- Australia

- /

- Consumer Services

- /

- ASX:KED

Keypath Education International (ASX:KED) adds AU$16m to market cap in the past 7 days, though investors from a year ago are still down 73%

Keypath Education International, Inc. (ASX:KED) shareholders should be happy to see the share price up 17% in the last month. But that hardly compensates for the shocking decline over the last twelve months. Specifically, the stock price nose-dived 73% in that time. It's not uncommon to see a bounce after a drop like that. The real question is whether the company can turn around its fortunes.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Keypath Education International

Because Keypath Education International made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Keypath Education International saw its revenue grow by 21%. We think that is pretty nice growth. However, it seems like the market wanted more, since the share price is down 73%. It could be that the losses are too much for investors to handle without losing their nerve. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

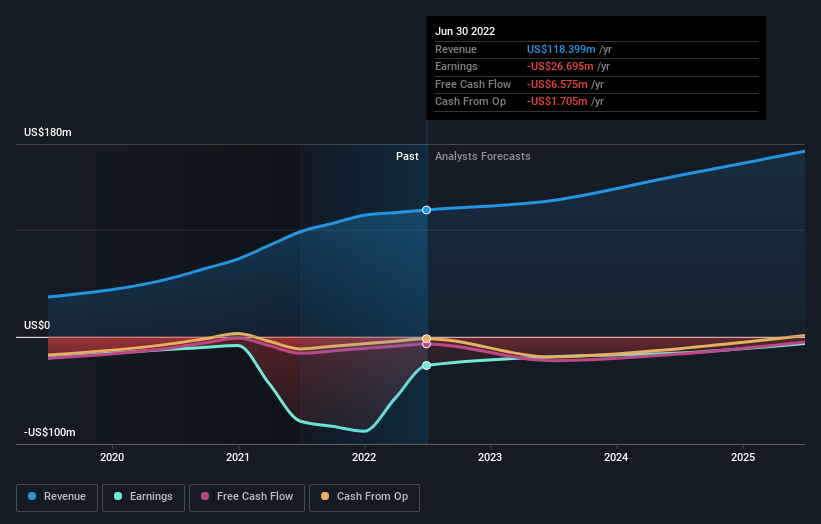

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While Keypath Education International shareholders are down 73% for the year, the market itself is up 6.8%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 6.7% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Keypath Education International is showing 3 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you're looking to trade Keypath Education International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keypath Education International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:KED

Keypath Education International

Designs, develops, and delivers career-relevant online education solutions in North America, the Asia-Pacific, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives