- Australia

- /

- Hospitality

- /

- ASX:CEH

Discovering ASX Penny Stocks: Baby Bunting Group Among 3 Noteworthy Picks

Reviewed by Simply Wall St

The ASX200 has experienced a volatile week, with IT, Discretionary, and Health Care sectors performing well while Materials and Energy faced challenges. Despite these fluctuations, investors continue to seek opportunities in various market segments. Penny stocks, often smaller or newer companies with potential for growth, remain an area of interest due to their affordability and the possibility of uncovering hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.03 | A$95.76M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.57 | A$108.68M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.95 | A$454.84M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.35 | A$2.68B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.775 | A$469.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.92 | A$981.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.37 | A$134.79M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.86 | A$149.81M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 460 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Baby Bunting Group (ASX:BBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baby Bunting Group Limited operates as a retailer of maternity and baby goods in Australia and New Zealand, with a market capitalization of A$242.86 million.

Operations: The company generates revenue of A$496.90 million from its specialty retail segment.

Market Cap: A$242.86M

Baby Bunting Group Limited, with a market cap of A$242.86 million, has shown mixed performance in the penny stock category. Despite a seasoned management team and stable weekly volatility, profit margins have declined to 1.2% from 2.4% last year, and earnings growth remains negative at -50%. The company's debt is well-covered by operating cash flow (177.9%), but interest payments are not adequately covered by EBIT (2.2x). While trading significantly below estimated fair value and having reduced its debt-to-equity ratio over five years, Baby Bunting faces challenges with long-term liabilities exceeding short-term assets.

- Click to explore a detailed breakdown of our findings in Baby Bunting Group's financial health report.

- Assess Baby Bunting Group's future earnings estimates with our detailed growth reports.

Coast Entertainment Holdings (ASX:CEH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Coast Entertainment Holdings Limited is involved in the investment, ownership, and operation of leisure and entertainment businesses in Australia, with a market cap of A$149.08 million.

Operations: The company's revenue is primarily generated from its Theme Parks & Attractions segment, which accounts for A$91.23 million.

Market Cap: A$149.08M

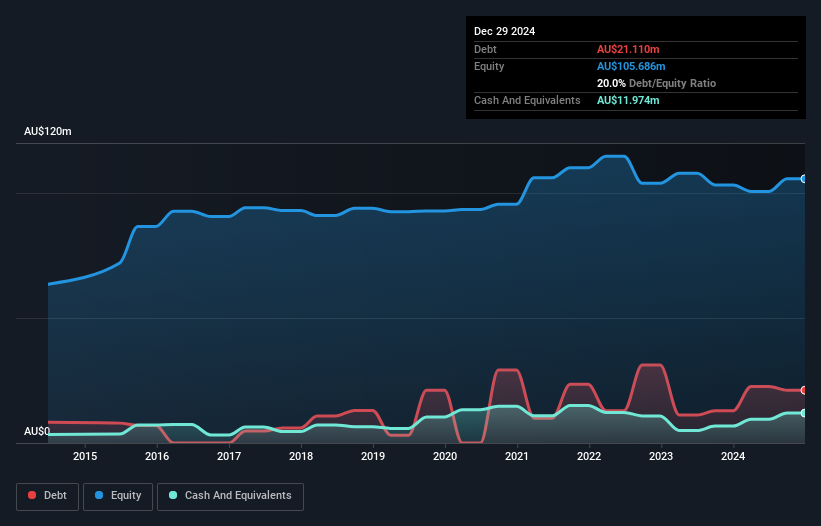

Coast Entertainment Holdings Limited, with a market cap of A$149.08 million, has recently turned profitable, marking a significant shift in its financial trajectory. The company's revenue is primarily driven by its Theme Parks & Attractions segment, generating A$91.23 million. It operates debt-free and maintains strong liquidity with short-term assets (A$73.1M) surpassing both short-term (A$31.8M) and long-term liabilities (A$1.2M). Despite having low Return on Equity at 0.4%, the firm exhibits stable weekly volatility and forecasts suggest earnings growth of 77.74% annually, indicating potential for future expansion within the penny stock sphere in Australia.

- Unlock comprehensive insights into our analysis of Coast Entertainment Holdings stock in this financial health report.

- Gain insights into Coast Entertainment Holdings' outlook and expected performance with our report on the company's earnings estimates.

SomnoMed (ASX:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

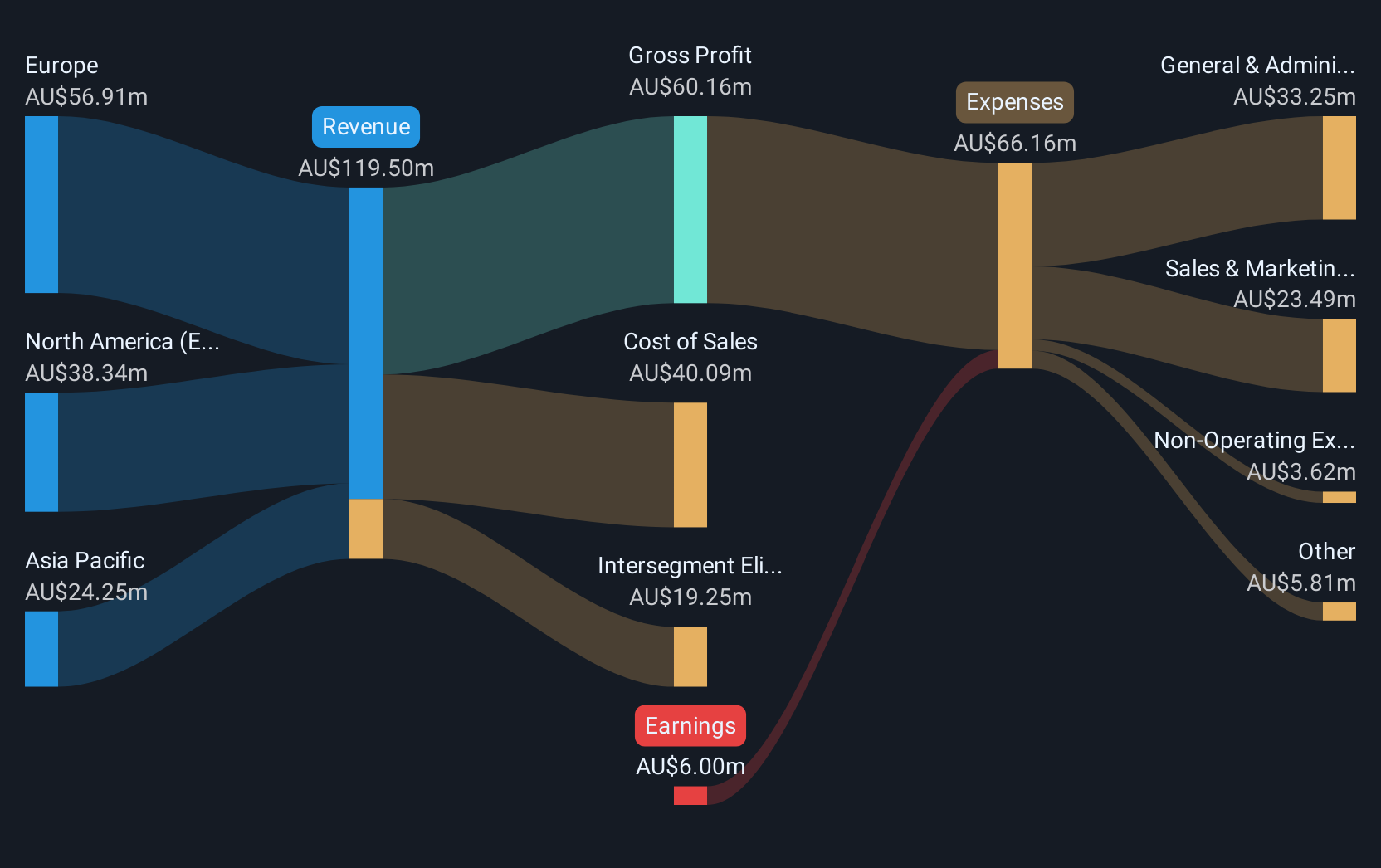

Overview: SomnoMed Limited, with a market cap of A$176.13 million, produces and sells devices for the oral treatment of sleep-related disorders across the Asia Pacific region, North America, and Europe.

Operations: The company generates revenue of A$100.25 million from the production and sale of products designed to treat sleep disordered breathing.

Market Cap: A$176.13M

SomnoMed Limited, with a market cap of A$176.13 million, is currently unprofitable, having seen its losses increase by 48.6% annually over the past five years. Despite this, it generates A$100.25 million in revenue from its sleep disorder treatment devices and maintains a strong financial position with short-term assets of A$41.6 million exceeding both short-term (A$23 million) and long-term liabilities (A$4.5 million). The company is trading at good value compared to peers and has not diluted shareholders recently. SomnoMed's cash runway exceeds three years even if free cash flow continues to decline historically by 20.3% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of SomnoMed.

- Explore SomnoMed's analyst forecasts in our growth report.

Key Takeaways

- Explore the 460 names from our ASX Penny Stocks screener here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CEH

Coast Entertainment Holdings

Engages in the investment, ownership, and operation of leisure and entertainment businesses in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives