, has shown promising signs in the penny stock arena by becoming profitable this year and reporting improved earnings for the half-year ending December 27, 2024. Sales increased to A$69.6 million from A$57.97 million a year ago, while net income rose to A$7.33 million from A$4.22 million previously. Despite these gains, challenges remain as interest coverage is weak at 1.7x EBIT and short-term assets (A$64.6M) do not cover long-term liabilities (A$106.5M). The company's debt management has improved significantly with a reduced debt-to-equity ratio of 11.5%.

- Get an in-depth perspective on Retail Food Group's performance by reading our balance sheet health report here.

- Evaluate Retail Food Group's prospects by accessing our earnings growth report.

Shriro Holdings (ASX:SHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shriro Holdings Limited, with a market cap of A$78.58 million, manufactures, markets, and distributes consumer products in Australia, New Zealand, and internationally.

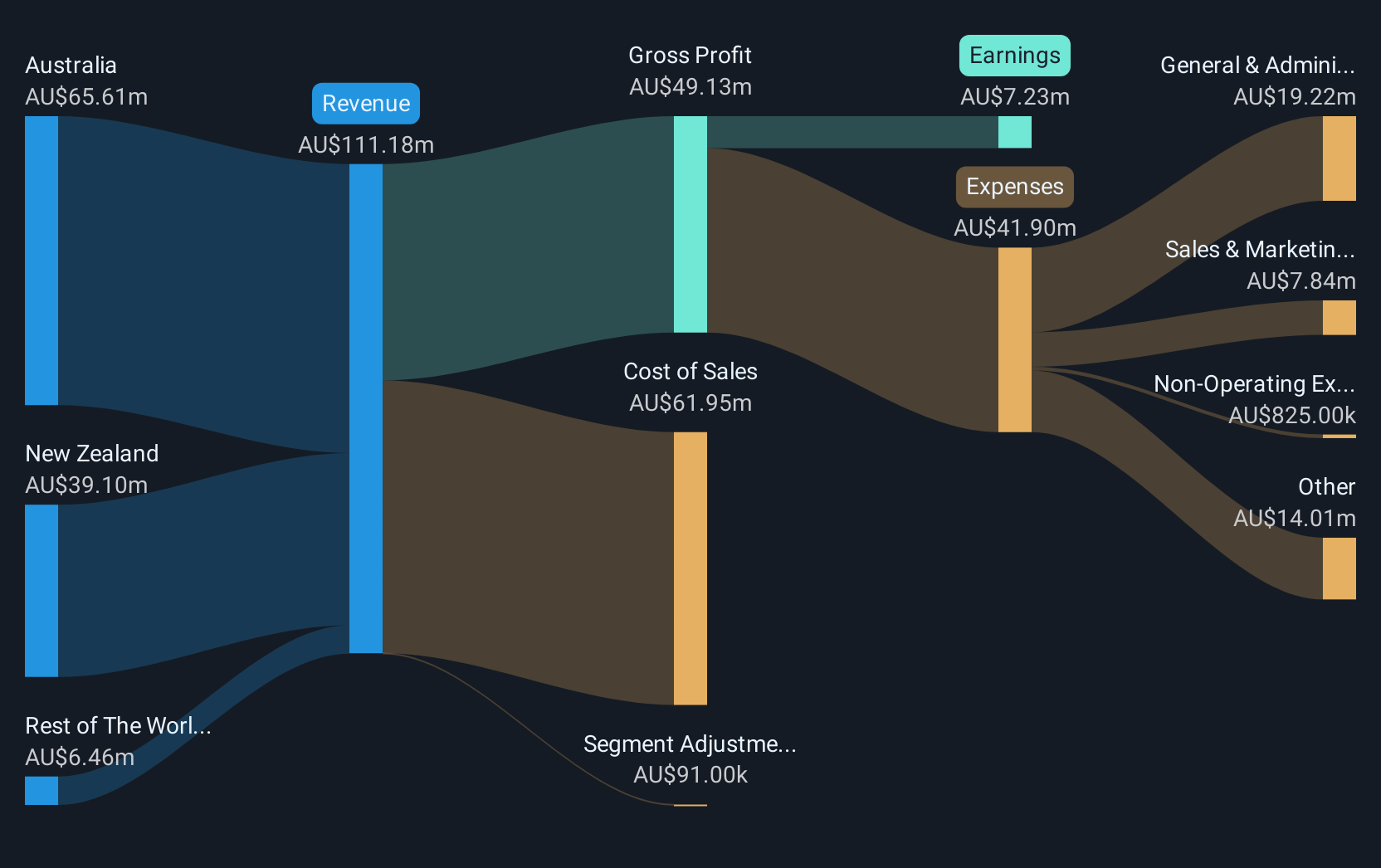

Operations: The company's revenue is generated from Australia (A$71.48 million), New Zealand (A$40.05 million), and the Rest of The World (A$7.97 million).

Market Cap: A$78.58M

Shriro Holdings Limited, with a market cap of A$78.58 million, operates without debt, providing financial stability uncommon in the penny stock sector. Despite this advantage and an experienced board averaging 3.8 years in tenure, the company faces challenges such as negative earnings growth of -25.9% over the past year and declining net profit margins from 7.9% to 6.1%. While short-term assets cover both short-term (A$17.4M) and long-term liabilities (A$12.9M), its Return on Equity remains low at 15%, indicating room for improvement in profitability metrics despite trading below estimated fair value by a significant margin.

- Dive into the specifics of Shriro Holdings here with our thorough balance sheet health report.

- Explore historical data to track Shriro Holdings' performance over time in our past results report.

Key Takeaways

- Click through to start exploring the rest of the 1,031 ASX Penny Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RFG

Retail Food Group

A food and beverage company, engages in the management of a multi-brand retail food and beverage franchise in Australia and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives