- Australia

- /

- Metals and Mining

- /

- ASX:CGR

February 2025's Standout Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market has faced challenges recently, with the ASX 200 down 0.83% as sectors like banking and energy weighed heavily on performance, compounded by economic concerns such as the administration of Whyalla steelworks and a slow wage growth rate. Despite these hurdles, investors often find opportunities in less conventional areas like penny stocks, which can offer unique value propositions through their affordability and potential for growth. While the term "penny stocks" might seem outdated, these smaller or newer companies continue to attract attention for their ability to combine value with financial strength in uncertain times.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.47M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.95 | A$92.93M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.20 | A$250.39M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.47 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.21 | A$346.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$340.29M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.525 | A$108.01M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.78 | A$101.78M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$63.64M | ★★★★★☆ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Coast Entertainment Holdings (ASX:CEH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Coast Entertainment Holdings Limited is involved in the investment, ownership, and operation of leisure and entertainment businesses in Australia, with a market cap of A$201.05 million.

Operations: The company generates revenue from its Theme Parks & Attractions segment, amounting to A$87.03 million.

Market Cap: A$201.05M

Coast Entertainment Holdings Limited, with a market cap of A$201.05 million, operates in the leisure and entertainment sector. Despite being unprofitable, the company has reduced its losses by 32.7% annually over the past five years and is trading at 27.1% below its estimated fair value. Analysts anticipate a potential stock price increase of 29.8%. The company maintains financial stability with short-term assets (A$97.3M) exceeding both short-term (A$30M) and long-term liabilities (A$1.3M), while remaining debt-free compared to five years ago when it had significant leverage issues.

- Take a closer look at Coast Entertainment Holdings' potential here in our financial health report.

- Gain insights into Coast Entertainment Holdings' future direction by reviewing our growth report.

CGN Resources (ASX:CGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CGN Resources Limited is an exploration company focused on the exploration and development of mineral projects in Australia, with a market cap of A$8.26 million.

Operations: CGN Resources Limited has not reported any revenue segments.

Market Cap: A$8.26M

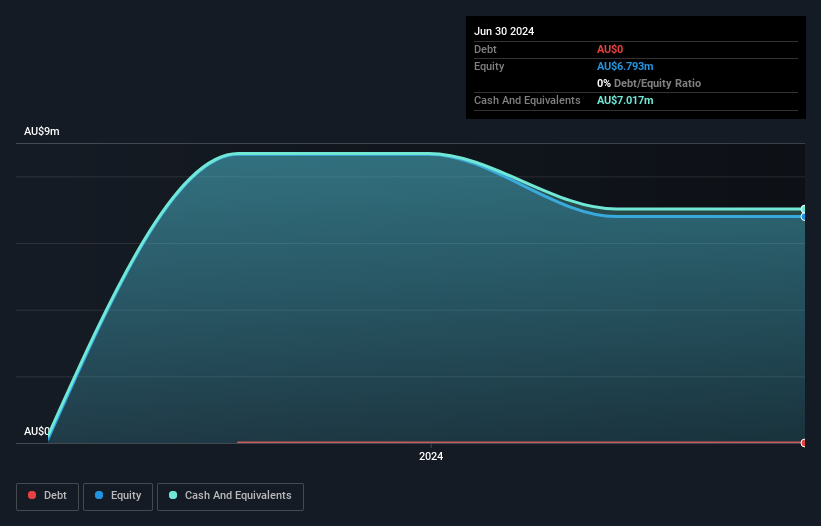

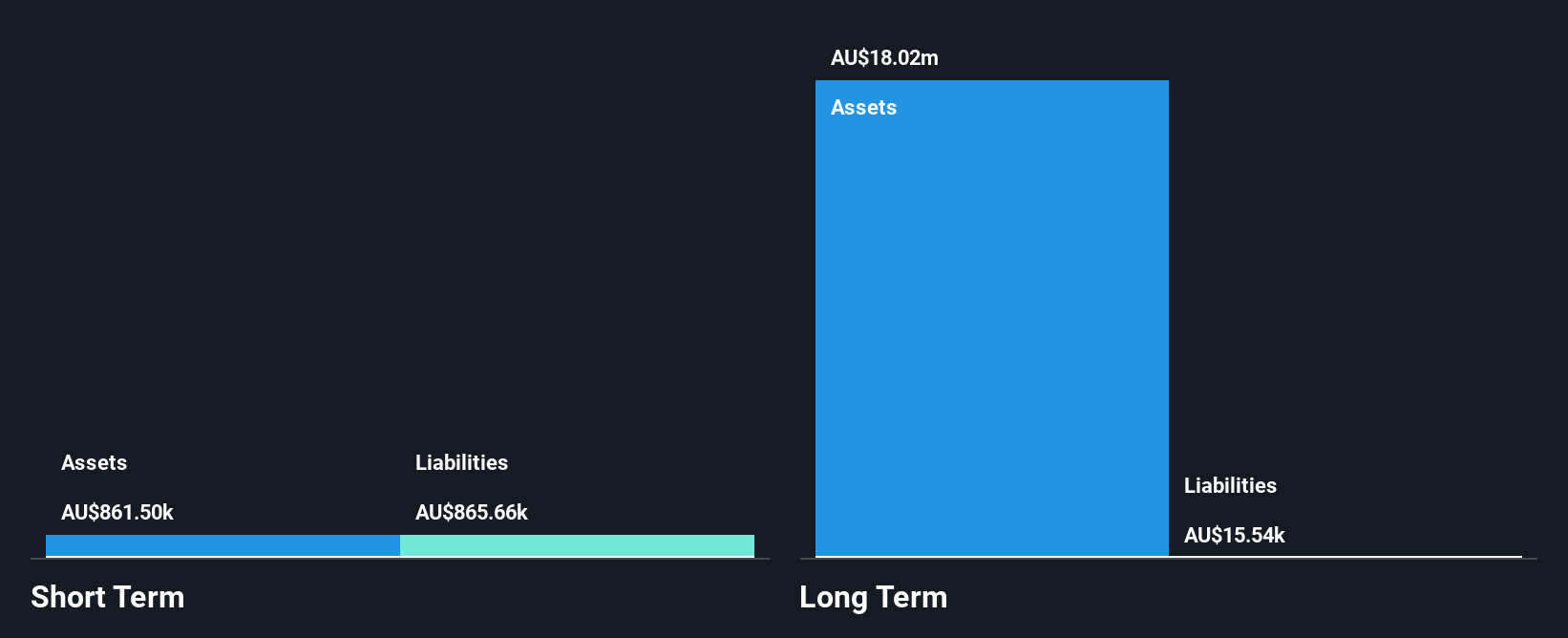

CGN Resources Limited, with a market cap of A$8.26 million, is a pre-revenue exploration company in Australia. It remains debt-free and has short-term assets of A$7.1 million that comfortably cover both its short-term and long-term liabilities. Despite having sufficient cash runway for over a year, the company's share price has been highly volatile recently, and its weekly volatility remains higher than 75% of Australian stocks. The board's average tenure is relatively new at 2.8 years, indicating recent changes in governance structure without significant shareholder dilution over the past year.

- Get an in-depth perspective on CGN Resources' performance by reading our balance sheet health report here.

- Learn about CGN Resources' historical performance here.

Rimfire Pacific Mining (ASX:RIM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rimfire Pacific Mining Limited focuses on the exploration and evaluation of mineral deposits in Australia, with a market cap of A$75.37 million.

Operations: Rimfire Pacific Mining Limited has not reported any revenue segments.

Market Cap: A$75.37M

Rimfire Pacific Mining Limited, with a market cap of A$75.37 million, is a pre-revenue exploration company in Australia. The company is debt-free but faces challenges as its short-term assets of A$385.5K do not cover short-term liabilities of A$423.1K, although long-term liabilities are minimal at A$14.9K. Despite having raised additional capital to extend its cash runway beyond the initial one-month estimate, Rimfire's share price has been highly volatile over the past three months and remains more volatile than 75% of Australian stocks. The board and management team are experienced, with average tenures exceeding industry norms.

- Jump into the full analysis health report here for a deeper understanding of Rimfire Pacific Mining.

- Understand Rimfire Pacific Mining's track record by examining our performance history report.

Taking Advantage

- Jump into our full catalog of 1,033 ASX Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CGR

CGN Resources

An exploration company, engages in the exploration and development of minerals projects in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives