- Australia

- /

- Consumer Services

- /

- ASX:IEL

With EPS Growth And More, IDP Education (ASX:IEL) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like IDP Education (ASX:IEL), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for IDP Education

How Fast Is IDP Education Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that IDP Education has managed to grow EPS by 27% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

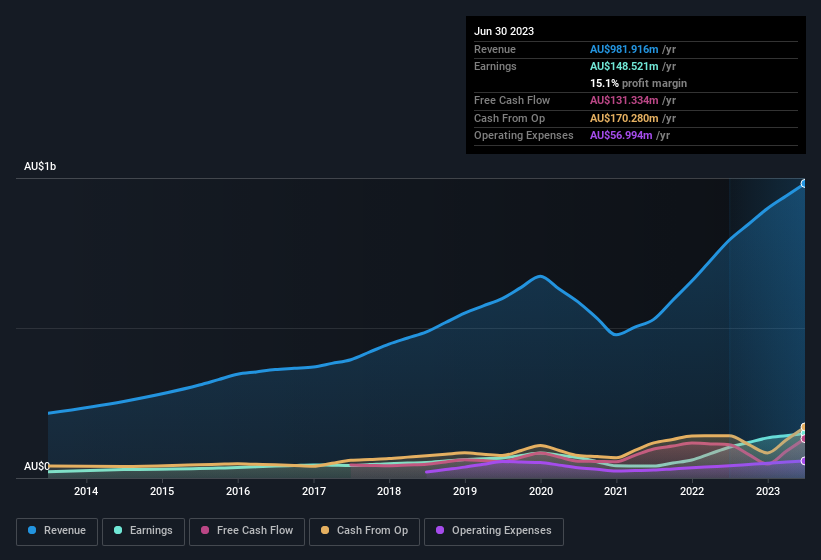

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that IDP Education is growing revenues, and EBIT margins improved by 2.4 percentage points to 22%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for IDP Education's future profits.

Are IDP Education Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did IDP Education insiders refrain from selling stock during the year, but they also spent AU$92k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

It's reassuring that IDP Education insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to IDP Education, with market caps between AU$3.1b and AU$10.0b, is around AU$3.4m.

The IDP Education CEO received total compensation of just AU$1.6m in the year to June 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add IDP Education To Your Watchlist?

For growth investors, IDP Education's raw rate of earnings growth is a beacon in the night. To add to the positives, IDP Education has recorded instances of insider buying and a modest executive pay to boot. All in all, this stock is worth the time to delve deeper into the details. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of IDP Education.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of IDP Education, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IEL

IDP Education

Engages in the placement of students into education institutions in Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives