- Australia

- /

- Hospitality

- /

- ASX:CEH

ASX Penny Stock Insights: Coast Entertainment Holdings Among 3 Noteworthy Picks

Reviewed by Simply Wall St

The ASX200 is set to open slightly lower, with investors closely watching upcoming inflation data and the political landscape as Australia nears a Federal Election. Amidst these broader market dynamics, penny stocks continue to capture attention for their potential to offer growth opportunities at accessible price points. Though the term "penny stocks" might seem outdated, these smaller or newer companies can still present intriguing investment prospects when they boast strong financial health and robust fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.685 | A$135.72M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.53 | A$72.17M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.47 | A$380.83M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.38 | A$160.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.88 | A$631.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ✅ 5 ⚠️ 3 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$248.22M | ✅ 3 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.60 | A$1.19B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.37 | A$43.53M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 988 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Coast Entertainment Holdings (ASX:CEH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Coast Entertainment Holdings Limited invests in, owns, and operates leisure and entertainment businesses in Australia with a market capitalization of A$171.53 million.

Operations: The company generates revenue of A$91.23 million from its Theme Parks & Attractions segment.

Market Cap: A$171.53M

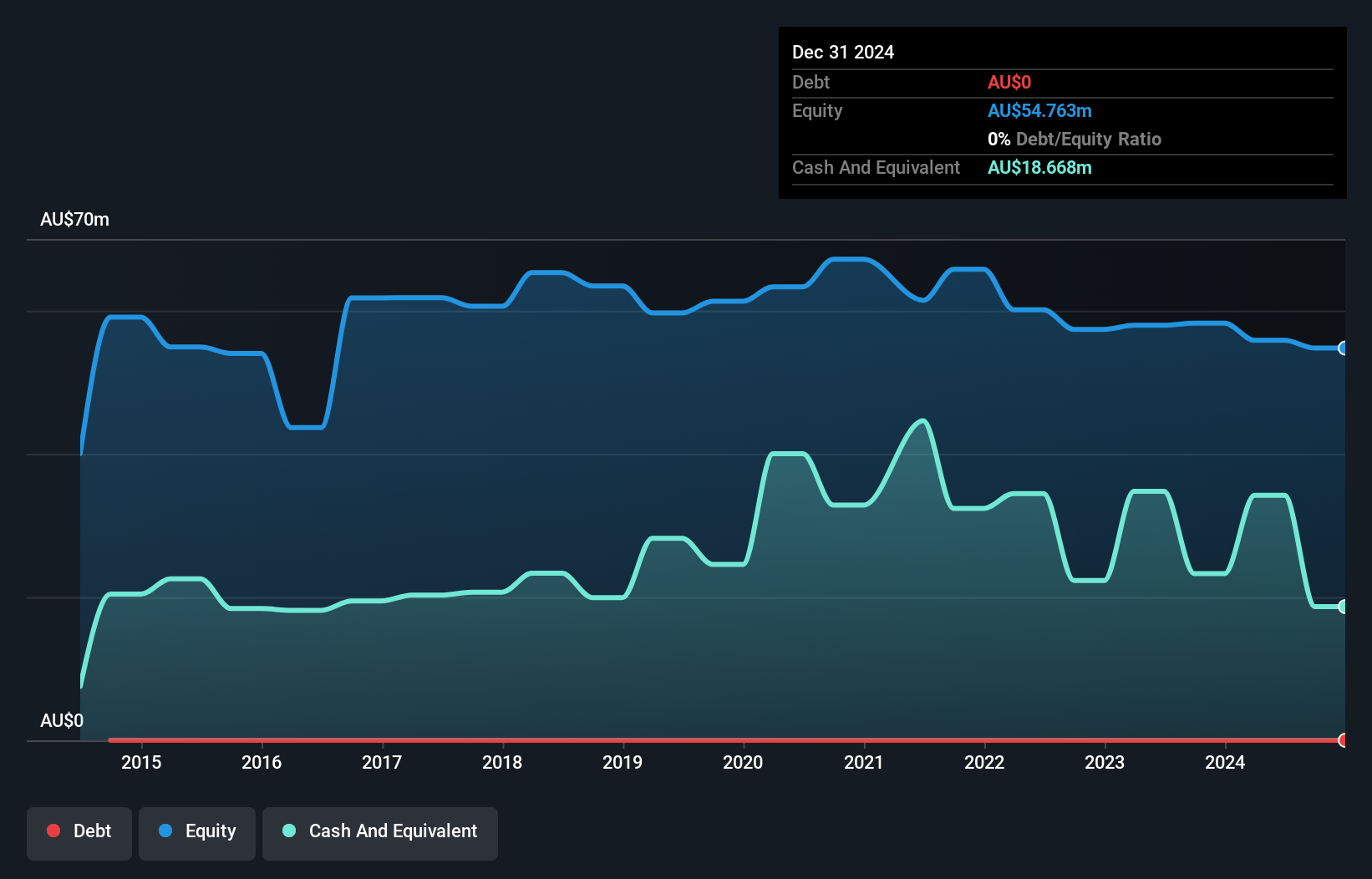

Coast Entertainment Holdings Limited, with a market capitalization of A$171.53 million, has shown resilience despite recent temporary closures due to severe weather events in South East Queensland and Northern NSW. The company's strategic investment in infrastructure has mitigated the financial impact during off-peak periods. Coast's financials reveal a revenue of A$54.89 million for the half year ended December 2024, though net income decreased compared to the previous year. The company is debt-free, with short-term assets exceeding liabilities significantly. Despite low return on equity at 0.4%, earnings are forecasted to grow substantially by 67.1% annually, indicating potential upside for investors seeking growth opportunities within penny stocks.

- Dive into the specifics of Coast Entertainment Holdings here with our thorough balance sheet health report.

- Explore Coast Entertainment Holdings' analyst forecasts in our growth report.

Frontier Digital Ventures (ASX:FDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Digital Ventures Limited is a private equity firm that invests in and develops online classifieds businesses in emerging markets, with a market cap of A$121.44 million.

