- Australia

- /

- Hospitality

- /

- ASX:FLT

Is Flight Centre's Renewed Buy-Back Strategy (ASX:FLT) a Signal of Capital Discipline or Caution?

Reviewed by Sasha Jovanovic

- In recent news, Flight Centre Travel Group announced an update to its on-market share buy-back program and disclosed ongoing reviews of its 47% stake in Pedal Group, with potential transactions not expected to materially impact its financials.

- This development highlights the company's focus on capital management and maintains attention on its earnings outlook as a key player within the ASX 200.

- We'll explore how Flight Centre's latest share buy-back activity could reshape its investment narrative and future outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Flight Centre Travel Group Investment Narrative Recap

Owning Flight Centre Travel Group means believing in a travel recovery that translates into sustained revenue and earnings growth despite global uncertainties and industry shifts. The company’s ongoing share buy-back and Pedal Group stake review reflect a disciplined approach to capital management, but neither is expected to materially affect the most important short-term catalyst: margin improvement driven by digital and higher-margin business travel. The principal risk remains exposure to volatile travel demand and evolving consumer habits, which continue to challenge sustainable profitability.

Of all recent announcements, Flight Centre’s update on the on-market buy-back stands out. With over 7.4 million shares repurchased so far this year, this move supports efforts to streamline the capital structure and could provide near-term support as the company focuses on strengthening earnings margins and accelerating digital adoption across its platforms.

However, investors should be aware that, in contrast to the promise of margin expansion, Flight Centre’s heavy reliance on physical retail and the persistent shift to digital channels could yet...

Read the full narrative on Flight Centre Travel Group (it's free!)

Flight Centre Travel Group's outlook anticipates A$3.2 billion in revenue and A$296.4 million in earnings by 2028. This reflects a 4.9% annual revenue growth rate and an earnings increase of A$186.9 million from current earnings of A$109.5 million.

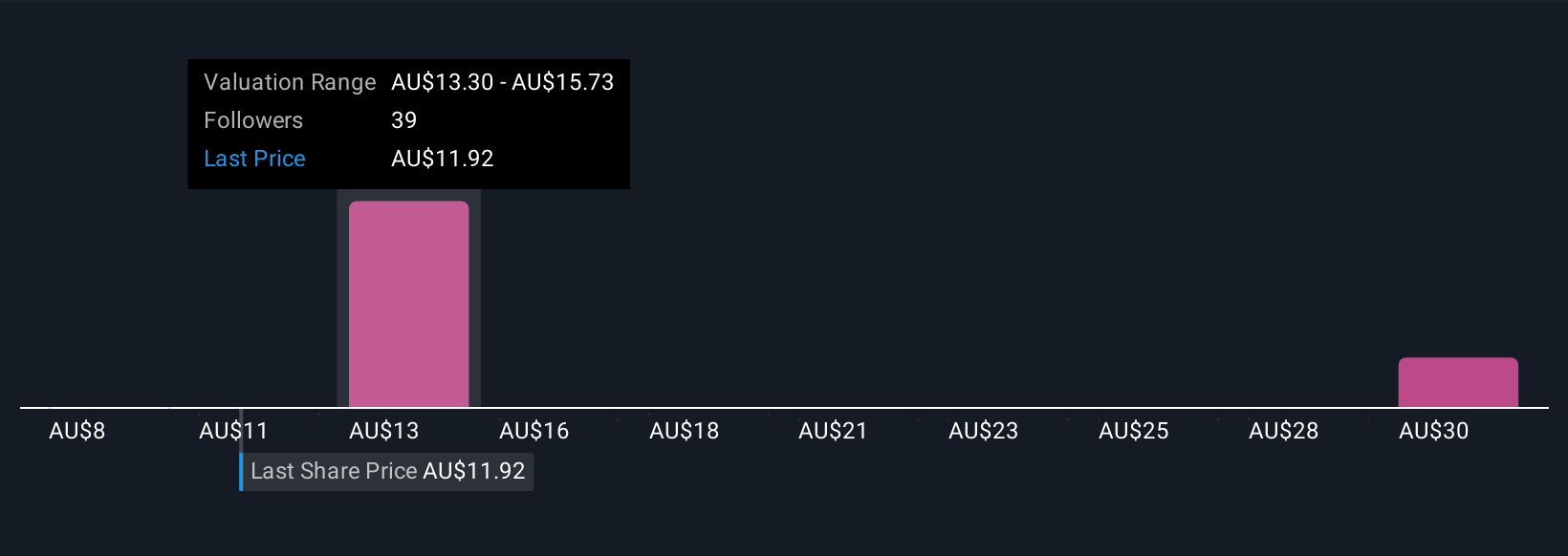

Uncover how Flight Centre Travel Group's forecasts yield a A$15.64 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community for Flight Centre Travel Group range from A$8.43 to A$32.76. While some expect strong recovery through digital expansion, you will find very different views on the company’s long-term risk and return profile, take a closer look and explore more perspectives.

Explore 6 other fair value estimates on Flight Centre Travel Group - why the stock might be worth 29% less than the current price!

Build Your Own Flight Centre Travel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flight Centre Travel Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flight Centre Travel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flight Centre Travel Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives