- Australia

- /

- Hospitality

- /

- ASX:DNA

Donaco International (ASX:DNA) Is Finding It Tricky To Allocate Its Capital

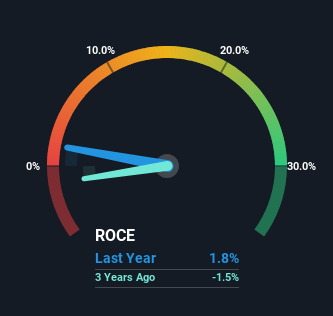

When researching a stock for investment, what can tell us that the company is in decline? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. And from a first read, things don't look too good at Donaco International (ASX:DNA), so let's see why.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Donaco International:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.018 = AU$2.3m ÷ (AU$182m - AU$52m) (Based on the trailing twelve months to June 2023).

Therefore, Donaco International has an ROCE of 1.8%. Ultimately, that's a low return and it under-performs the Hospitality industry average of 6.5%.

Check out our latest analysis for Donaco International

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Donaco International has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

We are a bit anxious about the trends of ROCE at Donaco International. To be more specific, today's ROCE was 7.8% five years ago but has since fallen to 1.8%. What's equally concerning is that the amount of capital deployed in the business has shrunk by 69% over that same period. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. If these underlying trends continue, we wouldn't be too optimistic going forward.

On a side note, Donaco International's current liabilities have increased over the last five years to 29% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. While the ratio isn't currently too high, it's worth keeping an eye on this because if it gets particularly high, the business could then face some new elements of risk.

The Key Takeaway

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. Investors haven't taken kindly to these developments, since the stock has declined 44% from where it was five years ago. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

One more thing, we've spotted 1 warning sign facing Donaco International that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DNA

Donaco International

Engages in the hotel accommodation, gaming, and leisure businesses in Australia, Cambodia, Vietnam, Singapore, Malaysia, and Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026