- Australia

- /

- Hospitality

- /

- ASX:FLT

Is Flight Centre’s (ASX:FLT) Ongoing Buy-Back a Sign of Strategic Confidence or a Shift in Priorities?

Reviewed by Sasha Jovanovic

- Flight Centre Travel Group recently continued its on-market buy-back program, repurchasing 8,508,824 ordinary fully paid securities as of October 6, 2025, while Citigroup Global Markets Australia ceased to be a substantial holder in the company in early October.

- This combination of increased company-led buy-backs and shifts in institutional holdings provides a window into management’s confidence and evolving investor sentiment.

- We'll explore how the ongoing share buy-back initiative underscores management's capital allocation priorities within Flight Centre's investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Flight Centre Travel Group Investment Narrative Recap

To be a shareholder in Flight Centre Travel Group, you need to believe in the company’s ability to adapt its model as travel recovers, execute on digital and high-margin business initiatives, and manage through persistent economic uncertainty. The recent expansion of the on-market share buy-back program, with over 8.5 million shares repurchased by October 6, 2025, and Citigroup Global Markets Australia's exit as a substantial holder appear unlikely to materially affect the most important short-term catalyst: accelerating adoption of digital distribution channels; nor the biggest risk, which remains exposure to volatile international travel demand and ongoing margin pressure from market shifts.

Recent company announcements highlight the progression of Flight Centre’s share buy-back plan, most recently the completion of a tranche covering more than 4.4 million shares in August 2025. This ongoing capital management activity is particularly relevant in the context of improving capital efficiency, but does not directly resolve structural risks around fixed-cost leverage and competitive digital disruption that influence near-term earnings and sentiment.

On the flip side, investors should be alert to the persistent challenge of...

Read the full narrative on Flight Centre Travel Group (it's free!)

Flight Centre Travel Group is forecast to reach A$3.2 billion in revenue and A$296.4 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 4.9%, with earnings rising by A$186.9 million from the current A$109.5 million.

Uncover how Flight Centre Travel Group's forecasts yield a A$15.64 fair value, a 30% upside to its current price.

Exploring Other Perspectives

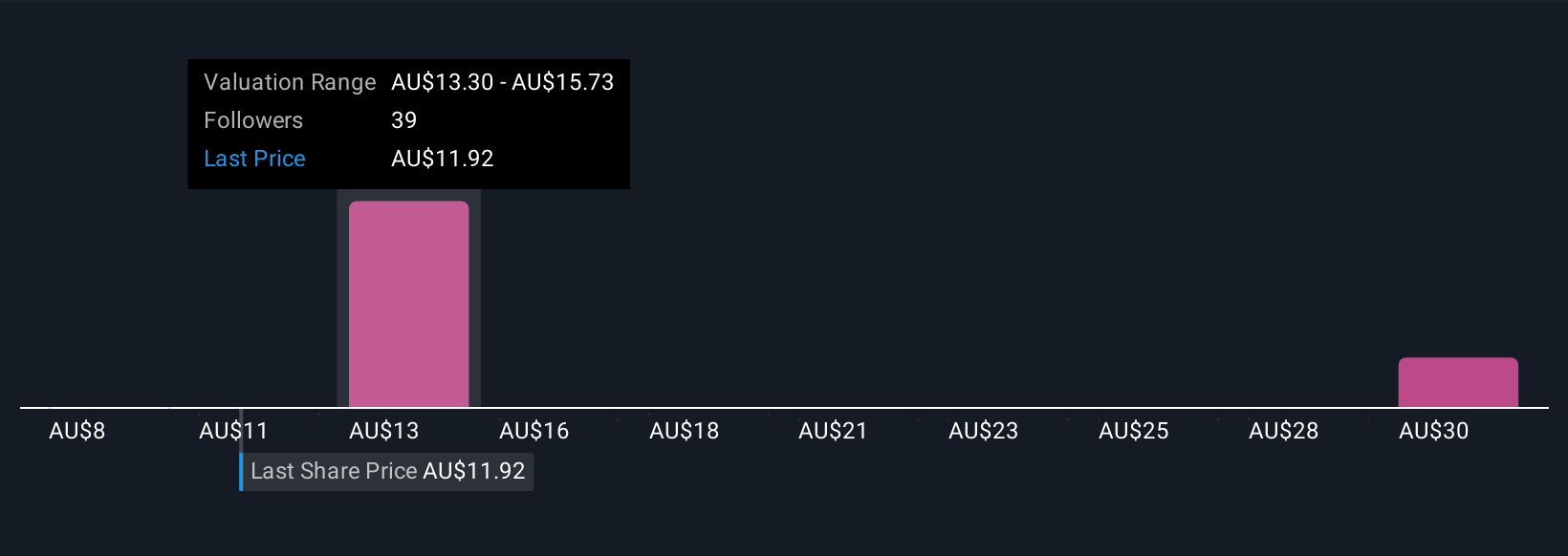

Six fair value estimates from the Simply Wall St Community range widely, from A$8.43 to A$32.72 per share. While participants see opportunity, continued volatility in international travel and evolving consumer preferences remain central to the company’s outlook, so you may want to compare these diverse viewpoints.

Explore 6 other fair value estimates on Flight Centre Travel Group - why the stock might be worth over 2x more than the current price!

Build Your Own Flight Centre Travel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flight Centre Travel Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flight Centre Travel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flight Centre Travel Group's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.