- Australia

- /

- Hospitality

- /

- ASX:PBH

The Market Lifts PointsBet Holdings Limited (ASX:PBH) Shares 27% But It Can Do More

PointsBet Holdings Limited (ASX:PBH) shareholders have had their patience rewarded with a 27% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

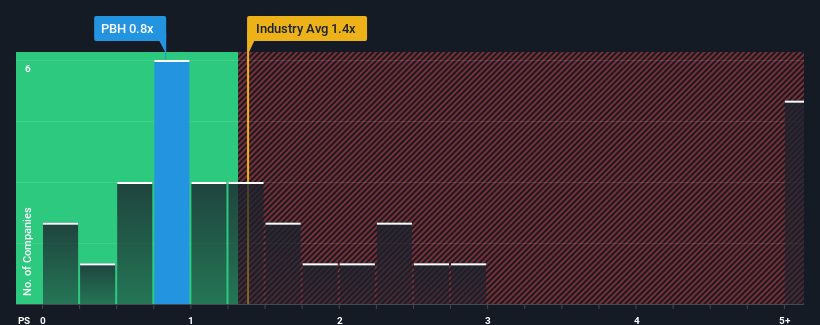

Even after such a large jump in price, given about half the companies operating in Australia's Hospitality industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider PointsBet Holdings as an attractive investment with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for PointsBet Holdings

How PointsBet Holdings Has Been Performing

With revenue growth that's superior to most other companies of late, PointsBet Holdings has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think PointsBet Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For PointsBet Holdings?

In order to justify its P/S ratio, PointsBet Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Revenue has also lifted 26% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 7.1% per annum growth forecast for the broader industry.

In light of this, it's peculiar that PointsBet Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does PointsBet Holdings' P/S Mean For Investors?

Despite PointsBet Holdings' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems PointsBet Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for PointsBet Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PBH

PointsBet Holdings

Provides sports, racing, and iGaming betting products and services through its cloud-based technology platform in Australia.

Undervalued with high growth potential.