Operations: The company's revenue segments include Yapo (A$7.61 million), Avito (A$7.66 million), Moteur (A$0.90 million), Tayara (A$0.69 million), Autodeal (A$2.20 million), Fincaraiz (A$14.14 million), Infocasas (A$19.43 million), Encuentra24 (A$11.65 million), Imyanmarhouse (A$2.94 million) and Lankapropertyweb (A$0.87 million).

Market Cap: A$121.44M

Frontier Digital Ventures, with a market cap of A$121.44 million, operates in the online classifieds sector across emerging markets. Despite being unprofitable and experiencing a net loss of A$10.27 million for 2024, its revenue increased slightly to A$68.08 million from the previous year. The company maintains more cash than total debt and has reduced its debt-to-equity ratio significantly over five years. While short-term assets surpass liabilities, management's limited experience may pose challenges. Recent removal from the S&P/ASX All Ordinaries Index highlights potential volatility risks for investors considering this penny stock opportunity in Australia.

- Click here and access our complete financial health analysis report to understand the dynamics of Frontier Digital Ventures.

- Gain insights into Frontier Digital Ventures' outlook and expected performance with our report on the company's earnings estimates.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various regions including Australia, Asia, the Americas, Africa, and Europe, with a market capitalization of A$590.65 million.

Operations: RPMGlobal Holdings Limited generates revenue through its Advisory segment, which accounts for A$34.17 million, and its Software segment, contributing A$74.88 million.

Market Cap: A$590.65M

RPMGlobal Holdings, with a market cap of A$590.65 million, reported half-year revenue of A$53.84 million but experienced a decline in net income to A$4.73 million compared to the previous year. Despite its seasoned management and board, RPMGlobal's profit margins have decreased from 9.7% to 6.2%, and earnings growth has been negative over the past year, contrasting with its five-year profitability trend of 59.7% annual growth. The company is debt-free with short-term assets exceeding liabilities; however, earnings are forecasted to decline by an average of 27.2% annually over the next three years, which could impact future performance stability for investors considering this stock in Australia’s penny stock landscape.

- Click here to discover the nuances of RPMGlobal Holdings with our detailed analytical financial health report.

- Examine RPMGlobal Holdings' earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Get an in-depth perspective on all 988 ASX Penny Stocks by using our screener here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CEH

Coast Entertainment Holdings

Engages in the investment, ownership, and operation of leisure and entertainment businesses in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives