The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Flight Centre Travel Group Limited (ASX:FLT) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Flight Centre Travel Group

What Is Flight Centre Travel Group's Debt?

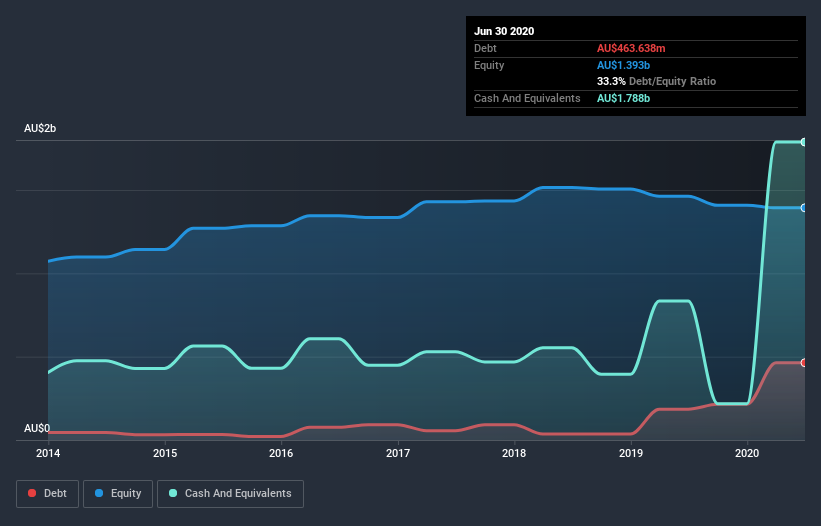

The image below, which you can click on for greater detail, shows that at June 2020 Flight Centre Travel Group had debt of AU$463.6m, up from AU$185.1m in one year. However, its balance sheet shows it holds AU$1.79b in cash, so it actually has AU$1.32b net cash.

How Strong Is Flight Centre Travel Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Flight Centre Travel Group had liabilities of AU$1.86b due within 12 months and liabilities of AU$749.1m due beyond that. On the other hand, it had cash of AU$1.79b and AU$475.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$342.6m.

Of course, Flight Centre Travel Group has a market capitalization of AU$3.22b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Flight Centre Travel Group also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Flight Centre Travel Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Flight Centre Travel Group made a loss at the EBIT level, and saw its revenue drop to AU$1.9b, which is a fall of 38%. To be frank that doesn't bode well.

So How Risky Is Flight Centre Travel Group?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Flight Centre Travel Group had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of AU$105m and booked a AU$662m accounting loss. With only AU$1.32b on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Flight Centre Travel Group is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Flight Centre Travel Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.